Real Property Assessment Division First Level Appeal Application Form - Government Of The District Of Columbia

ADVERTISEMENT

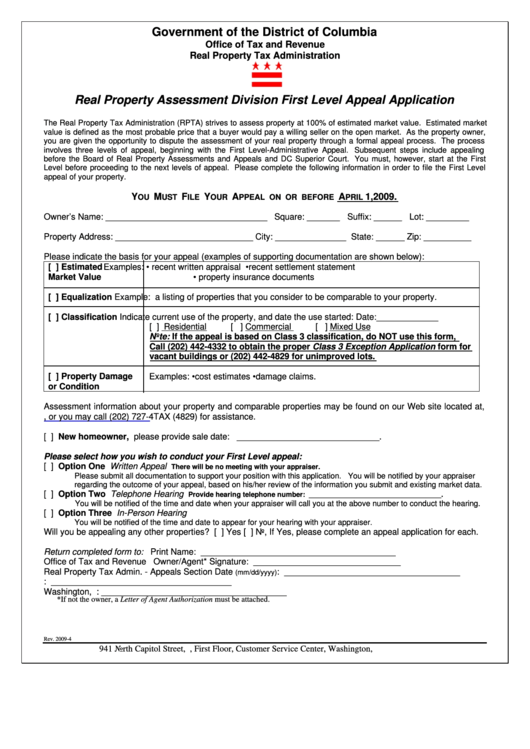

Government of the District of Columbia

Office of Tax and Revenue

Real Property Tax Administration

Real Property Assessment Division First Level Appeal Application

The Real Property Tax Administration (RPTA) strives to assess property at 100% of estimated market value. Estimated market

value is defined as the most probable price that a buyer would pay a willing seller on the open market. As the property owner,

you are given the opportunity to dispute the assessment of your real property through a formal appeal process. The process

involves three levels of appeal, beginning with the First Level-Administrative Appeal. Subsequent steps include appealing

before the Board of Real Property Assessments and Appeals and DC Superior Court. You must, however, start at the First

Level before proceeding to the next levels of appeal. Please complete the following information in order to file the First Level

appeal of your property.

Y

M

F

Y

A

A

1, 2009.

OU

UST

ILE

OUR

PPEAL ON OR BEFORE

PRIL

Owner’s Name: __________________________________ Square:

________

Suffix:

_______

Lot: _________

Property Address: _____________________________ City: ________________State: ______ Zip: __________

Please indicate the basis for your appeal (examples of supporting documentation are shown below):

[ ] Estimated

Examples: • recent written appraisal •recent settlement statement

Market Value

• property insurance documents

[ ] Equalization

Example: a listing of properties that you consider to be comparable to your property.

[ ] Classification

Indicate current use of the property, and date the use started: Date:_____________

[ ] Residential

[ ] Commercial

[ ] Mixed Use

Note: If the appeal is based on Class 3 classification, do NOT use this form,

Call (202) 442-4332 to obtain the proper Class 3 Exception Application form for

vacant buildings or (202) 442-4829 for unimproved lots.

[ ] Property Damage

Examples: •cost estimates •damage claims.

or Condition

Assessment information about your property and comparable properties may be found on our Web site located at,

, or you may call (202) 727-4TAX (4829) for assistance.

[ ] New homeowner, please provide sale date: ______________________________.

Please select how you wish to conduct your First Level appeal:

[ ] Option One Written Appeal

There will be no meeting with your appraiser.

Please submit all documentation to support your position with this application. You will be notified by your appraiser

regarding the outcome of your appeal, based on his/her review of the information you submit and existing market data.

[ ] Option Two Telephone Hearing

Provide hearing telephone number: __________________________________.

You will be notified of the time and date when your appraiser will call you at the above number to conduct the hearing.

[ ] Option Three In-Person Hearing

You will be notified of the time and date to appear for your hearing with your appraiser.

Will you be appealing any other properties? [ ] Yes [ ] No, If Yes, please complete an appeal application for each.

Return completed form to:

Print Name: _________________________________________

Office of Tax and Revenue

Owner/Agent* Signature: _______________________________

Real Property Tax Admin. - Appeals Section

Date

: _____________________________________

(mm/dd/yyyy)

P.O. Box 176

Daytime Phone: ______________________________________

Washington, D.C. 20044

Evening Phone: _______________________________________

*If not the owner, a Letter of Agent Authorization must be attached.

Rev. 2009-4

941 North Capitol Street, N.E., First Floor, Customer Service Center, Washington, D.C. 20002

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1