Individual Return Instructions - City Of Fairlawn

ADVERTISEMENT

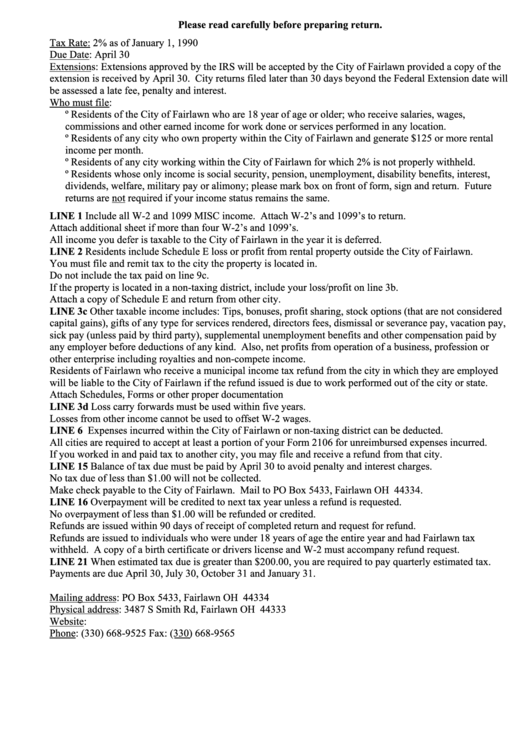

Please read carefully before preparing return.

Tax Rate: 2% as of January 1, 1990

Due Date: April 30

Extensions: Extensions approved by the IRS will be accepted by the City of Fairlawn provided a copy of the

extension is received by April 30. City returns filed later than 30 days beyond the Federal Extension date will

be assessed a late fee, penalty and interest.

Who must file:

º Residents of the City of Fairlawn who are 18 year of age or older; who receive salaries, wages,

commissions and other earned income for work done or services performed in any location.

º Residents of any city who own property within the City of Fairlawn and generate $125 or more rental

income per month.

º Residents of any city working within the City of Fairlawn for which 2% is not properly withheld.

º Residents whose only income is social security, pension, unemployment, disability benefits, interest,

dividends, welfare, military pay or alimony; please mark box on front of form, sign and return. Future

returns are not required if your income status remains the same.

LINE 1 Include all W-2 and 1099 MISC income. Attach W-2’s and 1099’s to return.

Attach additional sheet if more than four W-2’s and 1099’s.

All income you defer is taxable to the City of Fairlawn in the year it is deferred.

LINE 2 Residents include Schedule E loss or profit from rental property outside the City of Fairlawn.

You must file and remit tax to the city the property is located in.

Do not include the tax paid on line 9c.

If the property is located in a non-taxing district, include your loss/profit on line 3b.

Attach a copy of Schedule E and return from other city.

LINE 3c Other taxable income includes: Tips, bonuses, profit sharing, stock options (that are not considered

capital gains), gifts of any type for services rendered, directors fees, dismissal or severance pay, vacation pay,

sick pay (unless paid by third party), supplemental unemployment benefits and other compensation paid by

any employer before deductions of any kind. Also, net profits from operation of a business, profession or

other enterprise including royalties and non-compete income.

Residents of Fairlawn who receive a municipal income tax refund from the city in which they are employed

will be liable to the City of Fairlawn if the refund issued is due to work performed out of the city or state.

Attach Schedules, Forms or other proper documentation

LINE 3d Loss carry forwards must be used within five years.

Losses from other income cannot be used to offset W-2 wages.

LINE 6 Expenses incurred within the City of Fairlawn or non-taxing district can be deducted.

All cities are required to accept at least a portion of your Form 2106 for unreimbursed expenses incurred.

If you worked in and paid tax to another city, you may file and receive a refund from that city.

LINE 15 Balance of tax due must be paid by April 30 to avoid penalty and interest charges.

No tax due of less than $1.00 will not be collected.

Make check payable to the City of Fairlawn. Mail to PO Box 5433, Fairlawn OH 44334.

LINE 16 Overpayment will be credited to next tax year unless a refund is requested.

No overpayment of less than $1.00 will be refunded or credited.

Refunds are issued within 90 days of receipt of completed return and request for refund.

Refunds are issued to individuals who were under 18 years of age the entire year and had Fairlawn tax

withheld. A copy of a birth certificate or drivers license and W-2 must accompany refund request.

LINE 21 When estimated tax due is greater than $200.00, you are required to pay quarterly estimated tax.

Payments are due April 30, July 30, October 31 and January 31.

Mailing address: PO Box 5433, Fairlawn OH 44334

Physical address: 3487 S Smith Rd, Fairlawn OH 44333

Website:

Phone: (330) 668-9525

Fax: (330) 668-9565

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1