Form Cca - Net Profit Tax Return - Municipal Income Tax - 2005

ADVERTISEMENT

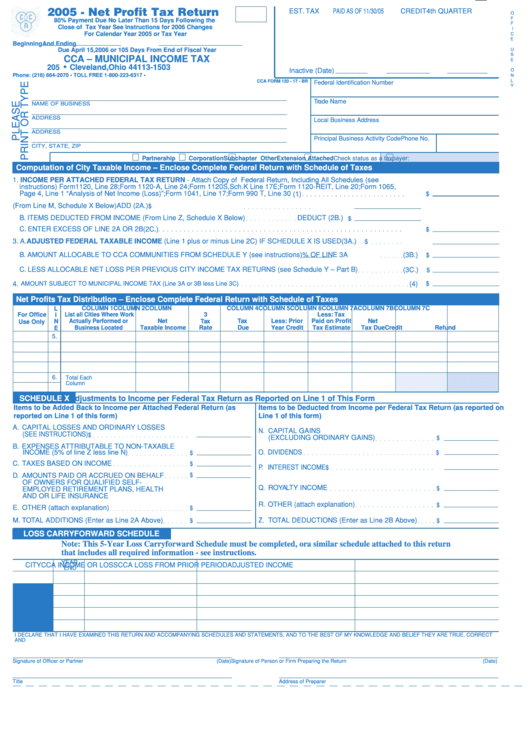

2005 - Net Profit Tax Return

EST. TAX

PAID AS OF 11/30/05

CREDIT

4th QUARTER

O

F

80% Payment Due No Later Than 15 Days Following the

F

Close of Tax Year See Instructions for 2006 Changes

I

For Calendar Year 2005 or Tax Year

C

E

Beginning

And Ending

Due April 15, 2006 or 105 Days From End of Fiscal Year

U

S

CCA – MUNICIPAL INCOME TAX

E

•

Cleveland, Ohio 44113-1503

205 W. St. Clair Ave.

Inactive (Date)

Emp.

Res.

O

Phone: (216) 664-2070 • TOLL FREE 1-800-223-6317 •

N

L

CCA FORM 120 - 17 - BR

Federal Identification Number

Y

Trade Name

NAME OF BUSINESS

ADDRESS

Local Business Address

ADDRESS

Principal Business Activity Code

Phone No.

CITY, STATE, ZIP

Check status as a taxpayer:

Partnership

Corporation

Subchapter S. Corp.

Other

Extension Attached

Computation of City Taxable Income – Enclose Complete Federal Return with Schedule of Taxes

1. INCOME PER ATTACHED FEDERAL TAX RETURN - Attach Copy of Federal Return, Including All Schedules (see

instructions) Form1120, Line 28; Form 1120-A, Line 24; Form 1120S,Sch. K Line 17E; Form 1120-REIT, Line 20; Form 1065,

Page 4, Line 1 “Analysis of Net Income (Loss)”; Form 1041, Line 17; Form 990 T, Line 30

(1)

$

2. A. ITEMS ADDED BACK TO INCOME (From Line M, Schedule X Below)

ADD (2A.)

$

B. ITEMS DEDUCTED FROM INCOME (From Line Z, Schedule X Below)

DEDUCT (2B.)

$

C. ENTER EXCESS OF LINE 2A OR 2B

(2C.)

$

3. A. ADJUSTED FEDERAL TAXABLE INCOME (Line 1 plus or minus Line 2C) IF SCHEDULE X IS USED

(3A.)

$

B. AMOUNT ALLOCABLE TO CCA COMMUNITIES FROM SCHEDULE Y (see instructions)

% OF LINE 3A

(3B.)

$

C. LESS ALLOCABLE NET LOSS PER PREVIOUS CITY INCOME TAX RETURNS (see Schedule Y – Part B)

(3C.)

$

4.

AMOUNT SUBJECT TO MUNICIPAL INCOME TAX (Line 3A or 3B less Line 3C)

(4)

$

Net Profits Tax Distribution – Enclose Complete Federal Return with Schedule of Taxes

L

COLUMN 1

COLUMN 2

COLUMN

COLUMN 4

COLUMN 5

COLUMN 6

COLUMN 7A

COLUMN 7B

COLUMN 7C

For Office

List all Cities Where Work

3

Less: Tax

I

Actually Performed or

Net

Tax

Tax

Less: Prior

Paid on Profit

Net

Use Only

N

Taxable Income

Due

Year Credit

Tax Due

Credit

Refund

E

Business Located

Rate

Tax Estimate

5.

6.

Total Each

Column

SCHEDULE X

Adjustments to Income per Federal Tax Return as Reported on Line 1 of This Form

Items to be Added Back to Income per Attached Federal Return (as

Items to be Deducted from Income per Federal Tax Return (as reported on

reported on Line 1 of this form)

Line 1 of this form)

A. CAPITAL LOSSES AND ORDINARY LOSSES

N. CAPITAL GAINS

(SEE INSTRUCTIONS)

$

(EXCLUDING ORDINARY GAINS)

$

B. EXPENSES ATTRIBUTABLE TO NON-TAXABLE

INCOME (5% of line Z less line N)

O. DIVIDENDS

$

$

C. TAXES BASED ON INCOME

$

P. INTEREST INCOME

$

D. AMOUNTS PAID OR ACCRUED ON BEHALF

$

OF OWNERS FOR QUALIFIED SELF-

Q. ROYALTY INCOME

$

EMPLOYED RETIREMENT PLANS, HEALTH

AND OR LIFE INSURANCE

R. OTHER (attach explanation)

$

E. OTHER (attach explanation)

$

M. TOTAL ADDITIONS (Enter as Line 2A Above)

Z. TOTAL DEDUCTIONS (Enter as Line 2B Above)

$

$

LOSS CARRYFORWARD SCHEDULE

Note: This 5-Year Loss Carryforward Schedule must be completed, or a similar schedule attached to this return

that includes all required information - see instructions.

YEAR

CITY

CCA INCOME OR LOSS

CCA LOSS FROM PRIOR PERIOD

ADJUSTED INCOME

END

I DECLARE THAT I HAVE EXAMINED THIS RETURN AND ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO THE BEST OF MY KNOWLEDGE AND BELIEF THEY ARE TRUE, CORRECT

AND COMPLETE. THE FIGURES USED HEREIN ARE THE SAME AS USED FOR FEDERAL INCOME TAX PURPOSES ADJUSTED TO MUNICIPAL INCOME TAX ORDINANCES.

Signature of Officer or Partner

(Date)

Signature of Person or Firm Preparing the Return

(Date)

Title

Address of Preparer

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2