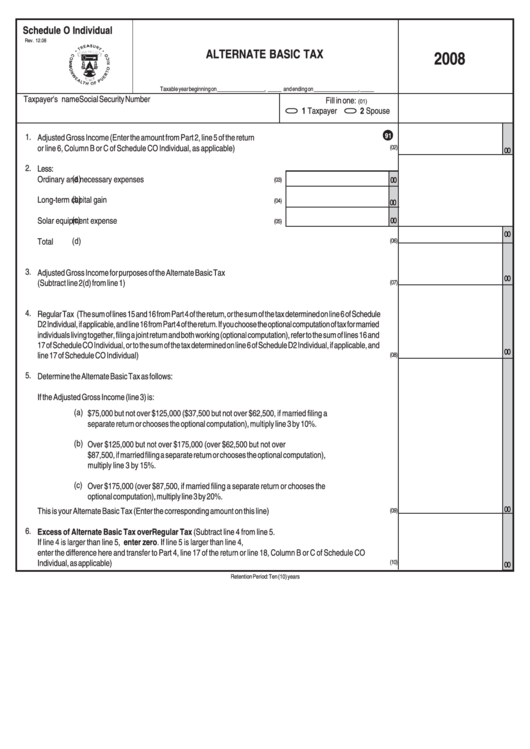

Schedule O Individual - Alternate Basic Tax - 2008

ADVERTISEMENT

Schedule O Individual

Rev. 12.08

ALTERNATE BASIC TAX

2008

Taxable year beginning on _________________, _____ and ending on ________________, _____

Social Security Number

Taxpayer's name

Fill in one:

(01)

1 Taxpayer

2 Spouse

1.

91

Adjusted Gross Income (Enter the amount from Part 2, line 5 of the return

or line 6, Column B or C of Schedule CO Individual, as applicable) .........................................................................

(02)

00

2.

Less:

(a)

Ordinary and necessary expenses .....................................

00

(03)

(b)

Long-term capital gain .........................................................

(04)

00

(c)

Solar equipment expense ....................................................

00

(05)

00

(d)

Total .............................................................................................................................................

(06)

3.

Adjusted Gross Income for purposes of the Alternate Basic Tax

00

(Subtract line 2(d) from line 1) ..................................................................................................................................

(07)

4.

Regular Tax (The sum of lines 15 and 16 from Part 4 of the return, or the sum of the tax determined on line 6 of Schedule

D2 Individual, if applicable, and line 16 from Part 4 of the return. If you choose the optional computation of tax for married

individuals living together, filing a joint return and both working (optional computation), refer to the sum of lines 16 and

17 of Schedule CO Individual, or to the sum of the tax determined on line 6 of Schedule D2 Individual, if applicable, and

00

line 17 of Schedule CO Individual) ...........................................................................................................................

(08)

5.

Determine the Alternate Basic Tax as follows:

If the Adjusted Gross Income (line 3) is:

(a)

$75,000 but not over $125,000 ($37,500 but not over $62,500, if married filing a

separate return or chooses the optional computation), multiply line 3 by 10%.

(b)

Over $125,000 but not over $175,000 (over $62,500 but not over

$87,500, if married filing a separate return or chooses the optional computation),

multiply line 3 by 15%.

(c)

Over $175,000 (over $87,500, if married filing a separate return or chooses the

optional computation), multiply line 3 by 20%.

00

This is your Alternate Basic Tax (Enter the corresponding amount on this line) .......................................................

(09)

6.

Excess of Alternate Basic Tax over Regular Tax (Subtract line 4 from line 5.

If line 4 is larger than line 5, enter zero. If line 5 is larger than line 4,

enter the difference here and transfer to Part 4, line 17 of the return or line 18, Column B or C of Schedule CO

Individual, as applicable) ........................................................................................................................................

(10)

00

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1