Schedule O Individua - Alternate Basic Tax - 2012

ADVERTISEMENT

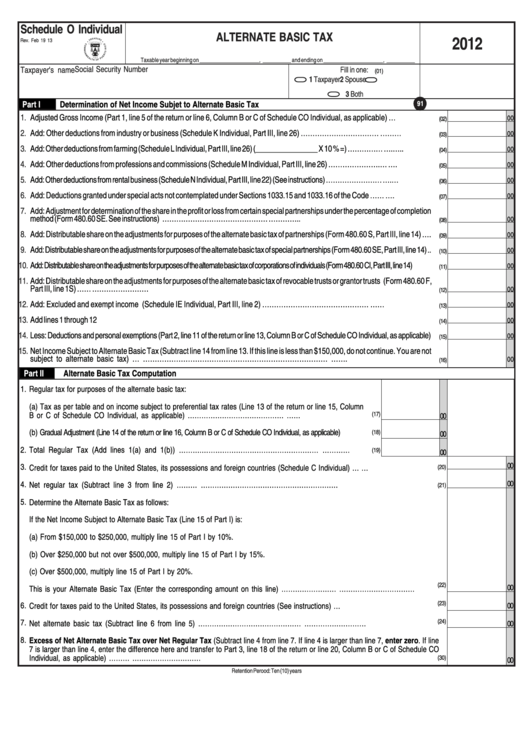

Schedule O Individual

ALTERNATE BASIC TAX

2012

Rev. Feb 19 13

Taxable year beginning on _____________________, __________ and ending on _____________________, __________

Social Security Number

Taxpayer's name

Fill in one:

(01)

1 Taxpayer

2 Spouse

3 Both

Part I

Determination of Net Income Subjet to Alternate Basic Tax

91

Adjusted Gross Income (Part 1, line 5 of the return or line 6, Column B or C of Schedule CO Individual, as applicable) …..................

1.

00

(02)

2.

Add: Other deductions from industry or business (Schedule K Individual, Part III, line 26) ……………………………................………

00

(03)

Add: Other deductions from farming (Schedule L Individual, Part III, line 26) (________________ X 10 % =) ……………...............….…..

3.

00

(04)

4.

Add: Other deductions from professions and commissions (Schedule M Individual, Part III, line 26) ………………….…..................….

00

(05)

Add: Other deductions from rental business (Schedule N Individual, Part III, line 22) (See instructions) ……………………..................….…

5.

00

(06)

6.

Add: Deductions granted under special acts not contemplated under Sections 1033.15 and 1033.16 of the Code ……...................….

00

(07)

Add: Adjustment for determination of the share in the profit or loss from certain special partnerships under the percentage of completion

7.

method (Form 480.60 SE. See instructions) ........................................................………………………………………..............…………..

00

(08)

8.

Add: Distributable share on the adjustments for purposes of the alternate basic tax of partnerships (Form 480.60 S, Part III, line 14) ….

00

(09)

9.

Add: Distributable share on the adjustments for purposes of the alternate basic tax of special partnerships (Form 480.60 SE, Part III, line 14) ..

00

(10)

10.

Add: Distributable share on the adjustments for purposes of the alternate basic tax of corporations of individuals (Form 480.60 CI, Part III, line 14) .........

00

(11)

11.

Add: Distributable share on the adjustments for purposes of the alternate basic tax of revocable trusts or grantor trusts (Form 480.60 F,

Part III, line 1S) ……................................................................................................................................................……………………

00

(12)

Add: Excluded and exempt income (Schedule IE Individual, Part III, line 2) ………………………………………..............……...........

12.

00

(13)

13.

Add lines 1 through 12 .........................................................................................................................................................................

00

(14)

Less: Deductions and personal exemptions (Part 2, line 11 of the return or line 13, Column B or C of Schedule CO Individual, as applicable)

14.

00

(15)

15.

Net Income Subject to Alternate Basic Tax (Subtract line 14 from line 13. If this line is less than $150,000, do not continue. You are not

subject to alternate basic tax) ….....…………………………………………………………………….........................................…….

00

(16)

Part II

Alternate Basic Tax Computation

1.

Regular tax for purposes of the alternate basic tax:

(a) Tax as per table and on income subject to preferential tax rates (Line 13 of the return or line 15, Column

B or C of Schedule CO Individual, as applicable) ……………………………………................................……

(17)

00

(b) Gradual Adjustment (Line 14 of the return or line 16, Column B or C of Schedule CO Individual, as applicable) ...............

(18)

00

2.

Total Regular Tax (Add lines 1(a) and 1(b)) ……….…………………………………………….............…………

(19)

00

00

3.

Credit for taxes paid to the United States, its possessions and foreign countries (Schedule C Individual) …....................................…

(20)

00

4.

Net regular tax (Subtract line 3 from line 2) ………....................................................……………………………………………………

(21)

5.

Determine the Alternate Basic Tax as follows:

If the Net Income Subject to Alternate Basic Tax (Line 15 of Part I) is:

(a) From $150,000 to $250,000, multiply line 15 of Part I by 10%.

(b) Over $250,000 but not over $500,000, multiply line 15 of Part I by 15%.

(c) Over $500,000, multiply line 15 of Part I by 20%.

(22)

00

This is your Alternate Basic Tax (Enter the corresponding amount on this line) …………………….............……………………………

(23)

6.

Credit for taxes paid to the United States, its possessions and foreign countries (See instructions) ….................................................

00

7.

(24)

Net alternate basic tax (Subtract line 6 from line 5) ………………………………………......................................………………………

00

8.

Excess of Net Alternate Basic Tax over Net Regular Tax (Subtract line 4 from line 7. If line 4 is larger than line 7, enter zero. If line

7 is larger than line 4, enter the difference here and transfer to Part 3, line 18 of the return or line 20, Column B or C of Schedule CO

Individual, as applicable) ………............................................................................................................................…………………………

(30)

00

Retention Perood: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1