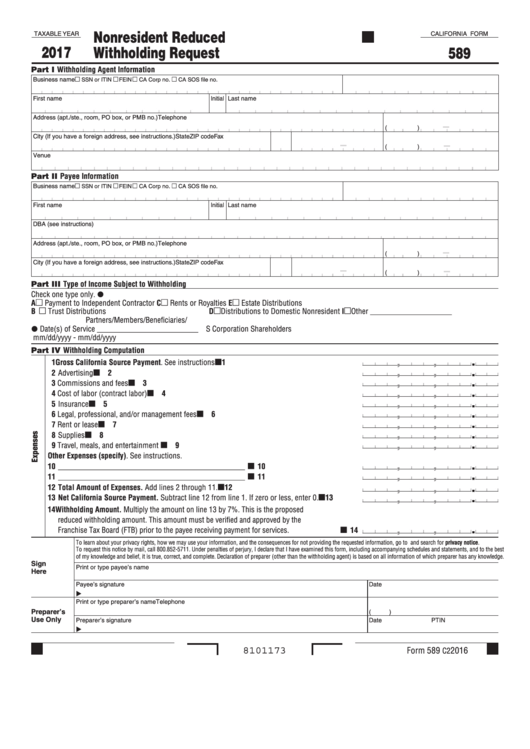

Nonresident Reduced

TAXABLE YEAR

CALIFORNIA FORM

2017

Withholding Request

589

Part I Withholding Agent Information

m

m

m

m

Business name

SSN or ITIN

FEIN

CA Corp no.

CA SOS file no.

First name

Initial Last name

Address (apt./ste., room, PO box, or PMB no.)

Telephone

–

(

)

City (If you have a foreign address, see instructions.)

State

ZIP code

Fax

–

–

(

)

Venue

Part II Payee Information

m

m

m

m

Business name

SSN or ITIN

FEIN

CA Corp no.

CA SOS file no.

First name

Initial Last name

DBA (see instructions)

Address (apt./ste., room, PO box, or PMB no.)

Telephone

–

(

)

City (If you have a foreign address, see instructions.)

State

ZIP code

Fax

–

–

(

)

Part III Type of Income Subject to Withholding

I

Check one type only.

m

m

m

A

Payment to Independent Contractor

C

Rents or Royalties

E

Estate Distributions

m

m

m

B

Trust Distributions

D

Distributions to Domestic Nonresident

I

Other _____________________

Partners/Members/Beneficiaries/

I

Date(s) of Service __________________________

S Corporation Shareholders

mm/dd/yyyy - mm/dd/yyyy

Part IV Withholding Computation

K

.

,

,

1 Gross California Source Payment. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

K

.

,

,

2 Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

K

.

,

,

3 Commissions and fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

K

.

,

,

4 Cost of labor (contract labor) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

K

.

,

,

5 Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

K

.

,

,

6 Legal, professional, and/or management fees. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

K

.

,

,

7 Rent or lease . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

K

.

,

,

8 Supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

K

.

,

,

9 Travel, meals, and entertainment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

Other Expenses (specify). See instructions.

K

.

,

,

10 ________________________________________________ . . . . . . . . . . . . . . . . . . . . . . . .

10

K

.

,

,

11 ________________________________________________ . . . . . . . . . . . . . . . . . . . . . . . .

11

K

.

,

,

12 Total Amount of Expenses. Add lines 2 through 11.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

K

.

,

,

13 Net California Source Payment. Subtract line 12 from line 1. If zero or less, enter 0.. . . . . .

13

14 Withholding Amount. Multiply the amount on line 13 by 7%. This is the proposed

reduced withholding amount. This amount must be verified and approved by the

K

.

,

,

Franchise Tax Board (FTB) prior to the payee receiving payment for services. . . . . . . . . . . . . . .

14

To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested information, go to ftb.ca.gov and search for privacy notice.

To request this notice by mail, call 800.852-5711. Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the best

of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than the withholding agent) is based on all information of which preparer has any knowledge.

Sign

Print or type payee’s name

Here

Payee’s signature

Date

Print or type preparer’s name

Telephone

Preparer’s

(

)

Use Only

Preparer’s signature

Date

PTIN

Form 589

2016

8101173

C2

1

1