Form A1-Qrt(Ez) - Arizona Quarterly Withholding Tax Return (Short Form)

ADVERTISEMENT

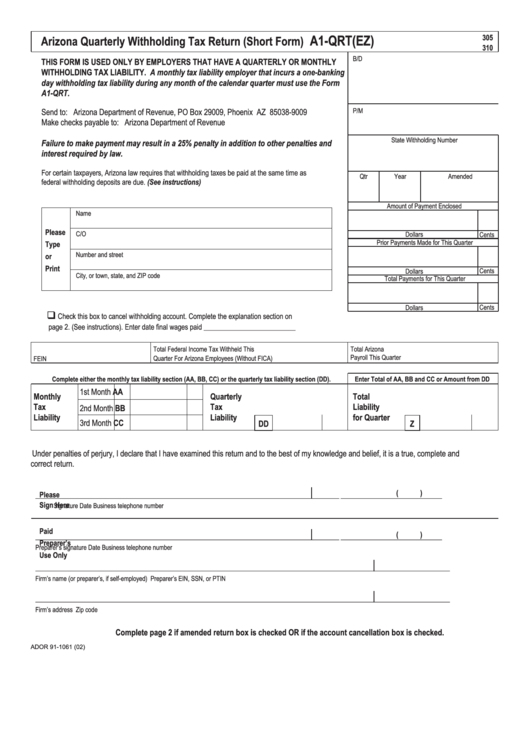

A1-QRT(EZ)

305

Arizona Quarterly Withholding Tax Return (Short Form)

310

B/D

THIS FORM IS USED ONLY BY EMPLOYERS THAT HAVE A QUARTERLY OR MONTHLY

WITHHOLDING TAX LIABILITY. A monthly tax liability employer that incurs a one-banking

day withholding tax liability during any month of the calendar quarter must use the Form

A1-QRT.

P/M

Send to: Arizona Department of Revenue, PO Box 29009, Phoenix AZ 85038-9009

Make checks payable to: Arizona Department of Revenue

State Withholding Number

Failure to make payment may result in a 25% penalty in addition to other penalties and

interest required by law.

For certain taxpayers, Arizona law requires that withholding taxes be paid at the same time as

Qtr

Year

Amended

federal withholding deposits are due. (See instructions)

Amount of Payment Enclosed

Name

Please

C/O

Dollars

Cents

Prior Payments Made for This Quarter

Type

Number and street

or

Print

Cents

Dollars

City, or town, state, and ZIP code

Total Payments for This Quarter

Cents

Dollars

q

Check this box to cancel withholding account. Complete the explanation section on

page 2. (See instructions). Enter date nal wages paid __________________________

Total Federal Income Tax Withheld This

Total Arizona

Payroll This Quarter

Quarter For Arizona Employees (Without FICA)

FEIN

Complete either the monthly tax liability section (AA, BB, CC) or the quarterly tax liability section (DD).

Enter Total of AA, BB and CC or Amount from DD

1st Month AA

Monthly

Quarterly

Total

Tax

Tax

Liability

2nd Month BB

Liability

Liability

for Quarter

3rd Month CC

DD

Z

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief, it is a true, complete and

correct return.

(

)

Please

________________________________________________________________________________________________

________________________________

Sign Here

Signature

Date

Business telephone number

Paid

(

)

________________________________________________________________________________________________

________________________________

Preparer’s

Preparer’s signature

Date

Business telephone number

Use Only

___________________________________________________________________________________________________________________________________

Firm’s name (or preparer’s, if self-employed)

Preparer’s EIN, SSN, or PTIN

___________________________________________________________________________________________________________________________________

Firm’s address

Zip code

Complete page 2 if amended return box is checked OR if the account cancellation box is checked.

ADOR 91-1061 (02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2