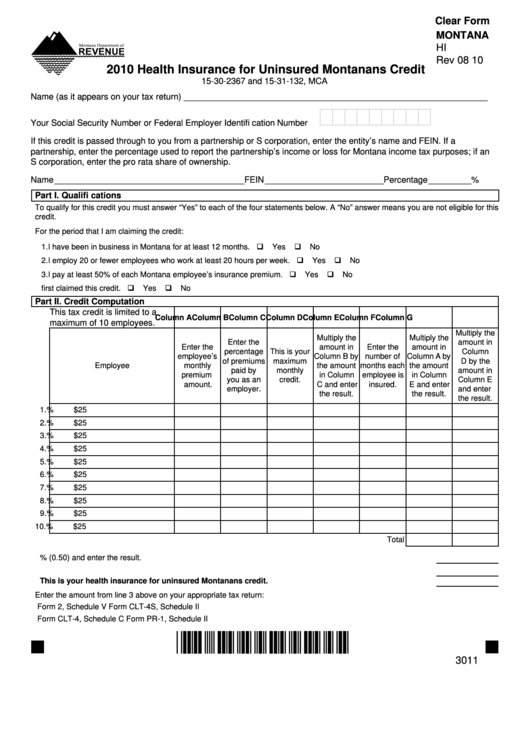

Clear Form

MONTANA

HI

Rev 08 10

2010 Health Insurance for Uninsured Montanans Credit

15-30-2367 and 15-31-132, MCA

Name (as it appears on your tax return) ________________________________________________________________

Your Social Security Number or Federal Employer Identifi cation Number

If this credit is passed through to you from a partnership or S corporation, enter the entity’s name and FEIN. If a

partnership, enter the percentage used to report the partnership’s income or loss for Montana income tax purposes; if an

S corporation, enter the pro rata share of ownership.

Name ________________________________________ FEIN _________________________ Percentage _________ %

Part I. Qualifi cations

To qualify for this credit you must answer “Yes” to each of the four statements below. A “No” answer means you are not eligible for this

credit.

For the period that I am claiming the credit:

1. I have been in business in Montana for at least 12 months. ..................................................... 1.

Yes

No

2. I employ 20 or fewer employees who work at least 20 hours per week. ................................... 2.

Yes

No

3. I pay at least 50% of each Montana employee’s insurance premium. ...................................... 3.

Yes

No

4. It has been 36 months or less since I fi rst claimed this credit. .................................................. 4.

Yes

No

Part II. Credit Computation

This tax credit is limited to a

Column A

Column B

Column C

Column D

Column E

Column F

Column G

maximum of 10 employees.

Multiply the

Multiply the

Multiply the

Enter the

amount in

Enter the

amount in

Enter the

amount in

percentage

This is your

Column

employee’s

Column B by

number of

Column A by

of premiums

maximum

D by the

Employee

monthly

the amount

months each

the amount

paid by

monthly

amount in

premium

in Column

employee is

in Column

you as an

credit.

Column E

amount.

C and enter

insured.

E and enter

employer.

and enter

the result.

the result.

the result.

1.

%

$25

2.

%

$25

3.

%

$25

4.

%

$25

5.

%

$25

6.

%

$25

7.

%

$25

8.

%

$25

9.

%

$25

10.

%

$25

Total

1. Multiply the total of Column F by 50% (0.50) and enter the result. ...................................................................... 1.

2. Enter the total of Column G. ................................................................................................................................ 2.

3. Enter the smaller of line 1 or line 2. This is your health insurance for uninsured Montanans credit. .......... 3.

Enter the amount from line 3 above on your appropriate tax return:

Form 2, Schedule V

Form CLT-4S, Schedule II

Form CLT-4, Schedule C

Form PR-1, Schedule II

*30110101*

3011

1

1