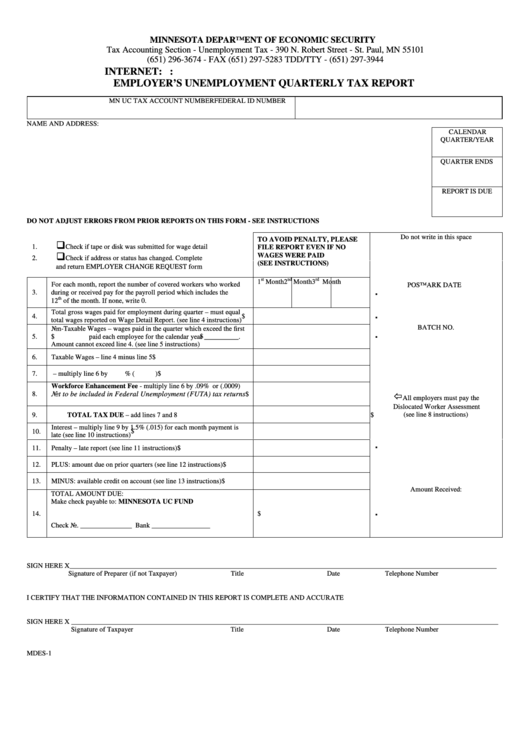

Form Mdes-1 - Employer'S Unemployment Quarterly Tax Report

ADVERTISEMENT

MINNESOTA DEPARTMENT OF ECONOMIC SECURITY

Tax Accounting Section - Unemployment Tax - 390 N. Robert Street - St. Paul, MN 55101

(651) 296-3674 - FAX (651) 297-5283 TDD/TTY - (651) 297-3944

INTERNET: - E-mail: mdes.tax@state.mn.us

EMPLOYER’S UNEMPLOYMENT QUARTERLY TAX REPORT

MN UC TAX ACCOUNT NUMBER

FEDERAL ID NUMBER

NAME AND ADDRESS:

CALENDAR

QUARTER/YEAR

QUARTER ENDS

REPORT IS DUE

DO NOT ADJUST ERRORS FROM PRIOR REPORTS ON THIS FORM - SEE INSTRUCTIONS

Do not write in this space

TO AVOID PENALTY, PLEASE

q

1.

Check if tape or disk was submitted for wage detail

FILE REPORT EVEN IF NO

q

WAGES WERE PAID

2.

Check if address or status has changed. Complete

(SEE INSTRUCTIONS)

and return EMPLOYER CHANGE REQUEST form

st

nd

rd

1

Month

2

Month

3

Month

For each month, report the number of covered workers who worked

POSTMARK DATE

3.

during or received pay for the payroll period which includes the

th

12

of the month. If none, write 0.

Total gross wages paid for employment during quarter – must equal

4.

$

total wages reported on Wage Detail Report. (see line 4 instructions)

BATCH NO.

Non-Taxable Wages – wages paid in the quarter which exceed the first

5.

$

paid each employee for the calendar year __________.

$

Amount cannot exceed line 4. (see line 5 instructions)

6.

Taxable Wages – line 4 minus line 5

$

7.

U.C. Tax Due – multiply line 6 by

% (

)

$

Workforce Enhancement Fee - multiply line 6 by .09% or (.0009)

ï

8.

Not to be included in Federal Unemployment (FUTA) tax returns

$

All employers must pay the

Dislocated Worker Assessment

(see line 8 instructions)

9.

TOTAL TAX DUE – add lines 7 and 8

$

Interest – multiply line 9 by 1.5% (.015) for each month payment is

10.

$

late (see line 10 instructions)

11.

Penalty – late report (see line 11 instructions)

$

12.

PLUS: amount due on prior quarters (see line 12 instructions)

$

13.

MINUS: available credit on account (see line 13 instructions)

$

Amount Received:

TOTAL AMOUNT DUE:

Make check payable to: MINNESOTA UC FUND

14.

$

Check No. _______________ Bank _________________

SIGN HERE X____________________________________________________________________________________________________________________________

Signature of Preparer (if not Taxpayer)

Title

Date

Telephone Number

I CERTIFY THAT THE INFORMATION CONTAINED IN THIS REPORT IS COMPLETE AND ACCURATE

SIGN HERE X ____________________________________________________________________________________________________________________________

Signature of Taxpayer

Title

Date

Telephone Number

MDES-1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1