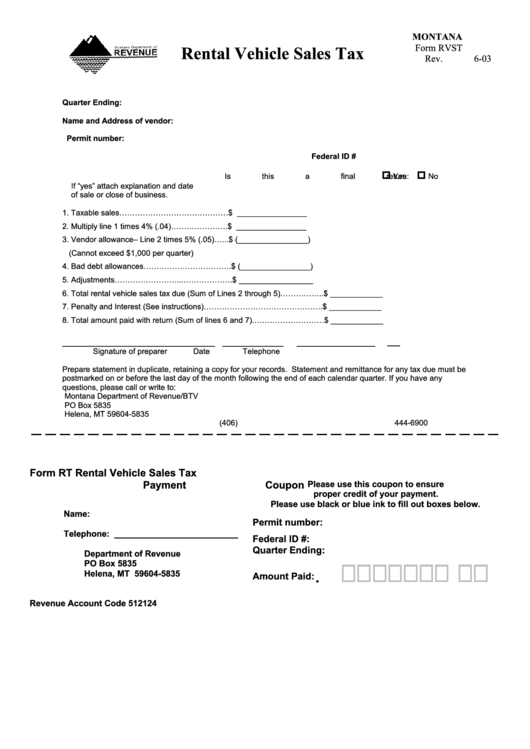

Form Rvst - Rental Vehicle Sales Tax - 2003

ADVERTISEMENT

MONTANA

Form RVST

Rental Vehicle Sales Tax

Rev. 6-03

Quarter Ending:

Name and Address of vendor:

Permit number:

Federal ID #

Is this a final return:

Yes

No

If “yes” attach explanation and date

of sale or close of business.

1. Taxable sales……………………………………$ ________________

2. Multiply line 1 times 4% (.04)………………….$ ________________

3. Vendor allowance– Line 2 times 5% (.05)…...$ (________________)

(Cannot exceed $1,000 per quarter)

4. Bad debt allowances…………………………….$ (________________)

5. Adjustments……………………...……………….$ _________________

6. Total rental vehicle sales tax due (Sum of Lines 2 through 5)……………..$ ____________

7. Penalty and Interest (See instructions)……………………………………….$ ____________

8. Total amount paid with return (Sum of lines 6 and 7).………………………$ ____________

___________________________________

______________

__________________

Signature of preparer

Date

Telephone

Prepare statement in duplicate, retaining a copy for your records. Statement and remittance for any tax due must be

postmarked on or before the last day of the month following the end of each calendar quarter. If you have any

questions, please call or write to:

Montana Department of Revenue/BTV

PO Box 5835

Helena, MT 59604-5835

(406) 444-6900

Form RT

Rental Vehicle Sales Tax

Payment Coupon

Please use this coupon to ensure

proper credit of your payment.

Please use black or blue ink to fill out boxes below.

Name:

P ermit number:

Telephone: __________________________

Federal ID #:

Quarter Ending:

Department of Revenue

PO Box 5835

.

Helena, MT 59604-5835

Amount Paid:

Revenue Account Code 512124

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1