Application For Equalization Of Real Property Assessment - Fairfax County Board Of Equalization - 2006

ADVERTISEMENT

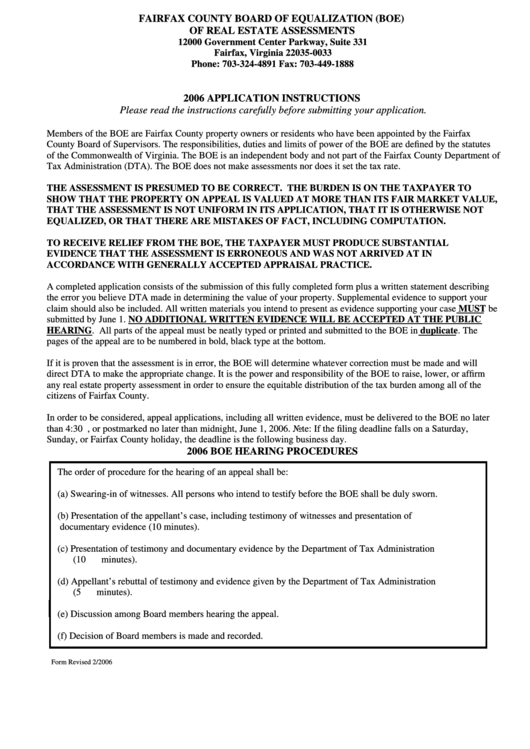

FAIRFAX COUNTY BOARD OF EQUALIZATION (BOE)

OF REAL ESTATE ASSESSMENTS

12000 Government Center Parkway, Suite 331

Fairfax, Virginia 22035-0033

Phone: 703-324-4891 Fax: 703-449-1888

2006 APPLICATION INSTRUCTIONS

Please read the instructions carefully before submitting your application.

Members of the BOE are Fairfax County property owners or residents who have been appointed by the Fairfax

County Board of Supervisors. The responsibilities, duties and limits of power of the BOE are defined by the statutes

of the Commonwealth of Virginia. The BOE is an independent body and not part of the Fairfax County Department of

Tax Administration (DTA). The BOE does not make assessments nor does it set the tax rate.

THE ASSESSMENT IS PRESUMED TO BE CORRECT. THE BURDEN IS ON THE TAXPAYER TO

SHOW THAT THE PROPERTY ON APPEAL IS VALUED AT MORE THAN ITS FAIR MARKET VALUE,

THAT THE ASSESSMENT IS NOT UNIFORM IN ITS APPLICATION, THAT IT IS OTHERWISE NOT

EQUALIZED, OR THAT THERE ARE MISTAKES OF FACT, INCLUDING COMPUTATION.

TO RECEIVE RELIEF FROM THE BOE, THE TAXPAYER MUST PRODUCE SUBSTANTIAL

EVIDENCE THAT THE ASSESSMENT IS ERRONEOUS AND WAS NOT ARRIVED AT IN

ACCORDANCE WITH GENERALLY ACCEPTED APPRAISAL PRACTICE.

A completed application consists of the submission of this fully completed form plus a written statement describing

the error you believe DTA made in determining the value of your property. Supplemental evidence to support your

claim should also be included. All written materials you intend to present as evidence supporting your case MUST be

submitted by June 1. NO ADDITIONAL WRITTEN EVIDENCE WILL BE ACCEPTED AT THE PUBLIC

HEARING. All parts of the appeal must be neatly typed or printed and submitted to the BOE in duplicate. The

pages of the appeal are to be numbered in bold, black type at the bottom.

If it is proven that the assessment is in error, the BOE will determine whatever correction must be made and will

direct DTA to make the appropriate change. It is the power and responsibility of the BOE to raise, lower, or affirm

any real estate property assessment in order to ensure the equitable distribution of the tax burden among all of the

citizens of Fairfax County.

In order to be considered, appeal applications, including all written evidence, must be delivered to the BOE no later

than 4:30 p.m., or postmarked no later than midnight, June 1, 2006. Note: If the filing deadline falls on a Saturday,

Sunday, or Fairfax County holiday, the deadline is the following business day.

2006 BOE HEARING PROCEDURES

The order of procedure for the hearing of an appeal shall be:

(a) Swearing-in of witnesses. All persons who intend to testify before the BOE shall be duly sworn.

(b) Presentation of the appellant’s case, including testimony of witnesses and presentation of

documentary evidence (10 minutes).

(c) Presentation of testimony and documentary evidence by the Department of Tax Administration

(10 minutes).

(d) Appellant’s rebuttal of testimony and evidence given by the Department of Tax Administration

(5 minutes).

(e) Discussion among Board members hearing the appeal.

(f) Decision of Board members is made and recorded.

Form Revised 2/2006

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3