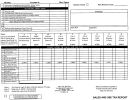

Sales And Use Tax Report Form - Louisiana

ADVERTISEMENT

SALES AND USE TAX REPORT GENERAL INSTRUCTIONS

1. All persons and dealers who are subject to the tax

correct period is entered or shown in the upper right

is entitled to the tax being remitted. The physical

levied are required to file a tax return monthly, unless

hand corner of the return; (b) the return is signed and

location of your business and your delivery activity

otherwise authorized. Returns are due on or before

dated by the appropriate company official; (c) a

a re important factors in determining the pro p e r

the 20

th

day of the month following the close of the

remittance for the exact amount of tax, penalty, and

column(s) in which to report taxable transactions.

period covered by the return.

interest accompanies the return; and (d) the return

and remittance are placed in the mail.

5. All amounts on the return should be rounded

2. Corrections or changes in the name and address

to the nearest dollar. Fifty cents and higher should

information, which appear on the return, should be

4. Sales tax revenues are distributed to governmental

be rounded up to the nearest doll ar, while forty-nine

made by lining through the incorrect information and

agencies on the basis of information supplied by

cents and below should be rounded down to the

by adding the correct information.

taxpayers on their monthly sales tax reports.

Of

nearest dollar.

special importance is using the correct column on the

3. Care should be exercised to insure that: (a) the

report so as to properly indicate the jurisdiction that

SPECIFIC INSTRUCTIONS

Beside each column heading (City of Baton Rouge,

Governmental Agencies or Instrumentalities.

Line 16(b):

Multiply the amount on line 16(a) by

Parish of East Baton Rouge, etc.) is a box. If any of

2%.

Line 7:

these boxes contain an “X”, your business is

(Deduction Code 007) Sales of food paid

for using USDA Food Stamp coupons or WIC

Line 16(c):

required to file a return for that jurisdiction.

Multiply the amount on line 16(a) by

program vouchers are totally exempt from sales taxes.

1%.

Even if there were no sales within a jurisdiction,

enter a zero in line one of that column.

Line 8, 9, and 10: Any other deductions authorized

Line 16(d):

Gross Tax (line 16) less amount

by law should be verified by reference to the law and

deductible (line 16(b) or 16(c)).

Line 1:

“Gross Sales” means the total sales of

regulation and properly identified.

tangible personal property, sales of certain taxable

Line 17: In cases where the actual tax collected for

services, and gross receipts from leasing or renting

Total Allowable Deductions:

The sum of lines 2

each jurisdiction exceeds the tax due on line 16(d),

tangible personal property as reported to the State of

through 10 is entered here, and this total is transferred

the excess shall be recorded on this line and included

Louisiana.

to Line 11 on Page 1.

in your computations of the tax due.

Deductions from gross sales, if applicable, are to

Line 11:

The total of all allowable deductions, as

Line 18: Self explanatory.

be calculated on page 2 (Deduction Worksheet)

calculated on page 2, is entered on this line.

of the return.

If not applicable, proceed to line

Line 19:

To receive Vendor’s Compensation of 1%

11.

Line 12: Self explanatory.

for the remittance of the tax due, payment must be

made on or before the 20th day following the period

Line 2:

(Deduction Code 002) Sales of tangible

Line 13: For office use only.

covered by this return.

Vendor’s Compensation is

personal property which is going to be resold by the

disallowed on delinquent returns.

purchaser, or sales of materials for further processing

Line 14:

A use tax is due on the cost of tangible

into articles of tangible personal property for resale

personal property used, consumed, distributed, or

Line 20: Self explanatory.

are to be listed on Line 2. Dealers who purchase for

stored for use or consumption in East Baton Rouge

either resale or further processing must provide the

Parish upon which East Baton Rouge Parish sales tax

Line 21: A delinquent penalty of 5% for each month

seller with a resale exemption certificate.

has not been paid at the time of purchase.

Also

or fraction thereof is assessed on each delinquency

include

the cost of tangible personal property

and is increased by 5% on the 1st day of each month

Line 3:

(Deduction Code 003) Cash discounts

imported

into

this

parish

from

other

taxing

thereafter until paid, to a maximum o f 2 5 % .

A

allowed by the seller and taken by the customer are

jurisdictions upon which a like and equal tax has not

monthly return becomes delinquent on the 21st day

allowed in the period claimed by the customer. Sales

been paid.

of the month following the return. A quarterly return

returns and allowances are allowed on returned

becomes delinquent on the 21st day of the month

merchandise on which the full sales price, including

Line 15: Self explanatory.

following the calendar quarter covered.

For

tax, has been refunded to the customer.

In no

example, a return for the month of January would be

instance should cash discounts and sales returns

Line 16: Multiply the totals on Line 15 by 5.00%.

subject to a 5% penalty on or after the 21st day of

exceed the gross sales listed on line 1. Repossession

February, a 10% penalty on or after the 1st day of

of property sold on an installment or credit basis is

Line 16(a):

March, etc.

Sales of food for preparation and

not allowed as a deduction from gross sales.

consumption in the home, prescription drugs and

Line 22: Interest at the rate of 1-1/4% per month or

insulin, orthotic and prosthetic devices, and patient

Line 4:

(Deduction Code 004) Enter the total sales

aids are exempted from 2% sales tax effective

fraction thereof is due on all returns transmitted to

delivered or shipped outside of East Baton Rouge

7/1/2000.

Do not include sales of food paid for

this office after the 20th of the month in which due.

Parish, and sales made in bona fide interstate or

with USDA food stamps or WIC vouchers on line

The interest will increase by 1-1/4 % on the 1st day

foreign commerce.

In order to qualify as an

16(a), but include them on line 7.

of each month thereafter until the amount due is paid.

allowable deduction, delivery must be made into

another parish, state, or country, or to a common

Sales of materials, supplies, and services to a qualified

Line 23: Self explanatory.

carrier for such purposes. Deductions taken on this

contractor or sub-contractor are specifically exempted

line must be fully supported by shipping documents,

from the additional 1% sales tax, provided that a

Line 24:

Although required by state statute, the

This

tickets, bills of lading, or similar documents.

written contract on a lump-sum or unit price basis

City

of

Baton

Rouge/Parish

of

East

Baton

deduction

does

not

apply

to

repair

services

was entered into prior to, or within 90 days of, July

Rouge does not use this line. Contact our office at

performed in this parish.

1, 2000.

Contractors and sub-contractors must

225-389-3084 for instructions on how to handle

provide the seller with a Contractor’s Exemption

debits or credits to your account.

Line 5:

(Deduction Code 005) The gross sales of

Certificate. Enter the amount of such exempt sales

gasoline and other motor fuels are exempt from sales

here. Contractors and sub-contractors that qualify for

Line 25: Self explanatory.

and use taxes.

this exemption after July 1, 2000, must pay the

additional sales tax when purchasing materials and

Line 26:

Total amount to be remitted.

Please

Line 6:

(Deduction Code 006) Enter sales of

supplies and then apply to the City-Parish for a

send a remittance in the form of a cashier’s check,

tangible personal property to, or any services

refund of any additional taxes paid.

PLEASE DO

personal check, or money order.

performed for, the U.S. Government, State of

NOT SEND CASH THROUGH THE MAIL.

Louisiana and its Political Subdivisions, and local

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2