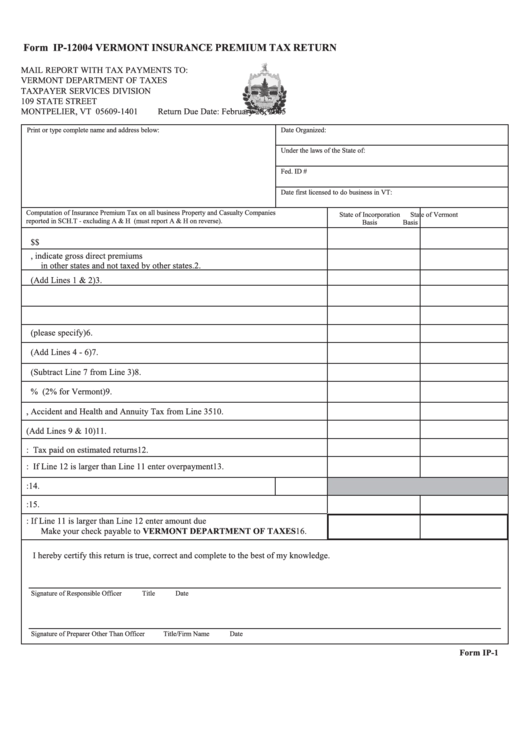

Form Ip-1 - Insurance Premium Tax Return - 2004

ADVERTISEMENT

Form IP-1

2004 VERMONT INSURANCE PREMIUM TAX RETURN

MAIL REPORT WITH TAX PAYMENTS TO:

VERMONT DEPARTMENT OF TAXES

TAXPAYER SERVICES DIVISION

109 STATE STREET

MONTPELIER, VT 05609-1401

Return Due Date: February 28, 2005

Print or type complete name and address below:

Date Organized:

Under the laws of the State of:

Fed. ID #

Date first licensed to do business in VT:

Computation of Insurance Premium Tax on all business Property and Casualty Companies

State of Incorporation

State of Vermont

reported in SCH.T - excluding A & H (must report A & H on reverse).

Basis

Basis

1. Gross direct premiums written on businesses in Vermont during the year.

1.

$

$

2. If a Vermont company, indicate gross direct premiums

in other states and not taxed by other states.

2.

3. TOTAL PREMIUMS (Add Lines 1 & 2)

3.

4. Dividends paid or credited to policyholders

4.

5. Return premiums

5.

6. Other deductions (please specify)

6.

7. TOTAL DEDUCTIONS (Add Lines 4 - 6)

7.

8. TAXABLE PREMIUMS (Subtract Line 7 from Line 3)

8.

9. Tax at rate of _______________ % (2% for Vermont)

9.

10. Life, Accident and Health and Annuity Tax from Line 35

10.

11. TOTAL INSURANCE PREMIUM TAX (Add Lines 9 & 10)

11.

12. LESS: Tax paid on estimated returns

12.

13. OVERPAYMENT: If Line 12 is larger than Line 11 enter overpayment

13.

14. Amount of overpayment to be credited to 2005 estimated tax: 14.

15. REFUND DUE:

15.

16. BALANCE DUE: If Line 11 is larger than Line 12 enter amount due

Make your check payable to VERMONT DEPARTMENT OF TAXES

16.

I hereby certify this return is true, correct and complete to the best of my knowledge.

Signature of Responsible Officer

Title

Date

Signature of Preparer Other Than Officer

Title/Firm Name

Date

Form IP-1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2