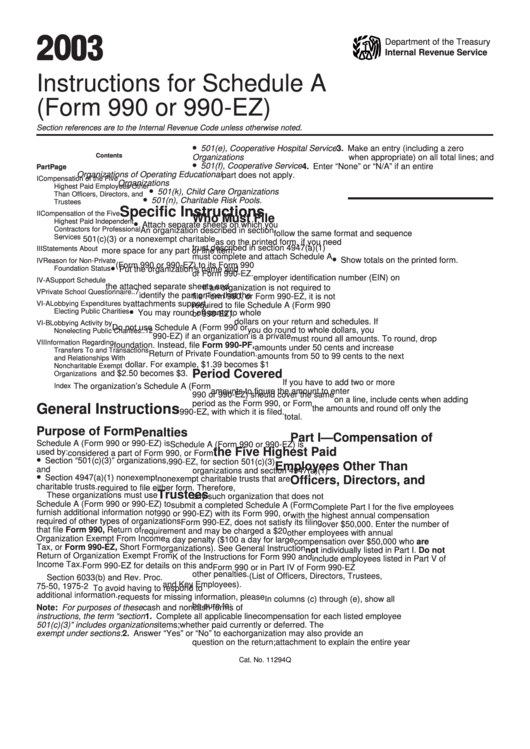

Instructions For Schedule A (Form 990 Or 990-Ez) - 2003

ADVERTISEMENT

03

2 0

Department of the Treasury

Internal Revenue Service

Instructions for Schedule A

(Form 990 or 990-EZ)

Section references are to the Internal Revenue Code unless otherwise noted.

•

501(e), Cooperative Hospital Service

3. Make an entry (including a zero

Contents

Organizations

when appropriate) on all total lines; and

•

501(f), Cooperative Service

4. Enter “None” or “N/A” if an entire

Part

Page

Organizations of Operating Educational

part does not apply.

I

Compensation of the Five

Organizations

Highest Paid Employees Other

•

501(k), Child Care Organizations

Than Officers, Directors, and

•

501(n), Charitable Risk Pools.

Trustees . . . . . . . . . . . . . . . .

1

Specific Instructions

II

Compensation of the Five

Who Must File

•

Highest Paid Independent

Attach separate sheets on which you

Contractors for Professional

An organization described in section

follow the same format and sequence

Services . . . . . . . . . . . . . . . .

2

501(c)(3) or a nonexempt charitable

as on the printed form, if you need

trust described in section 4947(a)(1)

III

Statements About Activities . . .

2

more space for any part or line item.

•

must complete and attach Schedule A

Show totals on the printed form.

IV

Reason for Non-Private

(Form 990 or 990-EZ) to its Form 990

•

Foundation Status . . . . . . . . .

3

Put the organization’s name and

or Form 990-EZ.

employer identification number (EIN) on

IV-A Support Schedule . . . . . . . . .

6

the attached separate sheets and

If an organization is not required to

V

Private School Questionnaire . .

7

identify the part or line that the

file Form 990, or Form 990-EZ, it is not

VI-A Lobbying Expenditures by

attachments support.

required to file Schedule A (Form 990

•

Electing Public Charities . . . . .

9

You may round off cents to whole

or 990-EZ).

dollars on your return and schedules. If

VI-B Lobbying Activity by

Do not use Schedule A (Form 990 or

you do round to whole dollars, you

Nonelecting Public Charities . .

12

990-EZ) if an organization is a private

must round all amounts. To round, drop

VII

Information Regarding

foundation. Instead, file Form 990-PF,

amounts under 50 cents and increase

Transfers To and Transactions

Return of Private Foundation.

amounts from 50 to 99 cents to the next

and Relationships With

dollar. For example, $1.39 becomes $1

Noncharitable Exempt

Period Covered

and $2.50 becomes $3.

Organizations . . . . . . . . . . . .

12

If you have to add two or more

Index . . . . . . . . . . . . . . . . . .

14

The organization’s Schedule A (Form

amounts to figure the amount to enter

990 or 990-EZ) should cover the same

on a line, include cents when adding

period as the Form 990, or Form

General Instructions

the amounts and round off only the

990-EZ, with which it is filed.

total.

Purpose of Form

Penalties

Part I—Compensation of

Schedule A (Form 990 or 990-EZ) is

Schedule A (Form 990 or 990-EZ) is

the Five Highest Paid

used by:

considered a part of Form 990, or Form

•

Section “501(c)(3)” organizations,

990-EZ, for section 501(c)(3)

Employees Other Than

and

organizations and section 4947(a)(1)

•

Section 4947(a)(1) nonexempt

nonexempt charitable trusts that are

Officers, Directors, and

charitable trusts.

required to file either form. Therefore,

Trustees

These organizations must use

any such organization that does not

Schedule A (Form 990 or 990-EZ) to

submit a completed Schedule A (Form

Complete Part I for the five employees

furnish additional information not

990 or 990-EZ) with its Form 990, or

with the highest annual compensation

required of other types of organizations

Form 990-EZ, does not satisfy its filing

over $50,000. Enter the number of

that file Form 990, Return of

requirement and may be charged a $20

other employees with annual

Organization Exempt From Income

a day penalty ($100 a day for large

compensation over $50,000 who are

Tax, or Form 990-EZ, Short Form

organizations). See General Instruction

not individually listed in Part I. Do not

Return of Organization Exempt From

K of the Instructions for Form 990 and

include employees listed in Part V of

Income Tax.

Form 990-EZ for details on this and

Form 990 or in Part IV of Form 990-EZ

other penalties.

(List of Officers, Directors, Trustees,

Section 6033(b) and Rev. Proc.

and Key Employees).

75-50, 1975-2 C.B. 587 require this

To avoid having to respond to

additional information.

requests for missing information, please

In columns (c) through (e), show all

be sure to:

Note: For purposes of these

cash and noncash forms of

instructions, the term “section

1. Complete all applicable line

compensation for each listed employee

501(c)(3)” includes organizations

items;

whether paid currently or deferred. The

exempt under sections:

2. Answer “Yes” or “No” to each

organization may also provide an

question on the return;

attachment to explain the entire year

Cat. No. 11294Q

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14