(

)

(

)

(

)

(

)

(

)

(

)

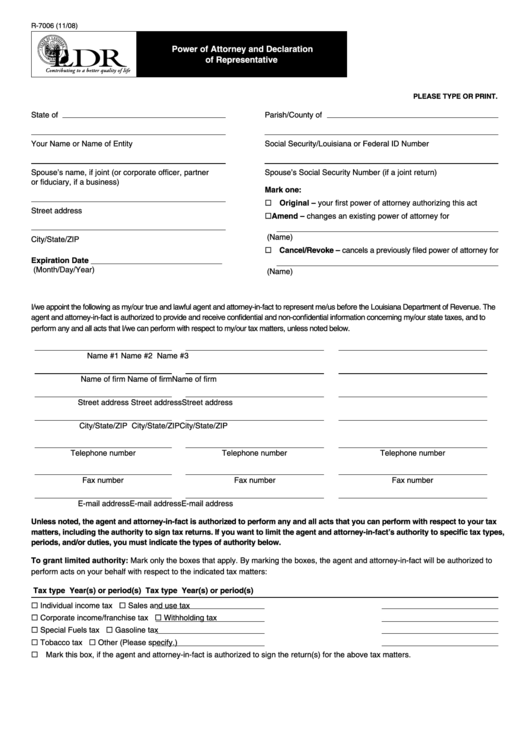

R-7006 (11/08)

Power of Attorney and Declaration

of Representative

PLEASE TYPE OR PRINT.

State of

Parish/County of

Your Name or Name of Entity

Social Security/Louisiana or Federal ID Number

Spouse’s name, if joint (or corporate officer, partner

Spouse’s Social Security Number (if a joint return)

or fiduciary, if a business)

Mark one:

Original – your first power of attorney authorizing this act

Street address

Amend – changes an existing power of attorney for

(Name)

City/State/ZIP

Cancel/Revoke – cancels a previously filed power of attorney for

Expiration Date ______________________________

(Month/Day/Year)

(Name)

I/we appoint the following as my/our true and lawful agent and attorney-in-fact to represent me/us before the Louisiana Department of Revenue. The

agent and attorney-in-fact is authorized to provide and receive confidential and non-confidential information concerning my/our state taxes, and to

perform any and all acts that I/we can perform with respect to my/our tax matters, unless noted below.

Name #1

Name #2

Name #3

Name of firm

Name of firm

Name of firm

Street address

Street address

Street address

City/State/ZIP

City/State/ZIP

City/State/ZIP

Telephone number

Telephone number

Telephone number

Fax number

Fax number

Fax number

E-mail address

E-mail address

E-mail address

Unless noted, the agent and attorney-in-fact is authorized to perform any and all acts that you can perform with respect to your tax

matters, including the authority to sign tax returns. If you want to limit the agent and attorney-in-fact’s authority to specific tax types,

periods, and/or duties, you must indicate the types of authority below.

To grant limited authority: Mark only the boxes that apply. By marking the boxes, the agent and attorney-in-fact will be authorized to

perform acts on your behalf with respect to the indicated tax matters:

Tax type

Year(s) or period(s)

Tax type

Year(s) or period(s)

Individual income tax

Sales and use tax

Corporate income/franchise tax

Withholding tax

Special Fuels tax

Gasoline tax

Tobacco tax

Other (Please specify.)

Mark this box, if the agent and attorney-in-fact is authorized to sign the return(s) for the above tax matters.

1

1 2

2