Instructions For Form Tse-Ext - Oregon Transit Self-Employment Tax Extension Payment Coupon - 2003

ADVERTISEMENT

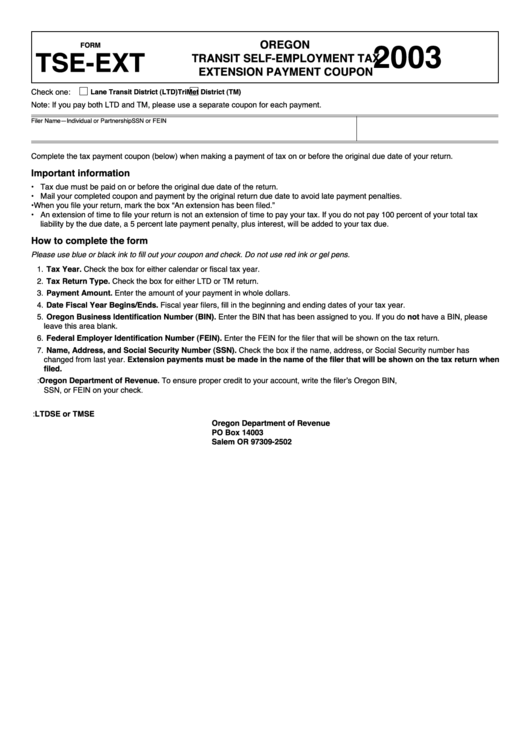

OREGON

FORM

2003

TSE-EXT

TRANSIT SELF-EMPLOYMENT TAX

EXTENSION PAYMENT COUPON

Check one:

Lane Transit District (LTD)

TriMet District (TM)

Note: If you pay both LTD and TM, please use a separate coupon for each payment.

Filer Name—Individual or Partnership

SSN or FEIN

Complete the tax payment coupon (below) when making a payment of tax on or before the original due date of your return.

Important information

• Tax due must be paid on or before the original due date of the return.

• Mail your completed coupon and payment by the original return due date to avoid late payment penalties.

• When you file your return, mark the box “An extension has been filed.”

• An extension of time to file your return is not an extension of time to pay your tax. If you do not pay 100 percent of your total tax

liability by the due date, a 5 percent late payment penalty, plus interest, will be added to your tax due.

How to complete the form

Please use blue or black ink to fill out your coupon and check. Do not use red ink or gel pens.

1. Tax Year. Check the box for either calendar or fiscal tax year.

2. Tax Return Type. Check the box for either LTD or TM return.

3. Payment Amount. Enter the amount of your payment in whole dollars.

4. Date Fiscal Year Begins/Ends. Fiscal year filers, fill in the beginning and ending dates of your tax year.

5. Oregon Business Identification Number (BIN). Enter the BIN that has been assigned to you. If you do not have a BIN, please

leave this area blank.

6. Federal Employer Identification Number (FEIN). Enter the FEIN for the filer that will be shown on the tax return.

7. Name, Address, and Social Security Number (SSN). Check the box if the name, address, or Social Security number has

changed from last year. Extension payments must be made in the name of the filer that will be shown on the tax return when

filed.

8. Make check payable to: Oregon Department of Revenue. To ensure proper credit to your account, write the filer’s Oregon BIN,

SSN, or FEIN on your check.

9. Keep a copy for your records. Your payment is your receipt.

10. Detach coupon and mail with your payment to: LTDSE or TMSE

Oregon Department of Revenue

PO Box 14003

Salem OR 97309-2502

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1