Montana Form Hi - Health Insurance For Uninsured Montanans Credit - 2012

ADVERTISEMENT

1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

3

3

MONTANA

4

4

HI

5

5

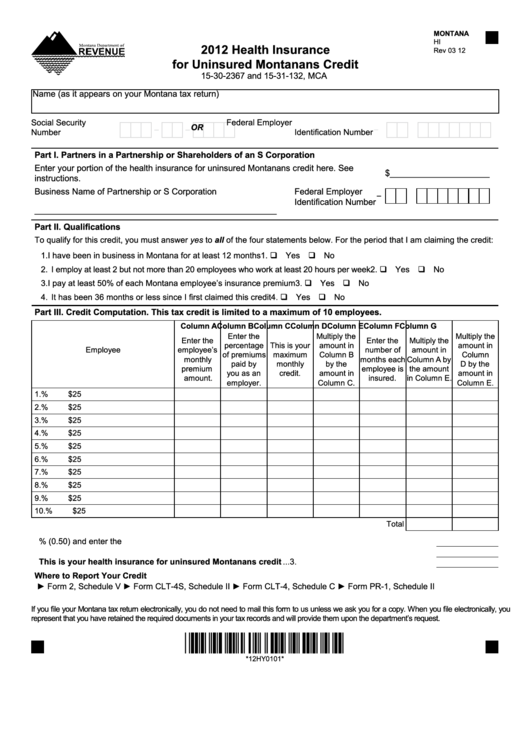

2012 Health Insurance

Rev 03 12

6

6

for Uninsured Montanans Credit

7

7

15-30-2367 and 15-31-132, MCA

8

8

9

9

Name (as it appears on your Montana tax return)

10

10

11

11

12

12

Social Security

Federal Employer

OR

-

-

-

X X X X X X X X X

13

X X X X X X X X X

13

Number

Identification Number

14

14

15

15

Part I. Partners in a Partnership or Shareholders of an S Corporation

16

16

Enter your portion of the health insurance for uninsured Montanans credit here. See

17

17

$_____________________

instructions.

18

18

Business Name of Partnership or S Corporation

Federal Employer

19

19

-

Identification Number

20

20

___________________________________________________

21

21

22

22

Part II. Qualifications

23

23

To qualify for this credit, you must answer yes to all of the four statements below. For the period that I am claiming the credit:

24

24

25

25

1. I have been in business in Montana for at least 12 months ..................................................1. Yes

No

26

26

2. I employ at least 2 but not more than 20 employees who work at least 20 hours per week ....2. Yes

No

27

27

3. I pay at least 50% of each Montana employee’s insurance premium ...................................3. Yes

No

28

28

29

29

4. It has been 36 months or less since I first claimed this credit ...............................................4. Yes

No

30

30

Part III. Credit Computation. This tax credit is limited to a maximum of 10 employees.

31

31

Column A

Column B

Column C

Column D

Column E

Column F

Column G

32

32

Enter the

Multiply the

Multiply the

33

33

Enter the

Enter the

Multiply the

percentage

This is your

amount in

amount in

34

34

Employee

employee’s

number of

amount in

of premiums

maximum

Column B

Column

35

35

monthly

months each

Column A by

paid by

monthly

by the

D by the

36

premium

employee is

the amount

36

you as an

credit.

amount in

amount in

amount.

insured.

in Column E.

37

37

employer.

Column C.

Column E.

38

38

1.

%

$25

39

39

2.

%

$25

40

40

41

3.

%

$25

41

42

42

4.

%

$25

43

43

5.

%

$25

44

44

6.

%

$25

45

45

46

7.

%

$25

46

47

47

8.

%

$25

48

48

9.

%

$25

49

49

10.

%

$25

50

50

51

Total

51

52

52

1. Multiply the total of Column F by 50% (0.50) and enter the result...............................................................1.

53

53

2. Enter the total of Column G .........................................................................................................................2.

54

54

3. Enter the smaller of line 1 or line 2. This is your health insurance for uninsured Montanans credit ...3.

55

55

Where to Report Your Credit

56

56

57

► Form 2, Schedule V

► Form CLT-4S, Schedule II

► Form CLT-4, Schedule C

► Form PR-1, Schedule II

57

58

58

59

59

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically, you

60

60

represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

61

61

62

*12HY0101*

62

63

63

64

64

*12HY0101*

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

8485

66

66

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2