Form Vec Fc-27 - Report To Determine Liability For State Unemployment Tax - Virginia Employment Commission - 2001

ADVERTISEMENT

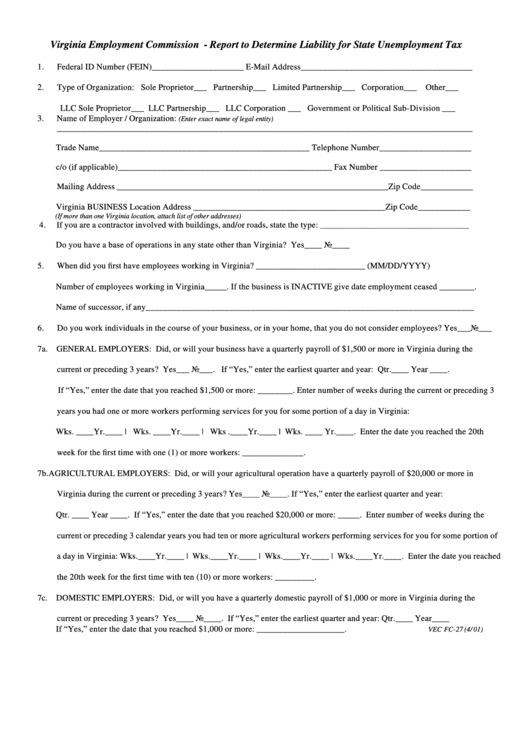

Virginia Employment Commission - Report to Determine Liability for State Unemployment Tax

1.

Federal ID Number (FEIN)_____________________ E-Mail Address_______________________________________

2.

Type of Organization: Sole Proprietor___ Partnership___ Limited Partnership___ Corporation___ Other___

LLC Sole Proprietor___ LLC Partnership___ LLC Corporation ___ Government or Political Sub-Division ___

3.

Name of Employer / Organization:

(Enter exact name of legal entity)

_______________________________________________________________________________________________

Trade Name________________________________________________ Telephone Number_____________________

c/o (if applicable)_________________________________________________ Fax Number _____________________

Mailing Address ______________________________________________________________Zip Code____________

Virginia BUSINESS Location Address ____________________________________________Zip Code____________

(If more than one Virginia location, attach list of other addresses)

4.

If you are a contractor involved with buildings, and/or roads, state the type: __________________________________

Do you have a base of operations in any state other than Virginia? Yes____ No____

5.

When did you first have employees working in Virginia? _________________________ (MM/DD/YYYY)

Number of employees working in Virginia_____. If the business is INACTIVE give date employment ceased ________.

Name of successor, if any___________________________________________________________________________

6.

Do you work individuals in the course of your business, or in your home, that you do not consider employees? Yes___No___

7a. GENERAL EMPLOYERS: Did, or will your business have a quarterly payroll of $1,500 or more in Virginia during the

current or preceding 3 years? Yes___ No___. If “Yes,” enter the earliest quarter and year: Qtr.____ Year ____.

If “Yes,” enter the date that you reached $1,500 or more: ________. Enter number of weeks during the current or preceding 3

years you had one or more workers performing services for you for some portion of a day in Virginia:

Wks. ____Yr.____ | Wks. ____Yr.____ | Wks .____Yr.____ | Wks. ____ Yr.____. Enter the date you reached the 20th

week for the first time with one (1) or more workers: ______________.

7b. AGRICULTURAL EMPLOYERS: Did, or will your agricultural operation have a quarterly payroll of $20,000 or more in

Virginia during the current or preceding 3 years? Yes____ No____. If “Yes,” enter the earliest quarter and year:

Qtr. ____ Year ____. If “Yes,” enter the date that you reached $20,000 or more: _____. Enter number of weeks during t he

current or preceding 3 calendar years you had ten or more agricultural workers performing services for you for some portion of

a day in Virginia: Wks.____Yr.____ | Wks.____Yr.____ | Wks.____Yr.____ | Wks.____Yr.____. Enter the date you reached

the 20th week for the first time with ten (10) or more workers: _________.

7c.

DOMESTIC EMPLOYERS: Did, or will you have a quarterly domestic payroll of $1,000 or more in Virginia during the

current or preceding 3 years? Yes____ No____. If “Yes,” enter the earliest quarter and year: Qtr.____ Year____

If “Yes,” enter the date that you reached $1,000 or more: ____________________.

VEC FC-27 (4/ 01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2