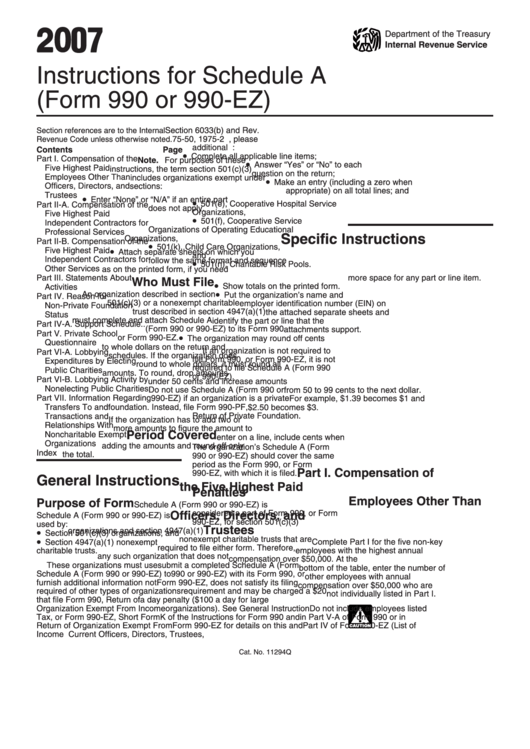

Instructions For Schedule A (Form 990 Or 990-Ez) - 2007

ADVERTISEMENT

2 0 07

Department of the Treasury

Internal Revenue Service

Instructions for Schedule A

(Form 990 or 990-EZ)

Section references are to the Internal

Section 6033(b) and Rev. Proc.

To avoid having to respond to

Revenue Code unless otherwise noted.

75-50, 1975-2 C.B. 587 require this

requests for missing information, please

additional information.

be sure to:

Contents

Page

•

Complete all applicable line items;

Part I. Compensation of the

Note. For purposes of these

•

Answer “Yes” or “No” to each

Five Highest Paid

instructions, the term section 501(c)(3)

question on the return;

Employees Other Than

includes organizations exempt under

•

Make an entry (including a zero when

Officers, Directors, and

sections:

appropriate) on all total lines; and

Trustees . . . . . . . . . . . . . . . . . . . .1

•

Enter “None” or “N/A” if an entire part

•

501(e), Cooperative Hospital Service

Part II-A. Compensation of the

does not apply.

Organizations,

Five Highest Paid

•

501(f), Cooperative Service

Independent Contractors for

Organizations of Operating Educational

Professional Services . . . . . . . . . . .2

Specific Instructions

Organizations,

Part II-B. Compensation of the

•

501(k), Child Care Organizations,

•

Five Highest Paid

Attach separate sheets on which you

and

Independent Contractors for

•

follow the same format and sequence

501(n), Charitable Risk Pools.

Other Services . . . . . . . . . . . . . . . .2

as on the printed form, if you need

more space for any part or line item.

Part III. Statements About

Who Must File

•

Show totals on the printed form.

Activities . . . . . . . . . . . . . . . . . . . .2

•

An organization described in section

Put the organization’s name and

Part IV. Reason for

501(c)(3) or a nonexempt charitable

employer identification number (EIN) on

Non-Private Foundation

trust described in section 4947(a)(1)

the attached separate sheets and

Status . . . . . . . . . . . . . . . . . . . . . .4

must complete and attach Schedule A

identify the part or line that the

Part IV-A. Support Schedule . . . . . . .8

(Form 990 or 990-EZ) to its Form 990

attachments support.

Part V. Private School

•

or Form 990-EZ.

The organization may round off cents

Questionnaire . . . . . . . . . . . . . . . .9

to whole dollars on the return and

If an organization is not required to

Part VI-A. Lobbying

schedules. If the organization does

file Form 990, or Form 990-EZ, it is not

Expenditures by Electing

round to whole dollars, it must round all

required to file Schedule A (Form 990

Public Charities . . . . . . . . . . . . . . 11

amounts. To round, drop amounts

or 990-EZ).

Part VI-B. Lobbying Activity by

under 50 cents and increase amounts

Nonelecting Public Charities . . . . 14

Do not use Schedule A (Form 990 or

from 50 to 99 cents to the next dollar.

Part VII. Information Regarding

990-EZ) if an organization is a private

For example, $1.39 becomes $1 and

Transfers To and

foundation. Instead, file Form 990-PF,

$2.50 becomes $3.

Return of Private Foundation.

Transactions and

If the organization has to add two or

Relationships With

more amounts to figure the amount to

Period Covered

Noncharitable Exempt

enter on a line, include cents when

Organizations . . . . . . . . . . . . . . . 14

adding the amounts and round off only

The organization’s Schedule A (Form

Index . . . . . . . . . . . . . . . . . . . . . . . 16

the total.

990 or 990-EZ) should cover the same

period as the Form 990, or Form

Part I. Compensation of

990-EZ, with which it is filed.

General Instructions

the Five Highest Paid

Penalties

Employees Other Than

Purpose of Form

Schedule A (Form 990 or 990-EZ) is

considered a part of Form 990, or Form

Officers, Directors, and

Schedule A (Form 990 or 990-EZ) is

990-EZ, for section 501(c)(3)

used by:

Trustees

•

organizations and section 4947(a)(1)

Section 501(c)(3) organizations, and

•

nonexempt charitable trusts that are

Complete Part I for the five non-key

Section 4947(a)(1) nonexempt

required to file either form. Therefore,

charitable trusts.

employees with the highest annual

any such organization that does not

compensation over $50,000. At the

These organizations must use

submit a completed Schedule A (Form

bottom of the table, enter the number of

Schedule A (Form 990 or 990-EZ) to

990 or 990-EZ) with its Form 990, or

other employees with annual

furnish additional information not

Form 990-EZ, does not satisfy its filing

compensation over $50,000 who are

required of other types of organizations

requirement and may be charged a $20

not individually listed in Part I.

that file Form 990, Return of

a day penalty ($100 a day for large

Organization Exempt From Income

organizations). See General Instruction

Do not include employees listed

!

Tax, or Form 990-EZ, Short Form

K of the Instructions for Form 990 and

in Part V-A of Form 990 or in

Return of Organization Exempt From

Form 990-EZ for details on this and

Part IV of Form 990-EZ (List of

CAUTION

Income Tax.

other penalties.

Current Officers, Directors, Trustees,

Cat. No. 11294Q

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16