Instructions For Form 514-Pt - Partnership Composite Income Tax Supplement

ADVERTISEMENT

514-PT: Partnership Composite Income Tax Supplement Instructions (Rule 710:50-19-1)

Any partnership required to file an Oklahoma income tax return may

Column 7 - For individuals only. Deduct a standard deduction for each

elect to file a composite return for nonresident partners. Any nonresi-

individual partner. When the filing status is married filing joint, head of

dent partner may be included in the composite return, unless the

household or qualifying widow(er), the standard deduction is $3,000.

partner has income from an Oklahoma source other than the partner-

When the filing status is single or married filing separate, the standard

ship or the partner is, or is electing to be treated as, a Sub S corpora-

deduction is $2,000. Trusts do not complete this column.

tion or partnership.

Note: The maximum standard deduction for partners filing a joint

Oklahoma Capital Gain Deduction Information:

Federal return is $3,000 for both partners combined. Each partner is

(Form 514-PT, Column 5 and Column 10)

not allowed to deduct $3,000 when computing his/her Oklahoma

Nonresident partners electing to be included in the composite return

taxable income.

can deduct qualifying gains receiving capital treatment which are

Column 8 - Subtract Column 7 from Column 6. This is the partner's

included in Federal taxable income. “Qualifying gains receiving capital

share of the taxable income computed as if all of the partnership

treatment” means the amount of the net capital gains, as defined by

income were earned in Oklahoma.

Internal Revenue Code Section 1221(11). The qualifying gain must:

Column 9 - Tax before allocation. Using the appropriate tax rate

1) Be earned on real or tangible personal property located within

schedule below, compute the tax on the taxable income in Column 8.

Oklahoma that you have owned, indirectly, for at least five uninter-

rupted years prior to the date of sale.

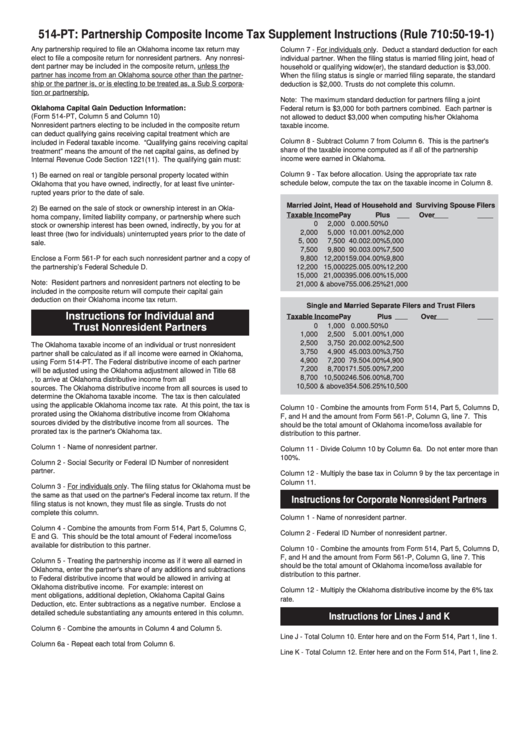

Married Joint, Head of Household and Surviving Spouse Filers

2) Be earned on the sale of stock or ownership interest in an Okla-

Taxable Income

Pay

Plus

Over

homa company, limited liability company, or partnership where such

0

2,000

0.00

0.50%

0

stock or ownership interest has been owned, indirectly, by you for at

2,000

5,000

10.00

1.00%

2,000

least three (two for individuals) uninterrupted years prior to the date of

5, 000

7,500

40.00

2.00%

5,000

sale.

7,500

9,800

90.00

3.00%

7,500

Enclose a Form 561-P for each such nonresident partner and a copy of

9,800

12,200

159.00

4.00%

9,800

the partnership’s Federal Schedule D.

12,200

15,000

225.00

5.00%

12,200

15,000

21,000

395.00

6.00%

15,000

Note: Resident partners and nonresident partners not electing to be

21,000 & above

755.00

6.25%

21,000

included in the composite return will compute their capital gain

deduction on their Oklahoma income tax return.

Single and Married Separate Filers and Trust Filers

Instructions for Individual and

Taxable Income

Pay

Plus

Over

Trust Nonresident Partners

0

1,000

0.00

0.50%

0

1,000

2,500

5.00

1.00%

1,000

2,500

3,750

20.00

2.00%

2,500

The Oklahoma taxable income of an individual or trust nonresident

3,750

4,900

45.00

3.00%

3,750

partner shall be calculated as if all income were earned in Oklahoma,

4,900

7,200

79.50

4.00%

4,900

using Form 514-PT. The Federal distributive income of each partner

7,200

8,700

171.50

5.00%

7,200

will be adjusted using the Oklahoma adjustment allowed in Title 68

8,700

10,500

246.50

6.00%

8,700

O.S. Section 2358, to arrive at Oklahoma distributive income from all

10,500 & above

354.50

6.25%

10,500

sources. The Oklahoma distributive income from all sources is used to

determine the Oklahoma taxable income. The tax is then calculated

using the applicable Oklahoma income tax rate. At this point, the tax is

Column 10 - Combine the amounts from Form 514, Part 5, Columns D,

prorated using the Oklahoma distributive income from Oklahoma

F, and H and the amount from Form 561-P, Column G, line 7. This

sources divided by the distributive income from all sources. The

should be the total amount of Oklahoma income/loss available for

prorated tax is the partner's Oklahoma tax.

distribution to this partner.

Column 1 - Name of nonresident partner.

Column 11 - Divide Column 10 by Column 6a. Do not enter more than

100%.

Column 2 - Social Security or Federal ID Number of nonresident

partner.

Column 12 - Multiply the base tax in Column 9 by the tax percentage in

Column 11.

Column 3 - For individuals only. The filing status for Oklahoma must be

the same as that used on the partner's Federal income tax return. If the

Instructions for Corporate Nonresident Partners

filing status is not known, they must file as single. Trusts do not

complete this column.

Column 1 - Name of nonresident partner.

Column 4 - Combine the amounts from Form 514, Part 5, Columns C,

Column 2 - Federal ID Number of nonresident partner.

E and G. This should be the total amount of Federal income/loss

available for distribution to this partner.

Column 10 - Combine the amounts from Form 514, Part 5, Columns D,

F, and H and the amount from Form 561-P, Column G, line 7. This

Column 5 - Treating the partnership income as if it were all earned in

should be the total amount of Oklahoma income/loss available for

Oklahoma, enter the partner's share of any additions and subtractions

distribution to this partner.

to Federal distributive income that would be allowed in arriving at

Oklahoma distributive income. For example: interest on U.S. Govern-

Column 12 - Multiply the Oklahoma distributive income by the 6% tax

ment obligations, additional depletion, Oklahoma Capital Gains

rate.

Deduction, etc. Enter subtractions as a negative number. Enclose a

detailed schedule substantiating any amounts entered in this column.

Instructions for Lines J and K

Column 6 - Combine the amounts in Column 4 and Column 5.

Line J - Total Column 10. Enter here and on the Form 514, Part 1, line 1.

Column 6a - Repeat each total from Column 6.

Line K - Total Column 12. Enter here and on the Form 514, Part 1, line 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1