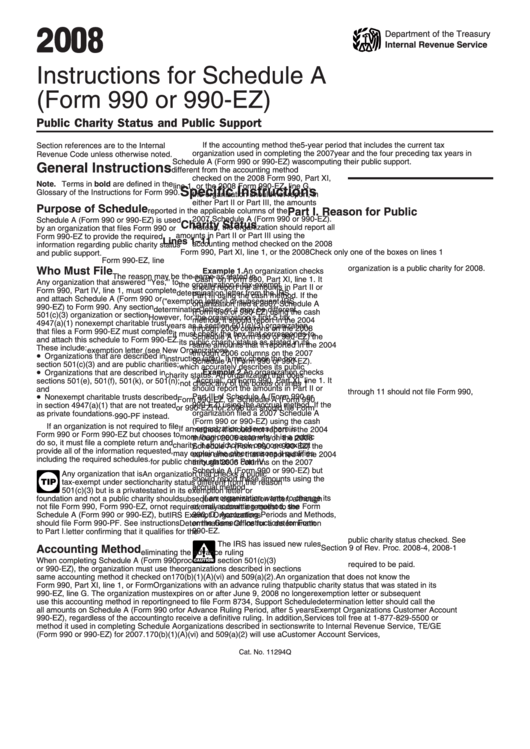

Instructions For Schedule A (Form 990 Or 990-Ez) - 2008

ADVERTISEMENT

2 0 08

Department of the Treasury

Internal Revenue Service

Instructions for Schedule A

(Form 990 or 990-EZ)

Public Charity Status and Public Support

If the accounting method the

5-year period that includes the current tax

Section references are to the Internal

organization used in completing the 2007

year and the four preceding tax years in

Revenue Code unless otherwise noted.

Schedule A (Form 990 or 990-EZ) was

computing their public support.

General Instructions

different from the accounting method

checked on the 2008 Form 990, Part XI,

Note. Terms in bold are defined in the

line 1, or the 2008 Form 990-EZ, line G,

Specific Instructions

Glossary of the Instructions for Form 990.

the organization should not report, in

either Part II or Part III, the amounts

Purpose of Schedule

reported in the applicable columns of the

Part I. Reason for Public

2007 Schedule A (Form 990 or 990-EZ).

Schedule A (Form 990 or 990-EZ) is used

Charity Status

Instead, the organization should report all

by an organization that files Form 990 or

amounts in Part II or Part III using the

Form 990-EZ to provide the required

Lines 1–11

accounting method checked on the 2008

information regarding public charity status

Form 990, Part XI, line 1, or the 2008

Check only one of the boxes on lines 1

and public support.

Form 990-EZ, line G.

through 11 to indicate the reason the

organization is a public charity for 2008.

Who Must File

Example 1. An organization checks

The reason may be the same as stated in

“Cash” on Form 990, Part XI, line 1. It

Any organization that answered ‘‘Yes,’’ to

the organization’s tax-exempt

should report the amounts in Part II or

Form 990, Part IV, line 1, must complete

determination letter from the IRS

Part III using the cash method. If the

and attach Schedule A (Form 990 or

(“exemption letter”) or subsequent IRS

organization filed a 2007 Schedule A

990-EZ) to Form 990. Any section

determination letter, or it may be different.

(Form 990 or 990-EZ) using the cash

501(c)(3) organization or section

However, for the organization’s first 5 tax

method, it should report in the 2004

4947(a)(1) nonexempt charitable trust

years as a section 501(c)(3) organization,

through 2006 columns on the 2008

that files a Form 990-EZ must complete

it must check the box that corresponds to

Schedule A (Form 990 or 990-EZ) the

and attach this schedule to Form 990-EZ.

its public charity status as stated in its

same amounts that it reported in the 2004

These include:

exemption letter (see New Organizations

•

through 2006 columns on the 2007

Organizations that are described in

instruction later). It may check the box

Schedule A (Form 990 or 990-EZ).

section 501(c)(3) and are public charities;

which accurately describes its public

•

Example 2. An organization checks

Organizations that are described in

charity status. An organization that does

‘‘Accrual’’ on Form 990, Part XI, line 1. It

sections 501(e), 501(f), 501(k), or 501(n);

not check any of the boxes on lines 1

should report the amounts in Part II or

and

through 11 should not file Form 990,

•

Part III of Schedule A (Form 990 or

Nonexempt charitable trusts described

Form 990-EZ, or Schedule A (Form 990

990-EZ) using the accrual method. If the

in section 4947(a)(1) that are not treated

or 990-EZ) for 2008 but should file Form

organization filed a 2007 Schedule A

as private foundations.

990-PF instead.

(Form 990 or 990-EZ) using the cash

If an organization is not required to file

If an organization believes there is

method, it should not report in the 2004

Form 990 or Form 990-EZ but chooses to

more than one reason why it is a public

through 2006 columns on the 2008

do so, it must file a complete return and

charity, it should check only one box but

Schedule A (Form 990 or 990-EZ) the

provide all of the information requested,

may explain the other reasons it qualifies

same amounts that it reported in the 2004

including the required schedules.

for public charity status in Part IV.

through 2006 columns on the 2007

Schedule A (Form 990 or 990-EZ) but

Any organization that is

An organization that checks a public

should report these amounts using the

TIP

tax-exempt under section

charity status different from the reason

accrual method.

501(c)(3) but is a private

stated in its exemption letter or

If an organization wants to change its

foundation and not a public charity should

subsequent determination letter, although

overall accounting method, see Form

not file Form 990, Form 990-EZ, or

not required, may submit a request to the

990, D. Accounting Periods and Methods,

Schedule A (Form 990 or 990-EZ), but

IRS Exempt Organizations

or the General Instructions for Form

should file Form 990-PF. See instructions

Determinations Office for a determination

990-EZ.

to Part I.

letter confirming that it qualifies for the

public charity status checked. See

The IRS has issued new rules

Accounting Method

Section 9 of Rev. Proc. 2008-4, 2008-1

!

eliminating the advance ruling

I.R.B. 121 for instructions. No user fee is

When completing Schedule A (Form 990

process for section 501(c)(3)

CAUTION

required to be paid.

or 990-EZ), the organization must use the

organizations described in sections

same accounting method it checked on

170(b)(1)(A)(vi) and 509(a)(2).

An organization that does not know the

Form 990, Part XI, line 1, or Form

Organizations with an advance ruling that

public charity status that was stated in its

990-EZ, line G. The organization must

expires on or after June 9, 2008 no longer

exemption letter or subsequent

use this accounting method in reporting

need to file Form 8734, Support Schedule

determination letter should call the

all amounts on Schedule A (Form 990 or

for Advance Ruling Period, after 5 years

Exempt Organizations Customer Account

990-EZ), regardless of the accounting

to receive a definitive ruling. In addition,

Services toll free at 1-877-829-5500 or

method it used in completing Schedule A

organizations described in sections

write to Internal Revenue Service, TE/GE

(Form 990 or 990-EZ) for 2007.

170(b)(1)(A)(vi) and 509(a)(2) will use a

Customer Account Services, P.O. Box

Cat. No. 11294Q

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9