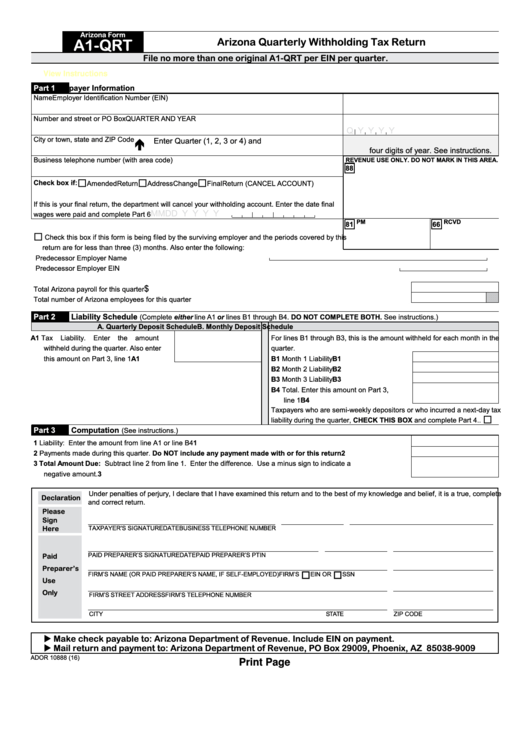

Arizona Form

A1-QRT

Arizona Quarterly Withholding Tax Return

File no more than one original A1-QRT per EIN per quarter.

View Instructions

Part 1

Taxpayer Information

Name

Employer Identification Number (EIN)

Number and street or PO Box

QUARTER AND YEAR

Q Y Y Y Y

City or town, state and ZIP Code

Enter Quarter (1, 2, 3 or 4) and

four digits of year. See instructions.

Business telephone number (with area code)

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

88

Check box if:

Amended Return

Address Change

Final Return (CANCEL ACCOUNT)

If this is your final return, the department will cancel your withholding account. Enter the date final

M M D D Y Y Y Y

wages were paid and complete Part 6 ....................................

PM

RCVD

81

66

Check this box if this form is being filed by the surviving employer and the periods covered by this

return are for less than three (3) months. Also enter the following:

Predecessor Employer Name ................................................................

Predecessor Employer EIN .......................................................................................................................................

$

Total Arizona payroll for this quarter ......................................................................................................................................

Total number of Arizona employees for this quarter ..............................................................................................................

Part 2

Tax Liability Schedule

(Complete either line A1 or lines B1 through B4. DO NOT COMPLETE BOTH. See instructions.)

A. Quarterly Deposit Schedule

B. Monthly Deposit Schedule

A1 Tax

Liability.

Enter

the

amount

For lines B1 through B3, this is the amount withheld for each month in the

withheld during the quarter. Also enter

quarter.

this amount on Part 3, line 1 ............

A1

B1 Month 1 Liability ................................ B1

B2 Month 2 Liability ................................ B2

B3 Month 3 Liability ................................ B3

B4 Total. Enter this amount on Part 3,

line 1 ................................................. B4

Taxpayers who are semi-weekly depositors or who incurred a next-day tax

liability during the quarter, CHECK THIS BOX and complete Part 4..

Part 3

Tax Computation

(See instructions.)

1 Liability: Enter the amount from line A1 or line B4 .........................................................................................................

1

2 Payments made during this quarter. Do NOT include any payment made with or for this return ............................

2

3 Total Amount Due: Subtract line 2 from line 1. Enter the difference. Use a minus sign to indicate a

3

negative amount. ............................................................................................................................................................

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief, it is a true, complete

Declaration

and correct return.

Please

Sign

TAXPAYER'S SIGNATURE

DATE

BUSINESS TELEPHONE NUMBER

Here

PAID PREPARER’S SIGNATURE

DATE

PAID PREPARER’S PTIN

Paid

Preparer’s

FIRM’S NAME (OR PAID PREPARER’S NAME, IF SELF-EMPLOYED)

FIRM’S

EIN OR

SSN

Use

Only

FIRM’S STREET ADDRESS

FIRM’S TELEPHONE NUMBER

CITY

STATE

ZIP CODE

Make check payable to:

Arizona Department of Revenue. Include EIN on payment.

Mail return and payment to:

Arizona Department of Revenue, PO Box 29009, Phoenix, AZ 85038-9009

ADOR 10888 (16)

Print Page

1

1 2

2