Form 61a203 - Apportioned Vehicle Property Tax Return (Schedule A-1, A And B) - Ky Department Of Revenue

ADVERTISEMENT

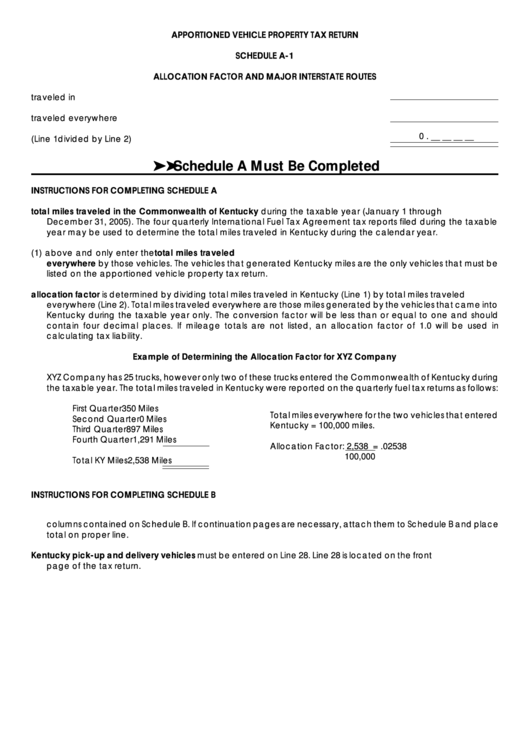

APPORTIONED VEHICLE PROPERTY TAX RETURN

SCHEDULE A-1

ALLOCATION FACTOR AND MAJOR INTERSTATE ROUTES

1. Total miles traveled in Kentucky ......................................................................................

2. Total miles traveled everywhere .....................................................................................

0 . __ __ __ __

3. Allocation factor (Line 1 divided by Line 2) ...................................................................

➤ ➤ ➤ ➤ ➤ Schedule A Must Be Completed

INSTRUCTIONS FOR COMPLETING SCHEDULE A

1. Enter the total miles traveled in the Commonwealth of Kentucky during the taxable year (January 1 through

December 31, 2005). The four quarterly International Fuel Tax Agreement tax reports filed during the taxable

year may be used to determine the total miles traveled in Kentucky during the calendar year.

2. Identify the vehicles that generated the miles reported in (1) above and only enter the total miles traveled

everywhere by those vehicles. The vehicles that generated Kentucky miles are the only vehicles that must be

listed on the apportioned vehicle property tax return.

3. The allocation factor is determined by dividing total miles traveled in Kentucky (Line 1) by total miles traveled

everywhere (Line 2). Total miles traveled everywhere are those miles generated by the vehicles that came into

Kentucky during the taxable year only. The conversion factor will be less than or equal to one and should

contain four decimal places. If mileage totals are not listed, an allocation factor of 1.0 will be used in

calculating tax liability.

Example of Determining the Allocation Factor for XYZ Company

XYZ Company has 25 trucks, however only two of these trucks entered the Commonwealth of Kentucky during

the taxable year. The total miles traveled in Kentucky were reported on the quarterly fuel tax returns as follows:

First Quarter

350 Miles

Total miles everywhere for the two vehicles that entered

Second Quarter

0 Miles

Kentucky = 100,000 miles.

Third Quarter

897 Miles

Fourth Quarter

1,291 Miles

Allocation Factor: 2,538 = .02538

100,000

Total KY Miles

2,538 Miles

INSTRUCTIONS FOR COMPLETING SCHEDULE B

1. List all pick-up and delivery vehicles that operate from a terminal within Kentucky. The taxpayer must fill in all

columns contained on Schedule B. If continuation pages are necessary, attach them to Schedule B and place

total on proper line.

2. The total for Kentucky pick-up and delivery vehicles must be entered on Line 28. Line 28 is located on the front

page of the tax return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4