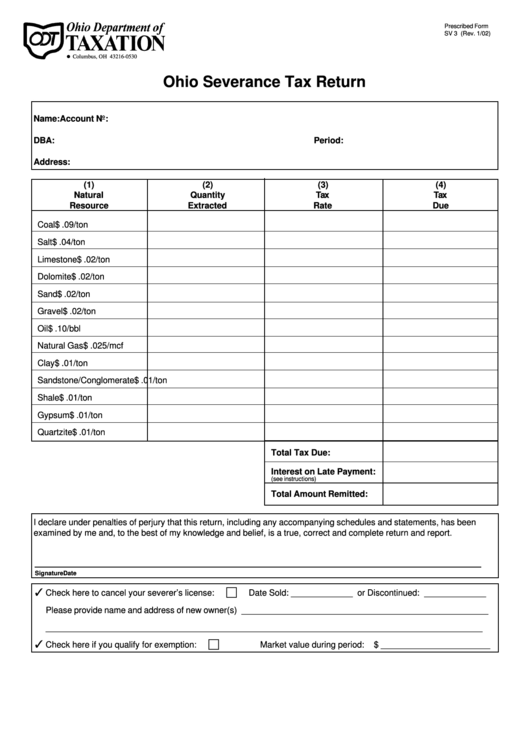

Form Sv 3 - Ohio Severance Tax Return - 2002

ADVERTISEMENT

Prescribed Form

SV 3 (Rev. 1/02)

P.O. Box 530= Columbus, OH 43216-0530

Ohio Severance Tax Return

Name:

Account No:

DBA:

Period:

Address:

(1)

(2)

(3)

(4)

Natural

Quantity

Tax

Tax

Resource

Extracted

Rate

Due

Coal

$ .09/ton

Salt

$ .04/ton

Limestone

$ .02/ton

Dolomite

$ .02/ton

Sand

$ .02/ton

Gravel

$ .02/ton

Oil

$ .10/bbl

Natural Gas

$ .025/mcf

Clay

$ .01/ton

Sandstone/Conglomerate

$ .01/ton

Shale

$ .01/ton

Gypsum

$ .01/ton

Quartzite

$ .01/ton

Total Tax Due:

Interest on Late Payment:

(see instructions)

Total Amount Remitted:

I declare under penalties of perjury that this return, including any accompanying schedules and statements, has been

examined by me and, to the best of my knowledge and belief, is a true, correct and complete return and report.

Signature

Date

c

Check here to cancel your severer’s license:

Date Sold: _____________ or Discontinued: _____________

Please provide name and address of new owner(s) ____________________________________________________

_____________________________________________________________________________________________

c

Check here if you qualify for exemption:

Market value during period:

$ _______________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1