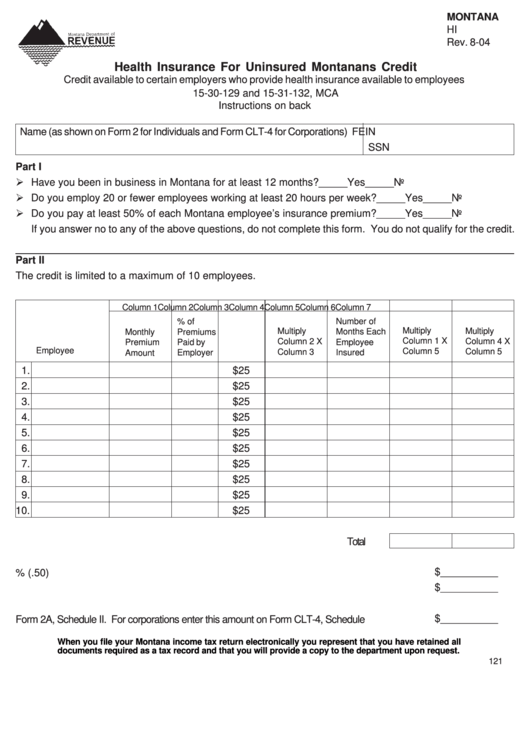

MONTANA

HI

Rev. 8-04

Health Insurance For Uninsured Montanans Credit

Credit available to certain employers who provide health insurance available to employees

15-30-129 and 15-31-132, MCA

Instructions on back

Name (as shown on Form 2 for Individuals and Form CLT-4 for Corporations)

FEIN

SSN

Part I

Have you been in business in Montana for at least 12 months?

_____Yes _____No

Do you employ 20 or fewer employees working at least 20 hours per week?

_____Yes _____No

Do you pay at least 50% of each Montana employee’s insurance premium?

_____Yes _____No

If you answer no to any of the above questions, do not complete this form. You do not qualify for the credit.

Part II

The credit is limited to a maximum of 10 employees.

Column 1

Column 2

Column 3

Column 4

Column 5

Column 6

Column 7

Number of

% of

Multiply

Multiply

Multiply

Monthly

Premiums

Months Each

Column 1 X

Column 2 X

Column 4 X

Employee

Premium

Paid by

Employee

Column 5

Column 5

Column 3

Amount

Employer

Insured

1.

$25

2.

$25

3.

$25

4.

$25

5.

$25

6.

$25

7.

$25

8.

$25

9.

$25

10.

$25

Total

$__________

1. Multiply total of column 6 by 50% (.50).............................................................................

$__________

2. Enter total from column 7..................................................................................................

3. Enter the smaller of line 1 or line 2. This is your credit. For individuals enter this amount on

$__________

Form 2A, Schedule II. For corporations enter this amount on Form CLT-4, Schedule C.................

When you file your Montana income tax return electronically you represent that you have retained all

documents required as a tax record and that you will provide a copy to the department upon request.

121

1

1