Lodging Or Accommodations Tax Monthly Report Form Page 2

ADVERTISEMENT

LODGING TAX REPORT FORM INSTRUCTIONS

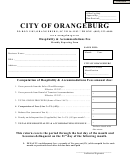

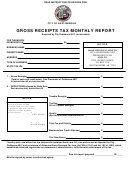

Mobile County levies a two percent (2%) tax on the gross receipts of providers of lodging accommodations for periods

of less than 180 days continuous occupancy. This applies to all owner/managers of a hotel, motel, condominium, tourist

camp, motor homes space, recreation vehicle (RV) campground, and the like within Mobile County. If anyone of the

foregoing also charge for meeting, banquet, or conference spaces, those receipts are also taxable as are receipts for

laundry, television, movie rental, internet charges or any other service charges billed, even if separate line item(s). On

occupancy of 179 days or less there are no exemptions and the tax does not have to be passed on to the occupant but

may be voluntarily.

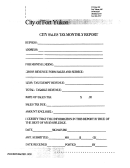

A provider of accommodations must report and pay the tax monthly on or before the twentieth (20th) of the month

following the reporting month. If your return and/or payment is mailed, the postal service’s post marked date will be

considered the date filed.

1.

Line one (1) of the Lodging Tax Form is used for reporting gross receipts from providing lodging and

accommodations. Gross receipts are the sum all receipts collected by a provider during a given month.

2.

Enter gross receipts from rental of and various fees for convention, party or other rooms and/or facilities.

3.

On line three (3) enter the subtotal of line 1and line 2.

4.

Line four (4) is a credit for lodging receipts in excess of 179 continuous days to the same occupant.

5.

Line five (5) is the total remaining as a measure of lodging tax after subtracting line 4 from line 3.

6.

Lodging tax due is calculated and entered on line six (6). Multiply the amount on line five (5) by 2% (line 5 x .02)

rounding to the nearest cent.

7.

At line seven (7) enter the late pay penalty if your payment is after the 20th of the month following the month for

which charges for lodging were received. The penalty is five percent (5%) per month, to a maximum of twenty-five

(25%) of the unpaid tax, for failure to pay the correct amount of tax on or before the due date.

8.

Line eight (8) is for the total of lines six and seven and is your liability for the month tax is being reported.

Please enter your email address and a daytime contact telephone number at the bottom and also your account number,

company name and mailing address. If the address you enter is a new address, check the box indicated. Be sure you

have signed and dated the return and indicate your position/title with the company.

MAKE CHECK PAYABLE TO MOBILE COUNTY AND MAIL TO:

DEPT# 1524, P.O. BOX 11407, BIRMINGHAM, AL 35246-1524

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2