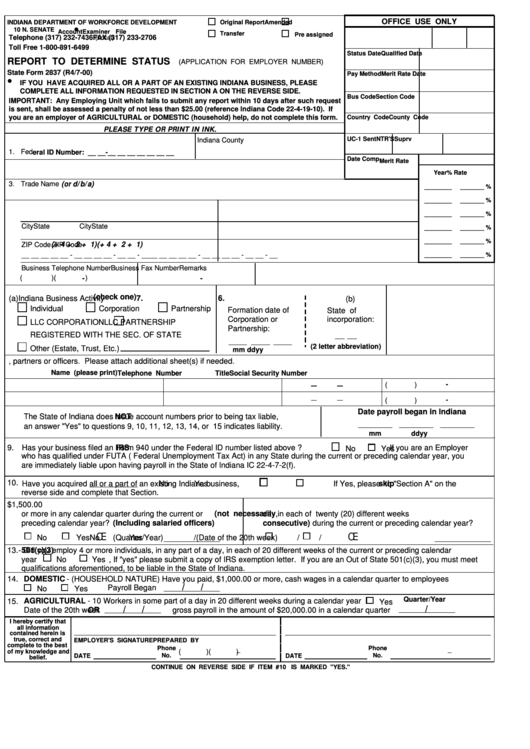

Form 2837 - Indiana Report To Determine Status (Application For Employer Number)

ADVERTISEMENT

OFFICE USE ONLY

Original Report

Amended

INDIANA DEPARTMENT OF WORKFORCE DEVELOPMENT

•

10 N. SENATE AVE.

INDIANAPOLIS IN 46204-2277

Account

Examiner File

Transfer

Pre assigned

Telephone (317) 232-7436

FAX (317) 233-2706

(Local)

Toll Free 1-800-891-6499

Status Date

Qualified Date

REPORT TO DETERMINE STATUS

(APPLICATION FOR EMPLOYER NUMBER)

State Form 2837 (R4/7-00)

Pay Method

Merit Rate Date

•

IF YOU HAVE ACQUIRED ALL OR A PART OF AN EXISTING INDIANA BUSINESS, PLEASE

COMPLETE ALL INFORMATION REQUESTED IN SECTION A ON THE REVERSE SIDE.

Bus Code

Section Code

IMPORTANT: Any Employing Unit which fails to submit any report within 10 days after such request

is sent, shall be assessed a penalty of not less than $25.00 (reference Indiana Code 22-4-19-10). If

you are an employer of AGRICULTURAL or DOMESTIC (household) help, do not complete this form.

Country Code

County Code

PLEASE TYPE OR PRINT IN INK.

UC-1 Sent

NTR'S

Suprv

Indiana County

1. Fed

eral ID Number: __ __-__ __ __ __ __ __ __

Date Comp

Merit Rate

2. Legal Name of Employing Unit

Year

% Rate

(or d/b/a)

3. Trade Name

________

_______ %

________

_______ %

4. Mailing Address

Physical Address

________

_______ %

City

State

City

State

________

_______ %

________

_______ %

(+4 + 2 + 1)

(+4 + 2 + 1)

ZIP Code

ZIP Code

__ __ __ __ __ - __ __ __ __ - __ __ - __

__ __ __ __ __ - __ __ __ __ - __ __ - __

________

_______ %

Business Telephone Number

Business Fax Number

Remarks

(

)

-

(

)

-

5. Type of organization

(check one)

6.

(a)

7.

Indiana Business Activity

(b)

Corporation

Partnership

Individual

Formation date of

State of

incorporation:

Corporation

or

LLC CORPORATION

LLC PARTNERSHIP

Partnership:

REGISTERED WITH THE SEC. OF STATE

(2 letter abbreviation)

Other (Estate, Trust, Etc.)

mm

dd

yy

8. Enter the required information for owner, partners or officers. Please attach additional sheet(s) if needed.

Name (please print)

Title

Social Security Number

Telephone Number

(

)

-

(

)

-

Date payroll began in Indiana

The State of Indiana does

NOT

issue account numbers prior to being tax liable,

an answer "Yes" to questions 9, 10, 11, 12, 13, 14, or 15 indicates liability.

mm

dd

yy

9. Has your business filed an

IRS

Form 940 under the Federal ID number listed above ?

If you are an Employer

No

Yes

who has qualified under FUTA ( Federal Unemployment Tax Act) in any State during the current or preceding calendar year, you

are immediately liable upon having payroll in the State of Indiana IC 22-4-7-2(f).

10. Have you acquired all or a part of an existing Indiana business,

If Yes, please

skip

to "Section A" on the

No

Yes

reverse side and complete that Section.

11. Has your business had a total Indiana payroll of $1,500.00

12. Has your business had one or more employees any part of a

or more in any calendar quarter during the current or

day,in each of twenty (20) different weeks

(not necessarily

preceding calendar year?

(Including salaried officers)

consecutive)

during the current or preceding calendar year?

Œ

Œ

No

Yes

No

Yes

(Quarter/Year)

/

(Date of the 20th week)

/

/

13.

501(c)(3)

- Did you employ 4 or more individuals, in any part of a day, in each of 20 different weeks of the current or preceding calendar

year

No

Yes

, If "yes" please submit a copy of IRS exemption letter. If you are an Out of State 501(c)(3), you must meet

qualifications aforementioned, to be liable in the State of Indiana.

14.

DOMESTIC

- (HOUSEHOLD NATURE) Have you paid, $1,000.00 or more, cash wages in a calendar quarter to employees

/

/

Payroll Began

No

Yes

Quarter/Year

AGRICULTURAL

- 10 Workers in some part of a day in 20 different weeks during a calendar year

15.

Yes

/

/

/

Date of the 20th week

OR

gross payroll in the amount of $20,000.00 in a calendar quarte r

I hereby certify that

all information

contained herein is

true, correct and

EMPLOYER'S SIGNATURE

PREPARED BY

complete to the best

Phone

Phone

of my knowledge and

(

)

(

)

No.

No.

DATE

DATE

belief.

CONTINUE ON REVERSE SIDE IF ITEM #10 IS MARKED "YES."

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2