Lodging Or Accommodations Tax Monthly Report Form

ADVERTISEMENT

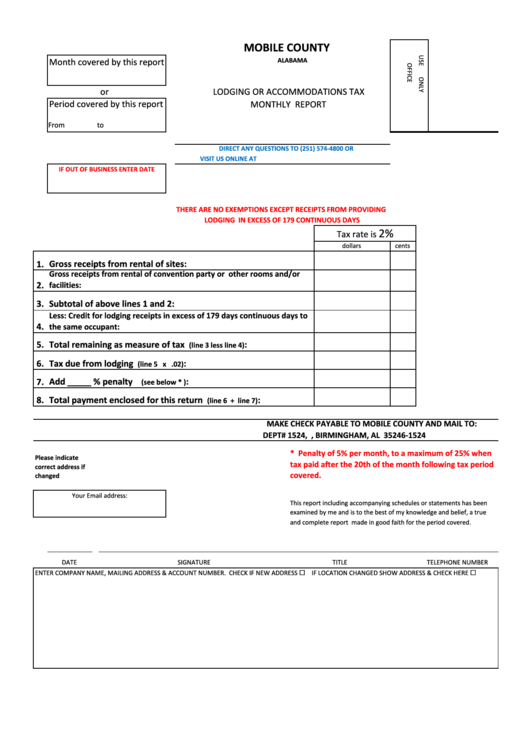

MOBILE COUNTY

ALABAMA

Month covered by this report

or

LODGING OR ACCOMMODATIONS TAX

Period covered by this report

MONTHLY REPORT

From

to

DIRECT ANY QUESTIONS TO (251) 574-4800 OR

VISIT US ONLINE AT

IF OUT OF BUSINESS ENTER DATE

THERE ARE NO EXEMPTIONS EXCEPT RECEIPTS FROM PROVIDING

LODGING IN EXCESS OF 179 CONTINUOUS DAYS

2%

Tax rate is

dollars

cents

1.

Gross receipts from rental of sites:

Gross receipts from rental of convention party or other rooms and/or

2.

facilities:

3.

Subtotal of above lines 1 and 2:

Less: Credit for lodging receipts in excess of 179 days continuous days to

4.

the same occupant:

5.

Total remaining as measure of tax

:

(line 3 less line 4)

6.

Tax due from lodging

:

(line 5 x .02)

7.

Add _____ % penalty

:

(see below * )

8.

Total payment enclosed for this return

:

(line 6 + line 7)

MAKE CHECK PAYABLE TO MOBILE COUNTY AND MAIL TO:

DEPT# 1524, P.O. BOX 11407, BIRMINGHAM, AL 35246-1524

* Penalty of 5% per month, to a maximum of 25% when

Please indicate

tax paid after the 20th of the month following tax period

correct address if

covered.

changed

Your Email address:

This report including accompanying schedules or statements has been

examined by me and is to the best of my knowledge and belief, a true

and complete report made in good faith for the period covered.

DATE

SIGNATURE

TITLE

TELEPHONE NUMBER

ENTER COMPANY NAME, MAILING ADDRESS & ACCOUNT NUMBER. CHECK IF NEW ADDRESS IF LOCATION CHANGED SHOW ADDRESS & CHECK HERE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2