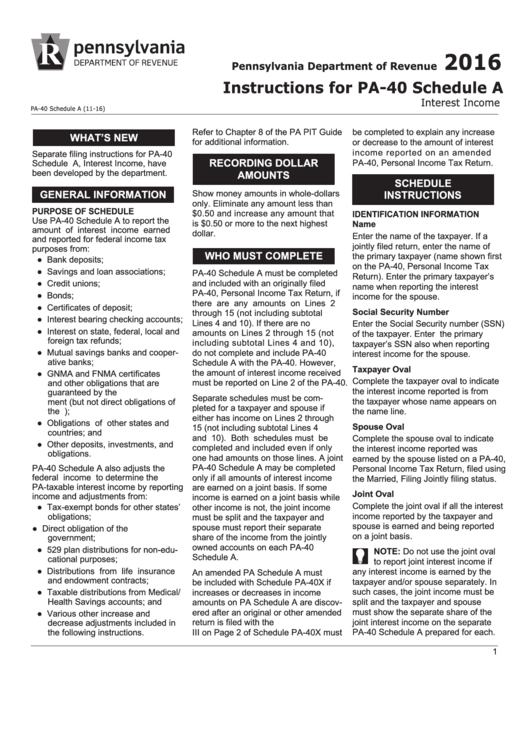

Instructions For Pa-40 Schedule A - Interest Income - Pennsylvania Department Of Revenue - 2016

ADVERTISEMENT

2016

Pennsylvania Department of Revenue

Instructions for PA-40 Schedule A

Interest Income

PA-40 Schedule A (11-16)

Refer to Chapter 8 of the PA PIT Guide

be completed to explain any increase

WHAT’S NEW

for additional information.

or decrease to the amount of interest

income reported on an amended

Separate filing instructions for PA-40

RECORDING DOLLAR

PA-40, Personal Income Tax Return.

Schedule A, Interest Income, have

AMOUNTS

been developed by the department.

SCHEDULE

GENERAL INFORMATION

INSTRUCTIONS

Show money amounts in whole-dollars

only. Eliminate any amount less than

PURPOSE OF SCHEDULE

$0.50 and increase any amount that

IDENTIFICATION INFORMATION

Use PA-40 Schedule A to report the

is $0.50 or more to the next highest

Name

amount of interest income earned

dollar.

Enter the name of the taxpayer. If a

and reported for federal income tax

jointly filed return, enter the name of

purposes from:

WHO MUST COMPLETE

the primary taxpayer (name shown first

● Bank deposits;

on the PA-40, Personal Income Tax

● Savings and loan associations;

PA-40 Schedule A must be completed

Return). Enter the primary taxpayer’s

and included with an originally filed

● Credit unions;

name when reporting the interest

PA-40, Personal Income Tax Return, if

● Bonds;

income for the spouse.

there are any amounts on Lines 2

● Certificates of deposit;

Social Security Number

through 15 (not including subtotal

● Interest bearing checking accounts;

Lines 4 and 10). If there are no

Enter the Social Security number (SSN)

● Interest on state, federal, local and

amounts on Lines 2 through 15 (not

of the taxpayer. Enter the primary

foreign tax refunds;

including subtotal Lines 4 and 10),

taxpayer’s SSN also when reporting

● Mutual savings banks and cooper-

do not complete and include PA-40

interest income for the spouse.

ative banks;

Schedule A with the PA-40. However,

Taxpayer Oval

the amount of interest income received

● GNMA and FNMA certificates

Complete the taxpayer oval to indicate

must be reported on Line 2 of the PA-40.

and other obligations that are

the interest income reported is from

guaranteed by the U.S. govern-

Separate schedules must be com-

the taxpayer whose name appears on

ment (but not direct obligations of

pleted for a taxpayer and spouse if

the U.S. government);

the name line.

either has income on Lines 2 through

● Obligations of other states and

Spouse Oval

15 (not including subtotal Lines 4

countries; and

and 10). Both schedules must be

Complete the spouse oval to indicate

● Other deposits, investments, and

completed and included even if only

the interest income reported was

obligations.

one had amounts on those lines. A joint

earned by the spouse listed on a PA-40,

PA-40 Schedule A may be completed

PA-40 Schedule A also adjusts the

Personal Income Tax Return, filed using

federal income to determine the

only if all amounts of interest income

the Married, Filing Jointly filing status.

PA-taxable interest income by reporting

are earned on a joint basis. If some

Joint Oval

income and adjustments from:

income is earned on a joint basis while

Complete the joint oval if all the interest

● Tax-exempt bonds for other states’

other income is not, the joint income

income reported by the taxpayer and

obligations;

must be split and the taxpayer and

spouse is earned and being reported

spouse must report their separate

● Direct obligation of the U.S.

on a joint basis.

share of the income from the jointly

government;

owned accounts on each PA-40

● 529 plan distributions for non-edu-

NOTE: Do not use the joint oval

Schedule A.

cational purposes;

to report joint interest income if

● Distributions from life insurance

any interest income is earned by the

An amended PA Schedule A must

and endowment contracts;

taxpayer and/or spouse separately. In

be included with Schedule PA-40X if

such cases, the joint income must be

● Taxable distributions from Medical/

increases or decreases in income

Health Savings accounts; and

split and the taxpayer and spouse

amounts on PA Schedule A are discov-

must show the separate share of the

ered after an original or other amended

● Various other increase and

joint interest income on the separate

return is filed with the department. Part

decrease adjustments included in

PA-40 Schedule A prepared for each.

the following instructions.

III on Page 2 of Schedule PA-40X must

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4