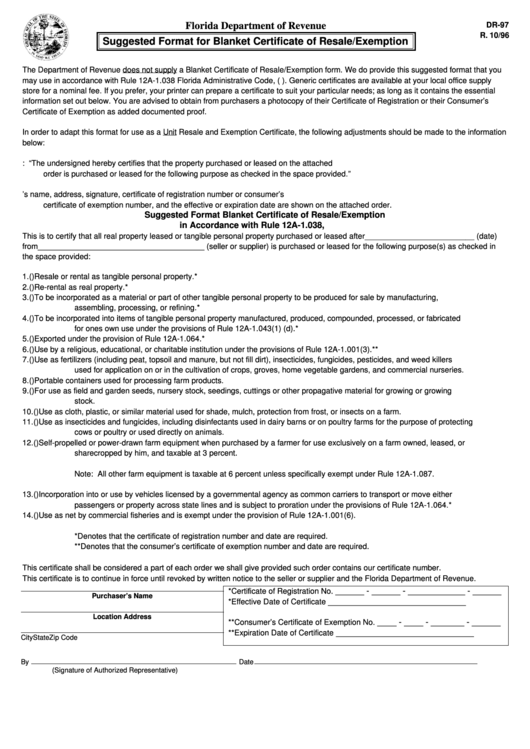

Florida Department of Revenue

DR-97

R. 10/96

Suggested Format for Blanket Certificate of Resale/Exemption

The Department of Revenue does not supply a Blanket Certificate of Resale/Exemption form. We do provide this suggested format that you

may use in accordance with Rule 12A-1.038 Florida Administrative Code, (F.A.C.). Generic certificates are available at your local office supply

store for a nominal fee. If you prefer, your printer can prepare a certificate to suit your particular needs; as long as it contains the essential

information set out below. You are advised to obtain from purchasers a photocopy of their Certificate of Registration or their Consumer’s

Certificate of Exemption as added documented proof.

In order to adapt this format for use as a Unit Resale and Exemption Certificate, the following adjustments should be made to the information

below:

1.

The first paragraph may be replaced with: “The undersigned hereby certifies that the property purchased or leased on the attached

order is purchased or leased for the following purpose as checked in the space provided.”

2.

The final paragraph may be omitted provided the purchaser’s name, address, signature, certificate of registration number or consumer’s

certificate of exemption number, and the effective or expiration date are shown on the attached order.

Suggested Format Blanket Certificate of Resale/Exemption

in Accordance with Rule 12A-1.038, F.A.C.

This is to certify that all real property leased or tangible personal property purchased or leased after _________________________ (date)

from ______________________________________ (seller or supplier) is purchased or leased for the following purpose(s) as checked in

the space provided:

1.

(

)

Resale or rental as tangible personal property.*

2.

(

)

Re-rental as real property.*

3.

(

)

To be incorporated as a material or part of other tangible personal property to be produced for sale by manufacturing,

assembling, processing, or refining.*

4.

(

)

To be incorporated into items of tangible personal property manufactured, produced, compounded, processed, or fabricated

for ones own use under the provisions of Rule 12A-1.043(1) (d).*

5.

(

)

Exported under the provision of Rule 12A-1.064.*

6.

(

)

Use by a religious, educational, or charitable institution under the provisions of Rule 12A-1.001(3).**

7.

(

)

Use as fertilizers (including peat, topsoil and manure, but not fill dirt), insecticides, fungicides, pesticides, and weed killers

used for application on or in the cultivation of crops, groves, home vegetable gardens, and commercial nurseries.

8.

(

)

Portable containers used for processing farm products.

9.

(

)

For use as field and garden seeds, nursery stock, seedings, cuttings or other propagative material for growing or growing

stock.

10.

(

)

Use as cloth, plastic, or similar material used for shade, mulch, protection from frost, or insects on a farm.

11.

(

)

Use as insecticides and fungicides, including disinfectants used in dairy barns or on poultry farms for the purpose of protecting

cows or poultry or used directly on animals.

12.

(

)

Self-propelled or power-drawn farm equipment when purchased by a farmer for use exclusively on a farm owned, leased, or

sharecropped by him, and taxable at 3 percent.

Note: All other farm equipment is taxable at 6 percent unless specifically exempt under Rule 12A-1.087.

13.

(

)

Incorporation into or use by vehicles licensed by a governmental agency as common carriers to transport or move either

passengers or property across state lines and is subject to proration under the provisions of Rule 12A-1.064.*

14.

(

)

Use as net by commercial fisheries and is exempt under the provision of Rule 12A-1.001(6).

* Denotes that the certificate of registration number and date are required.

** Denotes that the consumer’s certificate of exemption number and date are required.

This certificate shall be considered a part of each order we shall give provided such order contains our certificate number.

This certificate is to continue in force until revoked by written notice to the seller or supplier and the Florida Department of Revenue.

______ - ______ - ____________ - ______

*Certificate of Registration No.

Purchaser’s Name

_____________________________

*Effective Date of Certificate

Location Address

____ - ____ - _______ - ______

**Consumer’s Certificate of Exemption No.

_____________________________

**Expiration Date of Certificate

City

State

Zip Code

By

Date

(Signature of Authorized Representative)

1

1