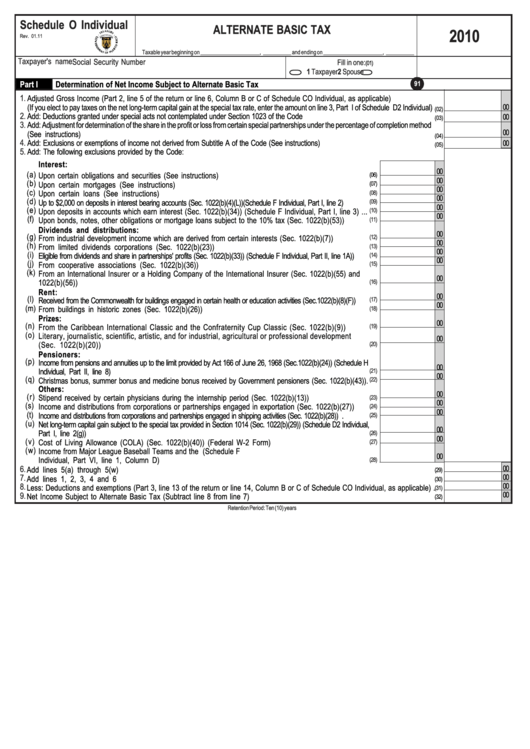

Schedule O Individual - Alternate Basic Tax - 2010

ADVERTISEMENT

Schedule O Individual

ALTERNATE BASIC TAX

2010

Rev. 01.11

Taxable year beginning on _____________________, __________ and ending on _____________________, __________

Taxpayer's name

Social Security Number

Fill in one:

(01)

1 Taxpayer

2 Spouse

Part I

Determination of Net Income Subject to Alternate Basic Tax

91

1.

Adjusted Gross Income (Part 2, line 5 of the return or line 6, Column B or C of Schedule CO Individual, as applicable)

(If you elect to pay taxes on the net long-term capital gain at the special tax rate, enter the amount on line 3, Part I of Schedule D2 Individual)

00

(02)

2.

Add: Deductions granted under special acts not contemplated under Section 1023 of the Code .......................................................................

00

(03)

3.

Add: Adjustment for determination of the share in the profit or loss from certain special partnerships under the percentage of completion method

00

(See instructions) ...............................................................................................................................................................................................

(04)

4.

Add: Exclusions or exemptions of income not derived from Subtitle A of the Code (See instructions)..............................................................

00

(05)

5.

Add: The following exclusions provided by the Code:

Interest:

00

(a)

Upon certain obligations and securities (See instructions) ............................................................................

(06)

00

(b)

Upon certain mortgages (See instructions) ..................................................................................................

(07)

00

(c)

Upon certain loans (See instructions) ..........................................................................................................

(08)

00

(d)

Up to $2,000 on deposits in interest bearing accounts (Sec. 1022(b)(4)(L))(Schedule F Individual, Part I, line 2) ...............

(09)

00

(e)

Upon deposits in accounts which earn interest (Sec. 1022(b)(34)) (Schedule F Individual, Part I, line 3) ...

(10)

00

(f)

Upon bonds, notes, other obligations or mortgage loans subject to the 10% tax (Sec. 1022(b)(53)) ...........

(11)

Dividends and distributions:

00

(g)

From industrial development income which are derived from certain interests (Sec. 1022(b)(7)) ................

(12)

00

(h)

From limited dividends corporations (Sec. 1022(b)(23)) .............................................................................

(13)

00

(i)

Eligible from dividends and share in partnerships' profits (Sec. 1022(b)(33)) (Schedule F Individual, Part II, line 1A)) ........

(14)

00

(j)

From cooperative associations (Sec. 1022(b)(36)) .....................................................................................

(15)

(k)

From an International Insurer or a Holding Company of the International Insurer (Sec. 1022(b)(55) and

00

1022(b)(56)) ..............................................................................................................................................

(16)

Rent:

00

(l)

Received from the Commonwealth for buildings engaged in certain health or education activities (Sec.1022(b)(8)(F)) ......

(17)

00

(m)

From buildings in historic zones (Sec. 1022(b)(26)) ...................................................................................

(18)

Prizes:

00

(n)

From the Caribbean International Classic and the Confraternity Cup Classic (Sec. 1022(b)(9)) .........

(19)

(o)

Literary, journalistic, scientific, artistic, and for industrial, agricultural or professional development

00

(Sec. 1022(b)(20)) .........................................................................................................................

(20)

Pensioners:

(p)

Income from pensions and annuities up to the limit provided by Act 166 of June 26, 1968 (Sec.1022(b)(24)) (Schedule H

00

Individual, Part II, line 8) .................................................................................................................................................................

(21)

00

(q)

Christmas bonus, summer bonus and medicine bonus received by Government pensioners (Sec. 1022(b)(43)).

(22)

Others:

00

(r)

Stipend received by certain physicians during the internship period (Sec. 1022(b)(13)) .............................

(23)

00

(s)

Income and distributions from corporations or partnerships engaged in exportation (Sec. 1022(b)(27)) ......

(24)

00

(t)

Income and distributions from corporations and partnerships engaged in shipping activities (Sec. 1022(b)(28)) ..................

(25)

(u)

Net long-term capital gain subject to the special tax provided in Section 1014 (Sec. 1022(b)(29)) (Schedule D2 Individual,

00

Part I, line 2(g)) ..............................................................................................................................................................................

(26)

00

(v)

Cost of Living Allowance (COLA) (Sec. 1022(b)(40)) (Federal W-2 Form) ................................................

(27)

(w)

Income from Major League Baseball Teams and the U.S. National Basketball Association (Schedule F

00

Individual, Part VI, line 1, Column D) ..........................................................................................................

(28)

6.

00

Add lines 5(a) through 5(w) ..............................................................................................................................................................

(29)

7.

00

Add lines 1, 2, 3, 4 and 6 ..................................................................................................................................................................

(30)

00

8.

Less: Deductions and exemptions (Part 3, line 13 of the return or line 14, Column B or C of Schedule CO Individual, as applicable) .

(31)

9.

00

Net Income Subject to Alternate Basic Tax (Subtract line 8 from line 7) ..............................................................................................

(32)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2