Withholding Registration Form - City Of Hamilton

ADVERTISEMENT

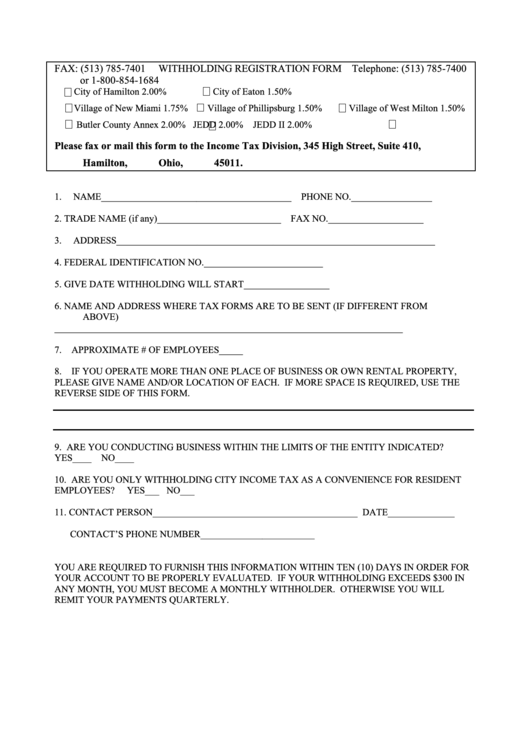

FAX: (513) 785-7401

WITHHOLDING REGISTRATION FORM Telephone: (513) 785-7400

or 1-800-854-1684

City of Hamilton 2.00%

City of Eaton 1.50%

Village of New Miami 1.75%

Village of Phillipsburg 1.50%

Village of West Milton 1.50%

Butler County Annex 2.00%

JEDD 2.00%

JEDD II 2.00%

Please fax or mail this form to the Income Tax Division, 345 High Street, Suite 410,

Hamilton, Ohio, 45011.

1.

NAME________________________________________ PHONE NO._________________

2.

TRADE NAME (if any)__________________________ FAX NO.____________________

3.

ADDRESS___________________________________________________________________

4.

FEDERAL IDENTIFICATION NO._________________________

5.

GIVE DATE WITHHOLDING WILL START__________________

6.

NAME AND ADDRESS WHERE TAX FORMS ARE TO BE SENT (IF DIFFERENT FROM

ABOVE)

_________________________________________________________________________

7. APPROXIMATE # OF EMPLOYEES_____

8. IF YOU OPERATE MORE THAN ONE PLACE OF BUSINESS OR OWN RENTAL PROPERTY,

PLEASE GIVE NAME AND/OR LOCATION OF EACH. IF MORE SPACE IS REQUIRED, USE THE

REVERSE SIDE OF THIS FORM.

9. ARE YOU CONDUCTING BUSINESS WITHIN THE LIMITS OF THE ENTITY INDICATED?

YES____ NO____

10. ARE YOU ONLY WITHHOLDING CITY INCOME TAX AS A CONVENIENCE FOR RESIDENT

EMPLOYEES?

YES___ NO___

11.

CONTACT PERSON___________________________________________ DATE______________

CONTACT’S PHONE NUMBER________________________

YOU ARE REQUIRED TO FURNISH THIS INFORMATION WITHIN TEN (10) DAYS IN ORDER FOR

YOUR ACCOUNT TO BE PROPERLY EVALUATED. IF YOUR WITHHOLDING EXCEEDS $300 IN

ANY MONTH, YOU MUST BECOME A MONTHLY WITHHOLDER. OTHERWISE YOU WILL

REMIT YOUR PAYMENTS QUARTERLY.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1