Instructions For Form 1098-C - 2006

ADVERTISEMENT

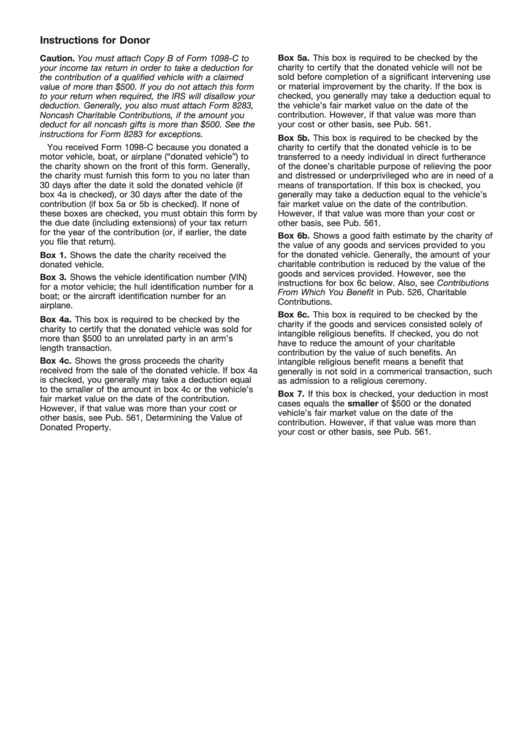

Instructions for Donor

Box 5a. This box is required to be checked by the

Caution. You must attach Copy B of Form 1098-C to

your income tax return in order to take a deduction for

charity to certify that the donated vehicle will not be

sold before completion of a significant intervening use

the contribution of a qualified vehicle with a claimed

or material improvement by the charity. If the box is

value of more than $500. If you do not attach this form

checked, you generally may take a deduction equal to

to your return when required, the IRS will disallow your

the vehicle’s fair market value on the date of the

deduction. Generally, you also must attach Form 8283,

contribution. However, if that value was more than

Noncash Charitable Contributions, if the amount you

your cost or other basis, see Pub. 561.

deduct for all noncash gifts is more than $500. See the

instructions for Form 8283 for exceptions.

Box 5b. This box is required to be checked by the

You received Form 1098-C because you donated a

charity to certify that the donated vehicle is to be

motor vehicle, boat, or airplane (“donated vehicle”) to

transferred to a needy individual in direct furtherance

the charity shown on the front of this form. Generally,

of the donee’s charitable purpose of relieving the poor

the charity must furnish this form to you no later than

and distressed or underprivileged who are in need of a

30 days after the date it sold the donated vehicle (if

means of transportation. If this box is checked, you

box 4a is checked), or 30 days after the date of the

generally may take a deduction equal to the vehicle’s

contribution (if box 5a or 5b is checked). If none of

fair market value on the date of the contribution.

these boxes are checked, you must obtain this form by

However, if that value was more than your cost or

the due date (including extensions) of your tax return

other basis, see Pub. 561.

for the year of the contribution (or, if earlier, the date

Box 6b. Shows a good faith estimate by the charity of

you file that return).

the value of any goods and services provided to you

for the donated vehicle. Generally, the amount of your

Box 1. Shows the date the charity received the

charitable contribution is reduced by the value of the

donated vehicle.

goods and services provided. However, see the

Box 3. Shows the vehicle identification number (VIN)

instructions for box 6c below. Also, see Contributions

for a motor vehicle; the hull identification number for a

From Which You Benefit in Pub. 526, Charitable

boat; or the aircraft identification number for an

Contributions.

airplane.

Box 6c. This box is required to be checked by the

Box 4a. This box is required to be checked by the

charity if the goods and services consisted solely of

charity to certify that the donated vehicle was sold for

intangible religious benefits. If checked, you do not

more than $500 to an unrelated party in an arm’s

have to reduce the amount of your charitable

length transaction.

contribution by the value of such benefits. An

Box 4c. Shows the gross proceeds the charity

intangible religious benefit means a benefit that

received from the sale of the donated vehicle. If box 4a

generally is not sold in a commerical transaction, such

is checked, you generally may take a deduction equal

as admission to a religious ceremony.

to the smaller of the amount in box 4c or the vehicle’s

Box 7. If this box is checked, your deduction in most

fair market value on the date of the contribution.

cases equals the smaller of $500 or the donated

However, if that value was more than your cost or

vehicle’s fair market value on the date of the

other basis, see Pub. 561, Determining the Value of

contribution. However, if that value was more than

Donated Property.

your cost or other basis, see Pub. 561.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25