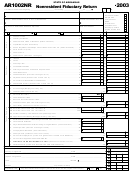

Form Au-766 - Guarantee Bond - 2003 Page 2

ADVERTISEMENT

appearing on the bond must be the same shown in the

General Instructions

records of the Office of the Secretary of State, or similar

Form AU-766, Guarantee Bond , must be executed by a

agency of another state if the nonresident contractor

nonresident contractor and a surety company licensed to do

is not a Connecticut corporation.

business in Connecticut. A power of attorney for the person

Part II: Enter the name and complete address of the person

signing the bond on behalf of the surety company must be

doing business with the nonresident contractor. If the

attached to the bond, carry the corporate seal of the surety

nonresident contractor is the general contractor, enter

company, and bear the same date as the execution date of the

the name and address of the owner of the property. If

bond.

the nonresident contractor is a subcontractor, enter

A nonresident contractor has the option of filing a guarantee

the name and address of the general contractor.

bond with DRS instead of the customer making a deposit with

Enter the Connecticut tax registration number of the

DRS under Conn. Gen. Stat. §12-430(7)(b)(i). Under this option,

person doing business with the nonresident contractor.

the nonresident contractor has 120 days from the

If the person doing business with the nonresident

commencement of the contract to file a guarantee bond with

contractor does not have a Connecticut tax registration

DRS.

number, enter that person’s Federal Employer

If the deadline for the customer to withhold and remit a deposit

Identification Number or Social Security Number.

to DRS is before the deadline for the nonresident contractor to

Part III:Enter the name and complete address of the surety

post a bond, DRS will accept the earlier of the deposit or the

company that guarantees this bond. Include the bond

bond. See Special Notice 2003(20), Legislation Affecting

number.

Contracts With Nonresident Contractors , for more information.

Part IV:Check the box if the deposit is for a change order

A nonresident contractor is a contractor who does not maintain

occurring after the bond for the initial contract has been

a regular place of business in this state.

A regular place of

furnished to DRS.

business means any bona fide office, factory, warehouse or

other space in Connecticut at which a contractor is doing

Enter the name of the project and the complete

business in its own name in a regular and systematic manner,

address, including the street address and the city or

and which place is continuously maintained, occupied, and

town where the project is physically located.

used by the contractor in carrying on its business through its

employees regularly in attendance to carry on such contractor’s

Enter the commencement date of this project or change

business in the contractor’s own name. A regular place of

order. The commencement date is the date the

business does not include a place of business for a statutory

contract is signed or the date the nonresident contractor

agent for service of process or a temporary office whether or

begins work, but it is never later than the date the

not it is located at the site of construction. A regular place of

nonresident contractor begins work.

business also does not include locations used by the contractor

Enter the date by which the nonresident contractor is

only for the duration of the contract, such as short-term leased

expected to complete work on this project or change

offices, warehouses, storage facilities, or facilities that do not

order.

have full time staff with regular business hours. An office

maintained, occupied, and used by a person affiliated with a

Enter, in words and figures, the total amount to be

contractor is not a regular place of business of the contractor.

paid to the nonresident contractor under the contract.

Indicate if this amount is an estimate. If this is a bond

Any bond that bears an erasure or alteration, regardless of its

for a change order, enter the additional amount of the

nature, must have the change authenticated by a notation in

bond for the change order.

the margin. The notation should describe the correction and

be signed in the name of the surety company by the officer

Multiply the total contract price or the amount of the

who executed the bond and must bear the corporate seal of

change order by 5% (.05) and enter the result on this

the surety company.

line.

Declarations: An authorized representative for the nonresident

Specific Instructions

contractor and the surety company must sign and date the

Part I: Enter the name and complete address of the

declaration on Form AU-766. The name of the nonresident

nonresident contractor furnishing the bond. Include

contractor and the surety company must be exactly as it

the nonresident contractor’s Connecticut tax

appears on the bond. The corporate seal of the surety company

registration number. The name and address of the

must be affixed by its signature on Form AU-766.

nonresident contractor appearing on the bond must

Return Form AU-766 to:

agree with the name and address on Form REG-1,

Business Taxes Registration Application , filed with the

Department of Revenue Services

Department of Revenue Services (DRS). (If the

State of Connecticut

information originally provided on Form REG-1 is now

Discovery Unit

incorrect, you must notify the DRS Registration Unit

25 Sigourney Street

in writing of the correct information.) If the nonresident

Hartford CT 06106

contractor is a corporation, the corporate name

Form AU-766(Back) (New 09/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2