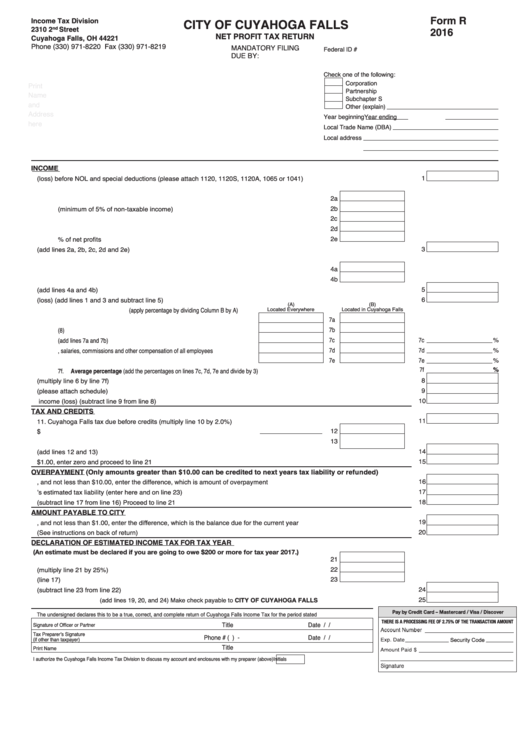

Form R - Net Profit Tax Return - 2016

ADVERTISEMENT

Form

R

Income Tax Division

CITY OF CUYAHOGA FALLS

2310 2

Street

nd

2016

NET PROFIT TAX RETURN

Cuyahoga Falls, OH 44221

Phone (330) 971-8220

Fax (330) 971-8219

MANDATORY FILING

Federal ID #

DUE BY:

Check one of the following:

Corporation

Print

Partnership

Name

Subchapter S

and

Other (explain)

Address

Year beginning

Year ending

here

Local Trade Name (DBA)

Local address

INCOME

1

1. Federal taxable income (loss) before NOL and special deductions (please attach 1120, 1120S, 1120A, 1065 or 1041)

2. Items not deductible

2a

2a. Capital losses

2b

2b. Expenses attributable to non-taxable income (minimum of 5% of non-taxable income)

2c

2c. Taxes based on income

2d

2d. Guaranteed payments to partners

2e

2e. Charitable contributions made in excess of 10% of net profits

3

3. Items not deductible subtotal (add lines 2a, 2b, 2c, 2d and 2e)

4. Items not taxable

4a

4a. Capital gains

4b

4b. Interest and dividend income

5

5. Items not taxable subtotal (add lines 4a and 4b)

6

6. Adjusted taxable income (loss) (add lines 1 and 3 and subtract line 5)

(A)

(B)

7. Business allocation formula (apply percentage by dividing Column B by A)

Located Everywhere

Located in Cuyahoga Falls

7a

7a. Average original cost of real and tangible personal property

7b

7b. Gross annual rentals multiplied by eight (8)

7c

7c

%

7c. Total (add lines 7a and 7b)

7d

7d

%

7d. Total wages, salaries, commissions and other compensation of all employees

7e

7e

%

7e. Gross receipts from sales made and/or work or services performed

7f .....................................

7f.

Average percentage (add the percentages on lines 7c, 7d, 7e and divide by 3)

%

8

8. Amount allocable to Cuyahoga Falls (multiply line 6 by line 7f)

9

9. Loss carried forward from previous five years (please attach schedule)

10

10. Cuyahoga Falls taxable income (loss) (subtract line 9 from line 8)

TAX AND CREDITS

11

11. Cuyahoga Falls tax due before credits (multiply line 10 by 2.0%)

12

12. Estimated tax payments made to Cuyahoga Falls as of

$

13

13. Income tax credit carried forward from prior years

14

14. Total tax payments and credits (add lines 12 and 13)

15

15. If difference between line 11 and line 14 is less than $1.00, enter zero and proceed to line 21

OVERPAYMENT (Only amounts greater than $10.00 can be credited to next years tax liability or refunded)

16

16. If line 14 is greater than line 11, and not less than $10.00, enter the difference, which is amount of overpayment

17

17. Amount of line 16 to be credited to next yearʼs estimated tax liability (enter here and on line 23)

18

18. Amount to be refunded (subtract line 17 from line 16) Proceed to line 21

AMOUNT PAYABLE TO CITY

19

19. If line 11 is greater than line 14, and not less than $1.00, enter the difference, which is the balance due for the current year

20

20. Penalty and interest (See instructions on back of return)

DECLARATION OF ESTIMATED INCOME TAX FOR TAX YEAR

(An estimate must be declared if you are going to owe $200 or more for tax year 2017.)

21

21. Estimated tax liability for the tax year

22

22. First quarter of estimated tax payable to City (multiply line 21 by 25%)

23

23. Previous year credits applied to estimated tax payments (line 17)

24

24. Net amount due for initial quarterly payment (subtract line 23 from line 22)

25

25. Total amount due

(add lines 19, 20, and 24) Make check payable to CITY OF CUYAHOGA FALLS

Pay by Credit Card – Mastercard / Visa / Discover

The undersigned declares this to be a true, correct, and complete return of Cuyahoga Falls Income Tax for the period stated

THERE IS A PROCESSING FEE OF 2.75% OF THE TRANSACTION AMOUNT

Title

Date

/

/

Signature of Officer or Partner

Tax Preparerʼs Signature

Phone # (

)

-

Date

/

/

(if other than taxpayer)

Security Code

Title

Print Name

I authorize the Cuyahoga Falls Income Tax Division to discuss my account and enclosures with my preparer (above)

Initials

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2