Form Mdes-1a - Employer'S Unemployment Annual Tax Report

ADVERTISEMENT

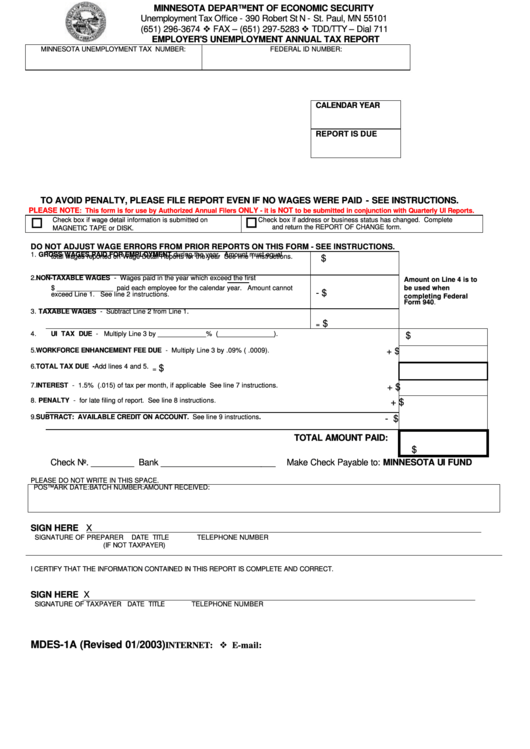

MINNESOTA DEPARTMENT OF ECONOMIC SECURITY

Unemployment Tax Office - 390 Robert St N - St. Paul, MN 55101

(651) 296-3674 v FAX – (651) 297-5283 v TDD/TTY – Dial 711

EMPLOYER'S UNEMPLOYMENT ANNUAL TAX REPORT

MINNESOTA UNEMPLOYMENT TAX NUMBER:

FEDERAL ID NUMBER:

CALENDAR YEAR

REPORT IS DUE

TO AVOID PENALTY, PLEASE FILE REPORT EVEN IF NO WAGES WERE PAID - SEE INSTRUCTIONS.

PLEASE NOTE

ONLY

NOT

: This form is for use by Authorized Annual Filers

- it is

to be submitted in conjunction with Quarterly UI Reports.

o

o

Check box if wage detail information is submitted on

Check box if address or business status has changed. Complete

MAGNETIC TAPE or DISK.

and return the REPORT OF CHANGE form.

DO NOT ADJUST WAGE ERRORS FROM PRIOR REPORTS ON THIS FORM - SEE INSTRUCTIONS.

1.

GROSS WAGES PAID FOR EMPLOYMENT during the year. Amount must equal

total wages reported on Wage Detail Reports for the year See line 1 instructions.

$

2.

NON-TAXABLE WAGES - Wages paid in the year which exceed the first

Amount on Line 4 is to

$ _______________ paid each employee for the calendar year. Amount cannot

be used when

- $

exceed Line 1. See line 2 instructions.

completing Federal

Form 940.

3.

TAXABLE WAGES - Subtract Line 2 from Line 1.

$

=

4.

UI TAX DUE - Multiply Line 3 by _____________% (_______________).

$

5.

WORKFORCE ENHANCEMENT FEE DUE - Multiply Line 3 by .09% ( .0009).

+ $

6.

TOTAL TAX DUE - Add lines 4 and 5.

$

=

7.

INTEREST - 1.5% (.015) of tax per month, if applicable See line 7 instructions.

+ $

8.

PENALTY - for late filing of report. See line 8 instructions.

+ $

9.

SUBTRACT: AVAILABLE CREDIT ON ACCOUNT. See line 9 instructions.

- $

TOTAL AMOUNT PAID:

$

Check No. _________ Bank ________________________

Make Check Payable to: MINNESOTA UI FUND

PLEASE DO NOT WRITE IN THIS SPACE.

POSTMARK DATE:

BATCH NUMBER:

AMOUNT RECEIVED:

SIGN HERE X

SIGNATURE OF PREPARER

DATE

TITLE

TELEPHONE NUMBER

(IF NOT TAXPAYER)

I CERTIFY THAT THE INFORMATION CONTAINED IN THIS REPORT IS COMPLETE AND CORRECT.

SIGN HERE X

SIGNATURE OF TAXPAYER

DATE

TITLE

TELEPHONE NUMBER

INTERNET: v E-mail: mdes.tax@state.mn.us

MDES-1A (Revised 01/2003)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1