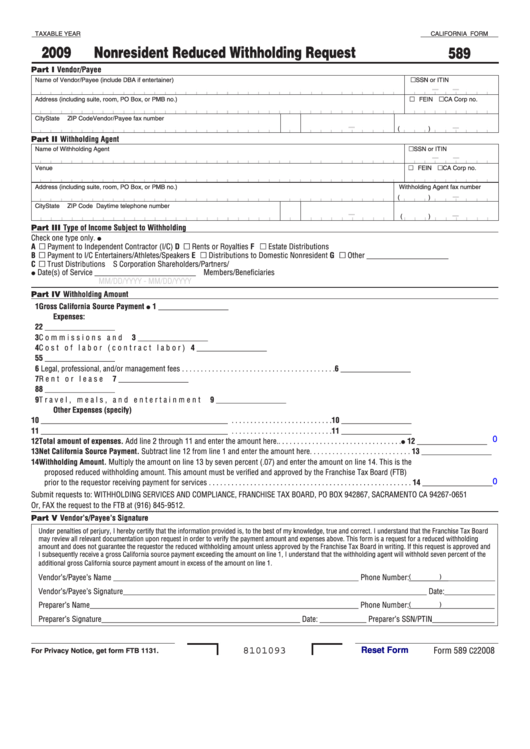

TAXABLE YEAR

CALIFORNIA FORM

2009

Nonresident Reduced Withholding Request

589

Part I Vendor/Payee

m SSN or ITIN

Name of Vendor/Payee (include DBA if entertainer)

–

–

m FEIN m CA Corp no.

Address (including suite, room, PO Box, or PMB no.)

City

State

ZIP Code

Vendor/Payee fax number

–

–

( )

Part II Withholding Agent

m SSN or ITIN

Name of Withholding Agent

–

–

m FEIN m CA Corp no.

Venue

Address (including suite, room, PO Box, or PMB no.)

Withholding Agent fax number

–

( )

City

State

ZIP Code

Daytime telephone number

–

–

( )

Part III Type of Income Subject to Withholding

Check one type only. I

A m Payment to Independent Contractor (I/C)

D m Rents or Royalties

F m Estate Distributions

B m Payment to I/C Entertainers/Athletes/Speakers

E m Distributions to Domestic Nonresident

G m Other _____________________

C m Trust Distributions

S Corporation Shareholders/Partners/

I Date(s) of Service __________________________

Members/Beneficiaries

MM/DD/YYYY - MM/DD/YYYY

Part IV Withholding Amount

1 Gross California Source Payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . I 1 __________________

Expenses:

2 Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 __________________

3 Commissions and fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 __________________

4 Cost of labor (contract labor) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 __________________

5 Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 __________________

6 Legal, professional, and/or management fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 __________________

7 Rent or lease . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 __________________

8 Supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 __________________

9 Travel, meals, and entertainment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 __________________

Other Expenses (specify)

10 ________________________________________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 __________________

11 ________________________________________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 __________________

0

12 Total amount of expenses. Add line 2 through 11 and enter the amount here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . I 12 __________________

13 Net California Source Payment. Subtract line 12 from line 1 and enter the amount here. . . . . . . . . . . . . . . . . . . . . . . . . . . 13 __________________

14 Withholding Amount. Multiply the amount on line 13 by seven percent (.07) and enter the amount on line 14. This is the

proposed reduced withholding amount. This amount must be verified and approved by the Franchise Tax Board (FTB)

prior to the requestor receiving payment for services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 __________________

0

Submit requests to: WITHHOLDING SERVICES AND COMPLIANCE, FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0651

Or, FAX the request to the FTB at (916) 845-9512.

Part V Vendor’s/Payee’s Signature

Under penalties of perjury, I hereby certify that the information provided is, to the best of my knowledge, true and correct. I understand that the Franchise Tax Board

may review all relevant documentation upon request in order to verify the payment amount and expenses above. This form is a request for a reduced withholding

amount and does not guarantee the requestor the reduced withholding amount unless approved by the Franchise Tax Board in writing. If this request is approved and

I subsequently receive a gross California source payment exceeding the amount on line 1, I understand that the withholding agent will withhold seven percent of the

additional gross California source payment amount in excess of the amount on line 1.

_________

Vendor’s/Payee’s Name _______________________________________________________________ Phone Number:

( )

____________

Vendor’s/Payee’s Signature______________________________________________________________________________ Date:_____________

Preparer’s Name_____________________________________________________________________ Phone Number:______________________

( )

Preparer’s Signature___________________________________________________ Date: ____________ Preparer’s SSN/PTIN________________

Form 589

2008

8101093

C2

For Privacy Notice, get form FTB 1131.

Reset Form

1

1