Ex Generic Form - Non Taxable Income - Newark City Income Tax Office - Ohio

ADVERTISEMENT

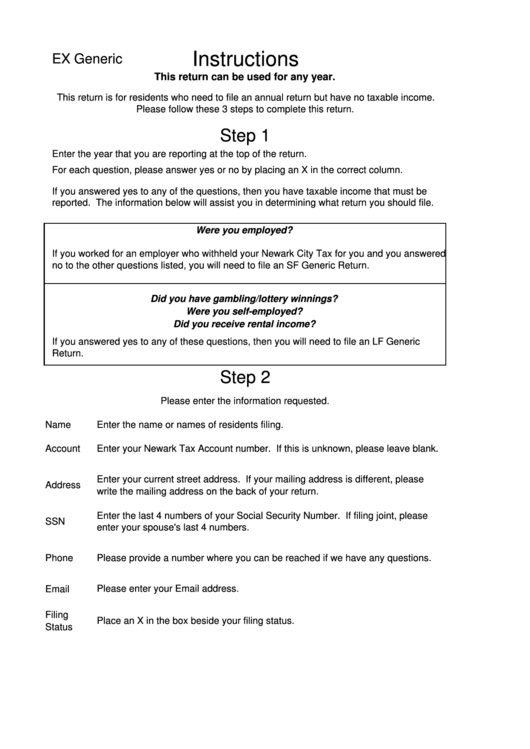

Instructions

EX Generic

This return can be used for any year.

This return is for residents who need to file an annual return but have no taxable income.

Please follow these 3 steps to complete this return.

Step 1

Enter the year that you are reporting at the top of the return.

For each question, please answer yes or no by placing an X in the correct column.

If you answered yes to any of the questions, then you have taxable income that must be

reported. The information below will assist you in determining what return you should file.

Were you employed?

If you worked for an employer who withheld your Newark City Tax for you and you answered

no to the other questions listed, you will need to file an SF Generic Return.

Did you have gambling/lottery winnings?

Were you self-employed?

Did you receive rental income?

If you answered yes to any of these questions, then you will need to file an LF Generic

Return.

Step 2

Please enter the information requested.

Name

Enter the name or names of residents filing.

Account

Enter your Newark Tax Account number. If this is unknown, please leave blank.

Enter your current street address. If your mailing address is different, please

Address

write the mailing address on the back of your return.

Enter the last 4 numbers of your Social Security Number. If filing joint, please

SSN

enter your spouse's last 4 numbers.

Phone

Please provide a number where you can be reached if we have any questions.

Please enter your Email address.

Email

Filing

Place an X in the box beside your filing status.

Status

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3