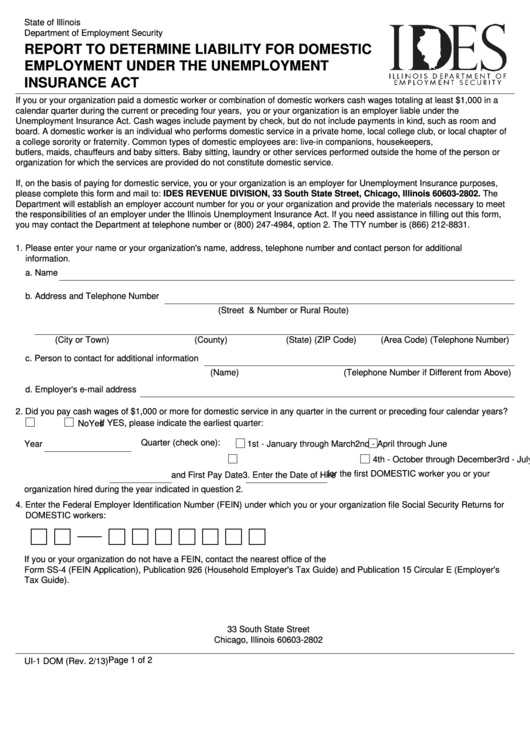

State of Illinois

Department of Employment Security

REPORT TO DETERMINE LIABILITY FOR DOMESTIC

EMPLOYMENT UNDER THE UNEMPLOYMENT

INSURANCE ACT

If you or your organization paid a domestic worker or combination of domestic workers cash wages totaling at least $1,000 in a

calendar quarter during the current or preceding four years, you or your organization is an employer liable under the

Unemployment Insurance Act. Cash wages include payment by check, but do not include payments in kind, such as room and

board. A domestic worker is an individual who performs domestic service in a private home, local college club, or local chapter of

a college sorority or fraternity. Common types of domestic employees are: live-in companions, housekeepers,

butlers, maids, chauffeurs and baby sitters. Baby sitting, laundry or other services performed outside the home of the person or

organization for which the services are provided do not constitute domestic service.

If, on the basis of paying for domestic service, you or your organization is an employer for Unemployment Insurance purposes,

please complete this form and mail to: IDES REVENUE DIVISION, 33 South State Street, Chicago, Illinois 60603-2802. The

Department will establish an employer account number for you or your organization and provide the materials necessary to meet

the responsibilities of an employer under the Illinois Unemployment Insurance Act. If you need assistance in filling out this form,

you may contact the Department at telephone number or (800) 247-4984, option 2. The TTY number is (866) 212-8831.

1. Please enter your name or your organization's name, address, telephone number and contact person for additional

information.

a. Name

b. Address and Telephone Number

(Street & Number or Rural Route)

(City or Town)

(County)

(State) (ZIP Code)

(Area Code) (Telephone Number)

c. Person to contact for additional information

(Name)

(Telephone Number if Different from Above)

d. Employer's e-mail address

2. Did you pay cash wages of $1,000 or more for domestic service in any quarter in the current or preceding four calendar years?

Yes

No

If YES, please indicate the earliest quarter:

Quarter (check one):

Year

1st - January through March

2nd - April through June

3rd - July through September

4th - October through December

for the first DOMESTIC worker you or your

3. Enter the Date of Hire

and First Pay Date

organization hired during the year indicated in question 2.

4. Enter the Federal Employer Identification Number (FEIN) under which you or your organization file Social Security Returns for

DOMESTIC workers:

If you or your organization do not have a FEIN, contact the nearest office of the U.S. Internal Revenue Service and request

Form SS-4 (FEIN Application), Publication 926 (Household Employer's Tax Guide) and Publication 15 Circular E (Employer's

Tax Guide).

33 South State Street

Chicago, Illinois 60603-2802

Page 1 of 2

UI-1 DOM (Rev. 2/13)

1

1 2

2