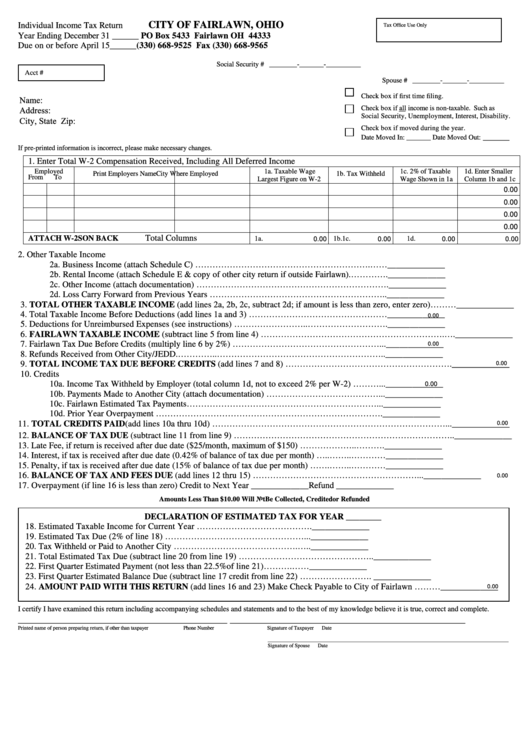

CITY OF FAIRLAWN, OHIO

Individual Income Tax Return

Tax Office Use Only

Year Ending December 31 ______

PO Box 5433 Fairlawn OH 44333

Due on or before April 15 ______

(330) 668-9525 Fax (330) 668-9565

Social Security # ________-_______-__________

Acct #

Spouse # ________-_______-__________

Check box if first time filing.

Name:

Address:

Check box if all income is non-taxable. Such as

Social Security, Unemployment, Interest, Disability.

City, State Zip:

Check box if moved during the year.

______

Date Moved In: _______ Date Moved Out:

If pre-printed information is incorrect, please make necessary changes.

1. Enter Total W-2 Compensation Received, Including All Deferred Income

Employed

1a. Taxable Wage

1c. 2% of Taxable

1d. Enter Smaller

Print Employers Name

City Where Employed

1b. Tax Withheld

From

To

Largest Figure on W-2

Wage Shown in 1a

Column 1b and 1c

0.00

0.00

0.00

0.00

Total Columns

ATTACH W-2S ON BACK

1a.

1b.

1c.

1d.

0.00

0.00

0.00

0.00

2. Other Taxable Income

2a. Business Income (attach Schedule C) …………………………………………………….……_____________

2b. Rental Income (attach Schedule E & copy of other city return if outside Fairlawn).…………._____________

2c. Other Income (attach documentation) …………………………………………………………._____________

2d. Loss Carry Forward from Previous Years …………………………………………………….._____________

3. TOTAL OTHER TAXABLE INCOME (add lines 2a, 2b, 2c, subtract 2d; if amount is less than zero, enter zero)………_____________

4. Total Taxable Income Before Deductions (add lines 1a and 3) …………………………………………_____________

0.00

5. Deductions for Unreimbursed Expenses (see instructions) ……………………..………………………._____________

6. FAIRLAWN TAXABLE INCOME (subtract line 5 from line 4) ……………………………………………………….…._____________

7. Fairlawn Tax Due Before Credits (multiply line 6 by 2%) ……………………………………………..._____________

0.00

8. Refunds Received from Other City/JEDD.…………..………………………………………………….._____________

9. TOTAL INCOME TAX DUE BEFORE CREDITS (add lines 7 and 8) …………………………………………………._____________

0.00

10. Credits

10a. Income Tax Withheld by Employer (total column 1d, not to exceed 2% per W-2) ………..._____________

0.00

10b. Payments Made to Another City (attach documentation) …………………………………..._____________

10c. Fairlawn Estimated Tax Payments…………………………………………………………..._____________

10d. Prior Year Overpayment ……………………………………………………………………._____________

11. TOTAL CREDITS PAID (add lines 10a thru 10d) ………………………………………………………………………..._____________

0.00

12. BALANCE OF TAX DUE (subtract line 11 from line 9) ………………………………………………………………….._____________

13. Late Fee, if return is received after due date ($25/month, maximum of $150) ………………..………._____________

14. Interest, if tax is received after due date (0.42% of balance of tax due per month) …..……..…………_____________

15. Penalty, if tax is received after due date (15% of balance of tax due per month) …….……..…………_____________

16. BALANCE OF TAX AND FEES DUE (add lines 12 thru 15) …………………………………………………................._____________

0.00

17. Overpayment (if line 16 is less than zero) Credit to Next Year _____________Refund _____________

Amounts Less Than $10.00 Will Not Be Collected, Credited or Refunded

DECLARATION OF ESTIMATED TAX FOR YEAR ________

18. Estimated Taxable Income for Current Year …………………………………._____________

19. Estimated Tax Due (2% of line 18) …………………………………………..._____________

20. Tax Withheld or Paid to Another City …………………………………….….._____________

21. Total Estimated Tax Due (subtract line 20 from line 19) ……………………………………….._____________

22. First Quarter Estimated Payment (not less than 22.5% of line 21)……….……_____________

23. First Quarter Estimated Balance Due (subtract line 17 credit from line 22) ……………………. _____________

24. AMOUNT PAID WITH THIS RETURN (add lines 16 and 23)

Make Check Payable to City of Fairlawn ………_____________

0.00

I certify I have examined this return including accompanying schedules and statements and to the best of my knowledge believe it is true, correct and complete.

________________________________________

_____________________________________________

Printed name of person preparing return, if other than taxpayer

Phone Number

Signature of Taxpayer

Date

__________________________________________________________________________________________

Signature of Spouse

Date

1

1 2

2