City Of Perrysburg Declaration Of Estimated Tax - 2004

ADVERTISEMENT

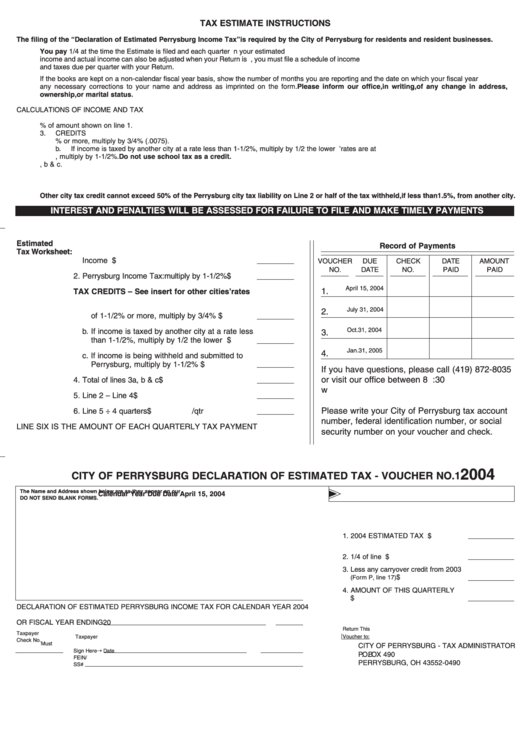

TAX ESTIMATE INSTRUCTIONS

The filing of the “Declaration of Estimated Perrysburg Income Tax” is required by the City of Perrysburg for residents and resident businesses.

You pay 1/4 at the time the Estimate is filed and each quarter thereafter. You may amend your estimate at any time. Any difference between your estimated

income and actual income can also be adjusted when your Return is filed. If your estimates are not paid in equal amounts, you must file a schedule of income

and taxes due per quarter with your Return.

If the books are kept on a non-calendar fiscal year basis, show the number of months you are reporting and the date on which your fiscal year ends. Make

any necessary corrections to your name and address as imprinted on the form. Please inform our office, in writing, of any change in address,

ownership, or marital status.

CALCULATIONS OF INCOME AND TAX

1.

Enter here the total estimated income subject to Perrysburg income tax. Use 2003 information if 2004 income cannot be established.

2.

Enter here 1-1/2% of amount shown on line 1.

3.

CREDITS

a.

If income is taxed by another city at the rate of 1-1/2% or more, multiply by 3/4% (.0075).

b.

If income is taxed by another city at a rate less than 1-1/2%, multiply by 1/2 the lower rate. Other cities’ rates are at

c.

If income is being withheld and submitted to Perrysburg, multiply by 1-1/2%. Do not use school tax as a credit.

4.

Total of lines 3a, b & c.

5.

Subtract line 4 from line 2.

6.

Divide line 5 by four. Line 6 is the amount of each quarterly payment.

Other city tax credit cannot exceed 50% of the Perrysburg city tax liability on Line 2 or half of the tax withheld, if less than 1.5%, from another city.

INTEREST AND PENALTIES WILL BE ASSESSED FOR FAILURE TO FILE AND MAKE TIMELY PAYMENTS

Estimated

Record of Payments

Tax Worksheet: 1. Total Estimated Income subject to Perrysburg

Income Tax ..........................................................$

VOUCHER

DUE

CHECK

DATE

AMOUNT

NO.

DATE

NO.

PAID

PAID

2. Perrysburg Income Tax: multiply by 1-1/2% ..........$

April 15, 2004

1.

TAX CREDITS – See insert for other cities’ rates

3. a. If income is taxed by another city at the rate

July 31, 2004

2.

of 1-1/2% or more, multiply by 3/4% ................$

Oct. 31, 2004

b. If income is taxed by another city at a rate less

3.

than 1-1/2%, multiply by 1/2 the lower rate......$

Jan. 31, 2005

4.

c. If income is being withheld and submitted to

Perrysburg, multiply by 1-1/2% ........................$

If you have questions, please call (419) 872-8035

4. Total of lines 3a, b & c ..........................................$

or visit our office between 8 a.m. and 4:30 p.m.

weekdays. There is no charge for our assistance.

5. Line 2 – Line 4 ......................................................$

Please write your City of Perrysburg tax account

6. Line 5 ÷ 4 quarters................................................$

/qtr

number, federal identification number, or social

LINE SIX IS THE AMOUNT OF EACH QUARTERLY TAX PAYMENT

security number on your voucher and check.

2004

CITY OF PERRYSBURG DECLARATION OF ESTIMATED TAX - VOUCHER NO. 1

The Name and Address shown below are as they appear on our records. Please correct as needed.

Calendar Year Due Date April 15, 2004

DO NOT SEND BLANK FORMS.

1. 2004 ESTIMATED TAX LIABILITY ....$

2. 1/4 of line 1 ......................................$

3. Less any carryover credit from 2003

..................................$

(Form P, line 17)

4. AMOUNT OF THIS QUARTERLY

INSTALLMENT ..................................$

DECLARATION OF ESTIMATED PERRYSBURG INCOME TAX FOR CALENDAR YEAR 2004

OR FISCAL YEAR ENDING

20

Return This

Taxpayer

Voucher to:

Taxpayer

Check No.

Must

CITY OF PERRYSBURG - TAX ADMINISTRATOR

Sign Here➝

Date

P.O. BOX 490

FEIN/

PERRYSBURG, OH 43552-0490

SS#

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2