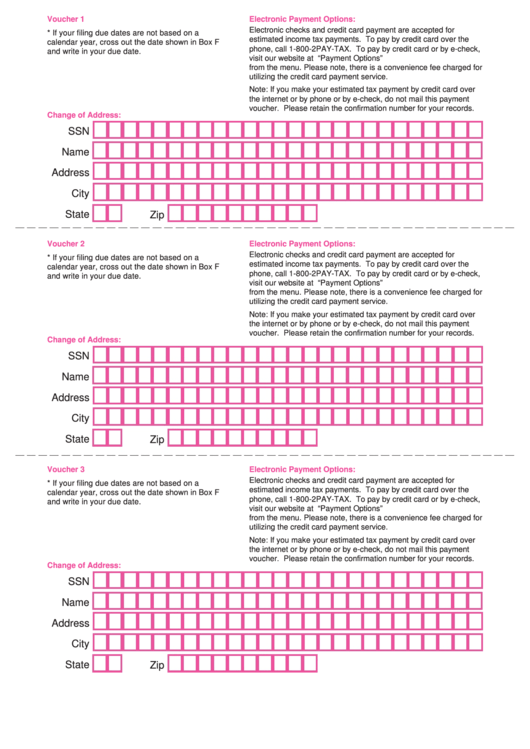

Voucher 1

Electronic Payment Options:

Electronic checks and credit card payment are accepted for

* If your filing due dates are not based on a

estimated income tax payments. To pay by credit card over the

calendar year, cross out the date shown in Box F

phone, call 1-800-2PAY-TAX. To pay by credit card or by e-check,

and write in your due date.

visit our website at and select “Payment Options”

from the menu. Please note, there is a convenience fee charged for

utilizing the credit card payment service.

Note: If you make your estimated tax payment by credit card over

the internet or by phone or by e-check, do not mail this payment

voucher. Please retain the confirmation number for your records.

Change of Address:

SSN

Name

Address

City

State

Zip

Voucher 2

Electronic Payment Options:

Electronic checks and credit card payment are accepted for

* If your filing due dates are not based on a

estimated income tax payments. To pay by credit card over the

calendar year, cross out the date shown in Box F

phone, call 1-800-2PAY-TAX. To pay by credit card or by e-check,

and write in your due date.

visit our website at and select “Payment Options”

from the menu. Please note, there is a convenience fee charged for

utilizing the credit card payment service.

Note: If you make your estimated tax payment by credit card over

the internet or by phone or by e-check, do not mail this payment

voucher. Please retain the confirmation number for your records.

Change of Address:

SSN

Name

Address

City

State

Zip

Voucher 3

Electronic Payment Options:

Electronic checks and credit card payment are accepted for

* If your filing due dates are not based on a

estimated income tax payments. To pay by credit card over the

calendar year, cross out the date shown in Box F

phone, call 1-800-2PAY-TAX. To pay by credit card or by e-check,

and write in your due date.

visit our website at and select “Payment Options”

from the menu. Please note, there is a convenience fee charged for

utilizing the credit card payment service.

Note: If you make your estimated tax payment by credit card over

the internet or by phone or by e-check, do not mail this payment

voucher. Please retain the confirmation number for your records.

Change of Address:

SSN

Name

Address

City

State

Zip

1

1 2

2