Form Eq1 - Employer'S Quarterly Return Of License Fee Withheld

ADVERTISEMENT

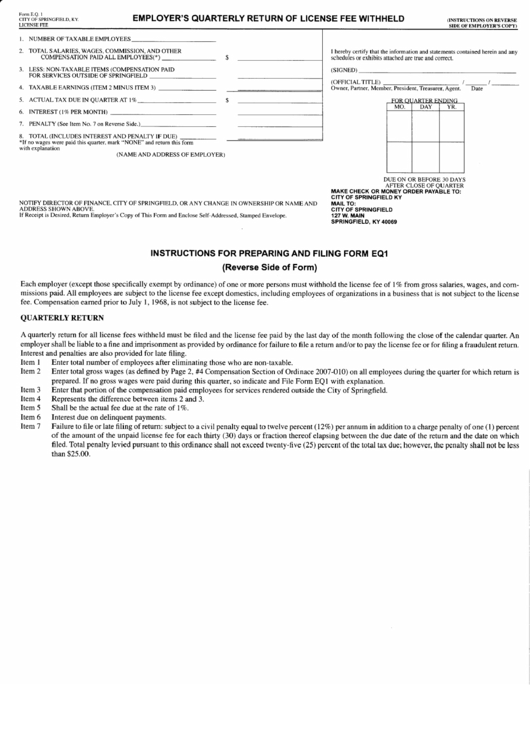

Fom E.Q, 1

CITY OF SPRINGFIELD, KY

LICENSE FEE

EMPLOYER'S QUARTERLY RETURN OF LICENSE FEE WITHHELD

(INSTRUCTIONS ON REVERSE

SIDE OF EMPLOYER'S COPY)

NUMBER OF TAXABLE EMPLOYEES

TOTAL SALARIES, WAGES, COMMISSION, AND OTHER

COMPENSATION PAID ALL EMPLOYEES( *)

3. LESS: NON-TAXABLE ITEMS (COMPENSATION PAID

FOR SERVICES OUTSIDE OF SPRINGFIELD

4. TAXABLE EARNINGS (ITEM 2 MINUS ITEM 3)

5. ACTUALTAX DUE IN QUARTER Nt t%o

6. INTEREST ( l7o PER MONTH)

7. PENALTY (See ltem No. 7 on Reverse Side.)

8. TOTAL (INCLUDES INTERESTAND PENALIY IF DUE)

*If no wages were paid this quarter. mark "NONE" and return this form

with explanation

(NAME AND ADDRESS OF EMPLOYER)

NOTIFY DIRECTOR OF FINANCE, CITY OF SPRINGFIELD, OR ANY CHANGE IN OWNERSHIP OR NAME AND

ADDRESS SHOWNABOVE.

If Receipt is Desired, Return Employer's Copy of This Form and Enclose Self-Addressed, Stamped Envelope.

Item 3

Item 4

Item 5

Item 6

Iteml

I hereby certify that the information and statements contained herein and any

schedules or exhibits attached are true and correct.

(SIGNED)

(OFFICIALTITLE)

Owner, Partner, Member, President, Treasurer, Agent.

Date

MO.

DAY

YR.

DUE ON OR BEFORE 30 DAYS

AFTER CLOSE OF QUARTER

MAKE CHECK OR MONEY ORDER PAYABLE TO:

CITY OF SPRINGFIELD KY

MAIL TO:

CITY OF SPRINGFIELD

127 W. MA|N

SPRINGFIELD, KY 40069

INSTRUCTIONS

FOR PREPARING AND FILING FORM EQ1

(Reverse Side of Form)

Each employer (except those specifically exempt by ordinance) of one or more persons must witlrhold the license fee of 1% from gross salaries, wages, and com-

missions paid. All employees are subject to the license fee except domestics, including employees of organizations in a business that is not subject to the license

fee. Compensation earned prior to July l, 1968, is not subject to the license fee.

QUARTERLY RETTJRN

A quarterly retum for all license fe€s withheld must be filed and the license fe€ paid by the last day of the month fotlowing the ctose of the calendar quarter. An

employer shall b€ liable to a fine and imprisonment as provided by ordinance for failure to file a retum and./or to pay the license fee or for f,ling a fraudulent return.

Interest and penalties are also provided for late fling.

Item I

Enter total number of employees after eliminating those who are non-taxable.

l1f.m2

Enter total gross wages (as defined by Page 2, #4 Comp€nsation Section of Ordinace 2007-010) on all employees during the quarter for which retum is

prepared, If no goss wages were paid during this quarter, so indicate and File Form EQI with explanation.

Enter that portion of the cornpensation paid employees for services render€d outside the City of Springfield.

Regesents the difference between i!9ms 2 and 3.

Shall b€ the actual fee due at the rate of 1%.

Inlerest due on delinquent payments.

Failwe to file or late filing of retum: subject to a civil penalty equal to twelve percent ( 12 ) per annum in addition to a charge pena.lty ofone (l) percent

of the amount of the unpaid license fee for each thirty (30) days or fraction thereof elapsing between the due date of the rctun and the date on which

filed. Total p€nalty levied pursuant to this ordinance shall not exceed twenty-five (25) percent of the total tax due; howevet the penalty shall not be less

than $25.00.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1