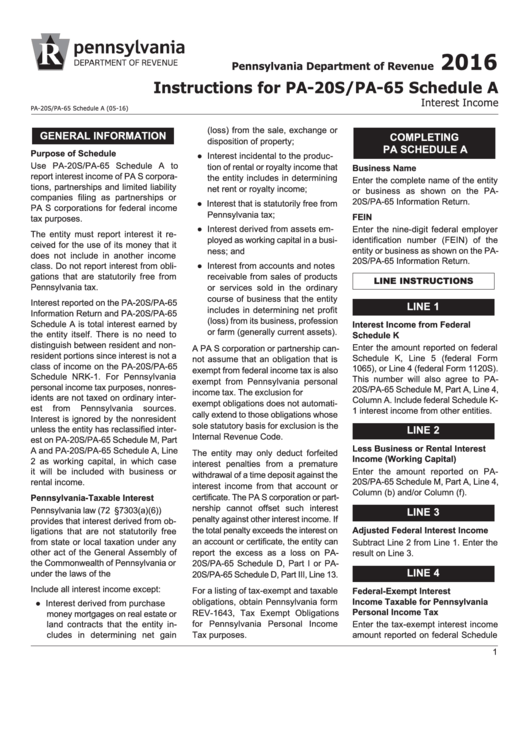

Instructions For Pa-20s/pa-65 Schedule A - Interest Income - Pennsylvania Department Of Revenue - 2016

ADVERTISEMENT

2016

Pennsylvania Department of Revenue

Instructions for PA-20S/PA-65 Schedule A

Interest Income

PA-20S/PA-65 Schedule A (05-16)

(loss) from the sale, exchange or

GENERAL INFORMATION

COMPLETING

disposition of property;

PA SCHEDULE A

Purpose of Schedule

● Interest incidental to the produc-

Use PA-20S/PA-65 Schedule A to

tion of rental or royalty income that

Business Name

report interest income of PA S corpora-

the entity includes in determining

Enter the complete name of the entity

tions, partnerships and limited liability

net rent or royalty income;

or business as shown on the PA-

companies filing as partnerships or

20S/PA-65 Information Return.

● Interest that is statutorily free from

PA S corporations for federal income

Pennsylvania tax;

FEIN

tax purposes.

● Interest derived from assets em-

Enter the nine-digit federal employer

The entity must report interest it re-

ployed as working capital in a busi-

identification number (FEIN) of the

ceived for the use of its money that it

entity or business as shown on the PA-

ness; and

does not include in another income

20S/PA-65 Information Return.

● Interest from accounts and notes

class. Do not report interest from obli-

gations that are statutorily free from

receivable from sales of products

LINE INSTRUCTIONS

Pennsylvania tax.

or services sold in the ordinary

course of business that the entity

Interest reported on the PA-20S/PA-65

LINE 1

includes in determining net profit

Information Return and PA-20S/PA-65

(loss) from its business, profession

Schedule A is total interest earned by

Interest Income from Federal

or farm (generally current assets).

the entity itself. There is no need to

Schedule K

distinguish between resident and non-

Enter the amount reported on federal

A PA S corporation or partnership can-

resident portions since interest is not a

Schedule K, Line 5 (federal Form

not assume that an obligation that is

class of income on the PA-20S/PA-65

1065), or Line 4 (federal Form 1120S).

exempt from federal income tax is also

Schedule NRK-1. For Pennsylvania

This number will also agree to PA-

exempt from Pennsylvania personal

personal income tax purposes, nonres-

20S/PA-65 Schedule M, Part A, Line 4,

income tax. The exclusion for U.S. tax-

idents are not taxed on ordinary inter-

Column A. Include federal Schedule K-

exempt obligations does not automati-

est

from

Pennsylvania

sources.

1 interest income from other entities.

cally extend to those obligations whose

Interest is ignored by the nonresident

sole statutory basis for exclusion is the

unless the entity has reclassified inter-

LINE 2

Internal Revenue Code.

est on PA-20S/PA-65 Schedule M, Part

Less Business or Rental Interest

A and PA-20S/PA-65 Schedule A, Line

The entity may only deduct forfeited

Income (Working Capital)

2 as working capital, in which case

interest penalties from a premature

Enter the amount reported on PA-

it will be included with business or

withdrawal of a time deposit against the

20S/PA-65 Schedule M, Part A, Line 4,

rental income.

interest income from that account or

Column (b) and/or Column (f).

certificate. The PA S corporation or part-

Pennsylvania-Taxable Interest

nership cannot offset such interest

Pennsylvania law (72 P.S. §7303(a)(6))

LINE 3

penalty against other interest income. If

provides that interest derived from ob-

the total penalty exceeds the interest on

Adjusted Federal Interest Income

ligations that are not statutorily free

an account or certificate, the entity can

from state or local taxation under any

Subtract Line 2 from Line 1. Enter the

other act of the General Assembly of

report the excess as a loss on PA-

result on Line 3.

the Commonwealth of Pennsylvania or

20S/PA-65 Schedule D, Part I or PA-

LINE 4

under the laws of the U.S. is taxable.

20S/PA-65 Schedule D, Part III, Line 13.

Include all interest income except:

For a listing of tax-exempt and taxable

Federal-Exempt Interest

obligations, obtain Pennsylvania form

Income Taxable for Pennsylvania

● Interest derived from purchase

Personal Income Tax

REV-1643, Tax Exempt Obligations

money mortgages on real estate or

for Pennsylvania Personal Income

land contracts that the entity in-

Enter the tax-exempt interest income

cludes in determining net gain

Tax purposes.

amount reported on federal Schedule

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2