Application For Equalization Of Real Property Assessment - Fairfax County Board Of Equalization - 2008

ADVERTISEMENT

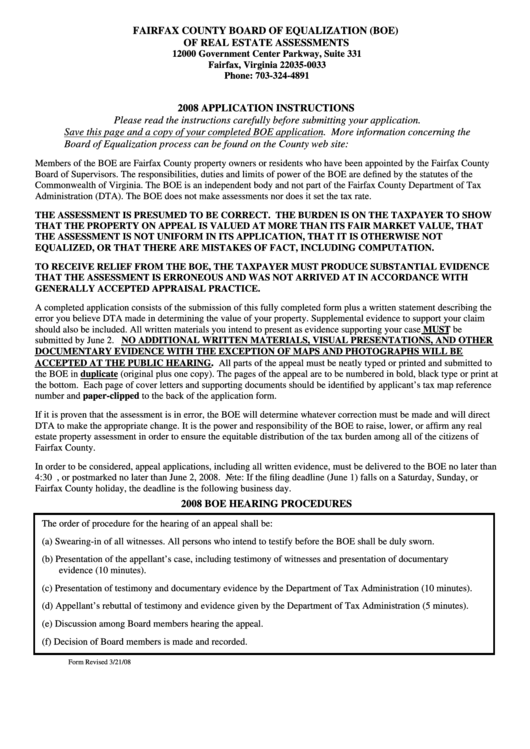

FAIRFAX COUNTY BOARD OF EQUALIZATION (BOE)

OF REAL ESTATE ASSESSMENTS

12000 Government Center Parkway, Suite 331

Fairfax, Virginia 22035-0033

Phone: 703-324-4891

2008 APPLICATION INSTRUCTIONS

Please read the instructions carefully before submitting your application.

Save this page and a copy of your completed BOE application. More information concerning the

Board of Equalization process can be found on the County web site: .

Members of the BOE are Fairfax County property owners or residents who have been appointed by the Fairfax County

Board of Supervisors. The responsibilities, duties and limits of power of the BOE are defined by the statutes of the

Commonwealth of Virginia. The BOE is an independent body and not part of the Fairfax County Department of Tax

Administration (DTA). The BOE does not make assessments nor does it set the tax rate.

THE ASSESSMENT IS PRESUMED TO BE CORRECT. THE BURDEN IS ON THE TAXPAYER TO SHOW

THAT THE PROPERTY ON APPEAL IS VALUED AT MORE THAN ITS FAIR MARKET VALUE, THAT

THE ASSESSMENT IS NOT UNIFORM IN ITS APPLICATION, THAT IT IS OTHERWISE NOT

EQUALIZED, OR THAT THERE ARE MISTAKES OF FACT, INCLUDING COMPUTATION.

TO RECEIVE RELIEF FROM THE BOE, THE TAXPAYER MUST PRODUCE SUBSTANTIAL EVIDENCE

THAT THE ASSESSMENT IS ERRONEOUS AND WAS NOT ARRIVED AT IN ACCORDANCE WITH

GENERALLY ACCEPTED APPRAISAL PRACTICE.

A completed application consists of the submission of this fully completed form plus a written statement describing the

error you believe DTA made in determining the value of your property. Supplemental evidence to support your claim

should also be included. All written materials you intend to present as evidence supporting your case MUST be

submitted by June 2. NO ADDITIONAL WRITTEN MATERIALS, VISUAL PRESENTATIONS, AND OTHER

DOCUMENTARY EVIDENCE WITH THE EXCEPTION OF MAPS AND PHOTOGRAPHS WILL BE

.

ACCEPTED AT THE PUBLIC HEARING

All parts of the appeal must be neatly typed or printed and submitted to

the BOE in duplicate (original plus one copy). The pages of the appeal are to be numbered in bold, black type or print at

the bottom. Each page of cover letters and supporting documents should be identified by applicant’s tax map reference

number and paper-clipped to the back of the application form.

If it is proven that the assessment is in error, the BOE will determine whatever correction must be made and will direct

DTA to make the appropriate change. It is the power and responsibility of the BOE to raise, lower, or affirm any real

estate property assessment in order to ensure the equitable distribution of the tax burden among all of the citizens of

Fairfax County.

In order to be considered, appeal applications, including all written evidence, must be delivered to the BOE no later than

4:30 p.m., or postmarked no later than June 2, 2008. Note: If the filing deadline (June 1) falls on a Saturday, Sunday, or

Fairfax County holiday, the deadline is the following business day.

2008 BOE HEARING PROCEDURES

The order of procedure for the hearing of an appeal shall be:

(a) Swearing-in of all witnesses. All persons who intend to testify before the BOE shall be duly sworn.

(b) Presentation of the appellant’s case, including testimony of witnesses and presentation of documentary

evidence (10 minutes).

(c) Presentation of testimony and documentary evidence by the Department of Tax Administration (10 minutes).

(d) Appellant’s rebuttal of testimony and evidence given by the Department of Tax Administration (5 minutes).

(e) Discussion among Board members hearing the appeal.

(f) Decision of Board members is made and recorded.

Form Revised 3/21/08

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4