Form Ap-204-2 - Texas Application For Tax Exemptions For Miscellaneous Organizations - 2002

ADVERTISEMENT

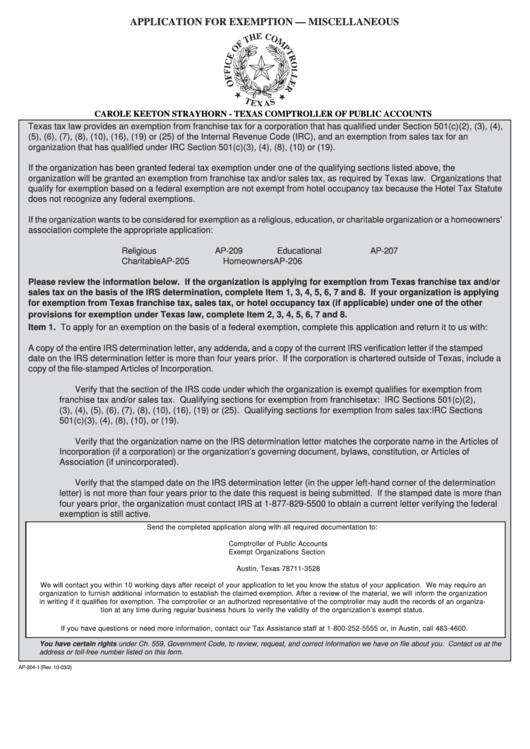

APPLICATION FOR EXEMPTION — MISCELLANEOUS

CAROLE KEETON STRAYHORN - TEXAS COMPTROLLER OF PUBLIC ACCOUNTS

Texas tax law provides an exemption from franchise tax for a corporation that has qualified under Section 501(c)(2), (3), (4),

(5), (6), (7), (8), (10), (16), (19) or (25) of the Internal Revenue Code (IRC), and an exemption from sales tax for an

organization that has qualified under IRC Section 501(c)(3), (4), (8), (10) or (19).

If the organization has been granted federal tax exemption under one of the qualifying sections listed above, the

organization will be granted an exemption from franchise tax and/or sales tax, as required by Texas law. Organizations that

qualify for exemption based on a federal exemption are not exempt from hotel occupancy tax because the Hotel Tax Statute

does not recognize any federal exemptions.

If the organization wants to be considered for exemption as a religious, education, or charitable organization or a homeowners'

association complete the appropriate application:

Religious

AP-209

Educational

AP-207

Charitable

AP-205

Homeowners

AP-206

Please review the information below. If the organization is applying for exemption from Texas franchise tax and/or

sales tax on the basis of the IRS determination, complete Item 1, 3, 4, 5, 6, 7 and 8. If your organization is applying

for exemption from Texas franchise tax, sales tax, or hotel occupancy tax (if applicable) under one of the other

provisions for exemption under Texas law, complete Item 2, 3, 4, 5, 6, 7 and 8.

Item 1. To apply for an exemption on the basis of a federal exemption, complete this application and return it to us with:

A copy of the entire IRS determination letter, any addenda, and a copy of the current IRS verification letter if the stamped

date on the IRS determination letter is more than four years prior. If the corporation is chartered outside of Texas, include a

copy of the file-stamped Articles of Incorporation.

Verify that the section of the IRS code under which the organization is exempt qualifies for exemption from

franchise tax and/or sales tax. Qualifying sections for exemption from franchise tax: IRC Sections 501(c)(2),

(3), (4), (5), (6), (7), (8), (10), (16), (19) or (25). Qualifying sections for exemption from sales tax: IRC Sections

501(c)(3), (4), (8), (10), or (19).

Verify that the organization name on the IRS determination letter matches the corporate name in the Articles of

Incorporation (if a corporation) or the organization’s governing document, bylaws, constitution, or Articles of

Association (if unincorporated).

Verify that the stamped date on the IRS determination letter (in the upper left-hand corner of the determination

letter) is not more than four years prior to the date this request is being submitted. If the stamped date is more than

four years prior, the organization must contact IRS at 1-877-829-5500 to obtain a current letter verifying the federal

exemption is still active.

Send the completed application along with all required documentation to:

Comptroller of Public Accounts

Exempt Organizations Section

P.O. Box 13528

Austin, Texas 78711-3528

We will contact you within 10 working days after receipt of your application to let you know the status of your application. We may require an

organization to furnish additional information to establish the claimed exemption. After a review of the material, we will inform the organization

in writing if it qualifies for exemption. The comptroller or an authorized representative of the comptroller may audit the records of an organiza-

tion at any time during regular business hours to verify the validity of the organization’s exempt status.

If you have questions or need more information, contact our Tax Assistance staff at 1-800-252-5555 or, in Austin, call 463-4600.

You have certain rights under Ch. 559, Government Code, to review, request, and correct information we have on file about you. Contact us at the

address or toll-free number listed on this form.

AP-204-1 (Rev. 10-03/2)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2