Instructions For Voluntary Dissolution Of New York State Business Corporations - Form Tr-125 - 2007

ADVERTISEMENT

New York State Department of Taxation and Finance

TR-125

Instructions for Voluntary Dissolution of

(7/07)

New York State Business Corporations

General information

A domestic corporation that does not voluntarily dissolve will

be subject to dissolution by proclamation pursuant to Tax Law

In order to dissolve a domestic corporation, the corporation must

section 203-a after it has not filed franchise tax returns for at least

receive consent from the Tax Department. The Tax Department

two years.

will not consent to the dissolution of a business corporation

unless all of the required New York State franchise tax returns are

For more specific information, refer to TSB-M-06(5)C, Certain

filed and its franchise taxes are paid. Any liability for other taxes

Domestic Business Corporations Exempt from the Article 9-A

administered by the Tax Department must also be satisfied.

Fixed Dollar Minimum Tax.

Requesting dissolution of a domestic corporation

Dissolution procedure

To initiate the dissolution process, the corporation must file its

Once the consent has been granted, you must send the following

final return and mark an X in the Final return box located in the

documents to the NYS Department of State:

top left hand corner of the return. For corporations filing a final

• A copy of the Tax Commissioner’s consent;

return for tax periods beginning on or after January 1, 2006,

• A $60.00 filing fee. Make your check payable to The New York

it is not necessary to call and request the consent if you mark an

State Department of State; and

X in the Final return box. The automated system will review the

corporation’s account and issue either the Tax Commissioner’s

• A properly completed Certificate of Dissolution. For more

consent or a letter stating the requirements necessary for consent

information on preparing and filing your Certificate of

to be granted. Depending on which form is filed, the final return

Dissolution with the NYS Department of State, visit their

must be mailed to one of the addresses listed below. You may also

Web site at

e-file corporation tax returns. For information on e-filing corporation

Mail all materials to:

tax returns, visit our Web site at

NYS DEPARTMENT OF STATE

Do not send returns to any other address unless specifically

DIVISION OF CORPORATIONS

requested by a Tax Department representative.

41 STATE STREET

ALBANY NY 12231

Effective for tax years beginning on or after January 1, 2006,

certain domestic corporations are exempt from the fixed dollar

Do not mail any materials to the Tax Department.

minimum tax. Under this exemption, a domestic corporation that is

no longer doing business, employing capital, or owning or leasing

Summary

property in this state is exempt from the fixed dollar minimum tax for

1. Request consent to dissolve by filing a corporation tax return

tax years following its final tax year provided that the corporation:

for tax years beginning on or after January 1, 2006 with an

X marked in the Final return box. For tax years beginning

• is not doing business in New York State;

prior to January 1, 2006, you must call the Tax Department at

• is not employing capital in New York State;

1 800 327-9688.

• does not own or lease property in New York State;

2. Mail all returns and payments to the appropriate address listed

• does not have any outstanding Article 9-A franchise taxes for its

below.

final tax year or any prior tax year; and

3. Upon receipt of all tax returns due and payments due, the Tax

• has filed an Article 9-A franchise tax return (original or

Department will automatically issue the consent.

amended) which it intends to be its final return and indicates

4. Mail the NYS Department of State’s $60.00 filing fee, the

that it is the final by marking an X in the Final return box on

Certificate of Dissolution, and the Tax Commissioner’s consent

the return. The return indicated as final must cover the period

letter to the NYS Department of State.

through the date the corporation no longer does business,

5. The NYS Department of State will review the documents. If

employs capital, or owns or leases property in New York State.

the documents are accepted by the NYS Department of State,

the Certificate of Dissolution will be filed and a receipt will be

mailed to the filer of the certificate.

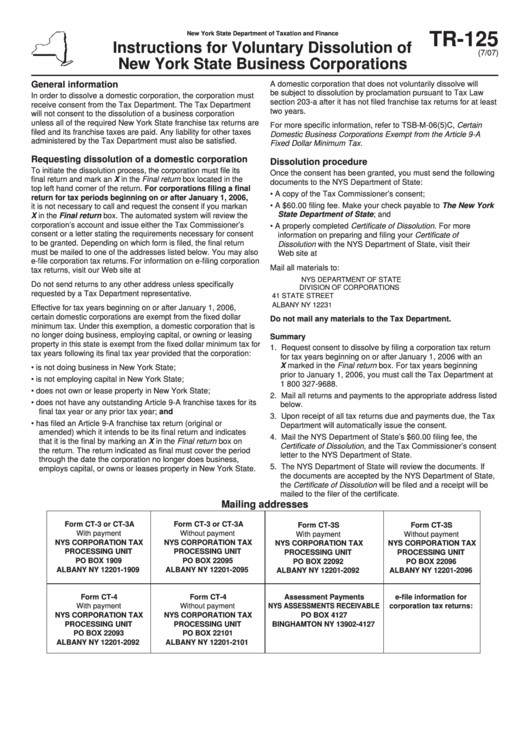

Mailing addresses

Form CT-3 or CT-3A

Form CT-3 or CT-3A

Form CT-3S

Form CT-3S

With payment

Without payment

With payment

Without payment

NYS CORPORATION TAX

NYS CORPORATION TAX

NYS CORPORATION TAX

NYS CORPORATION TAX

PROCESSING UNIT

PROCESSING UNIT

PROCESSING UNIT

PROCESSING UNIT

PO BOX 1909

PO BOX 22095

PO BOX 22092

PO BOX 22096

ALBANY NY 12201-1909

ALBANY NY 12201-2095

ALBANY NY 12201-2092

ALBANY NY 12201-2096

Form CT-4

Form CT-4

Assessment Payments

e-file information for

With payment

Without payment

NYS ASSESSMENTS RECEIVABLE

corporation tax returns:

NYS CORPORATION TAX

NYS CORPORATION TAX

PO BOX 4127

PROCESSING UNIT

PROCESSING UNIT

BINGHAMTON NY 13902-4127

PO BOX 22093

PO BOX 22101

ALBANY NY 12201-2092

ALBANY NY 12201-2101

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1