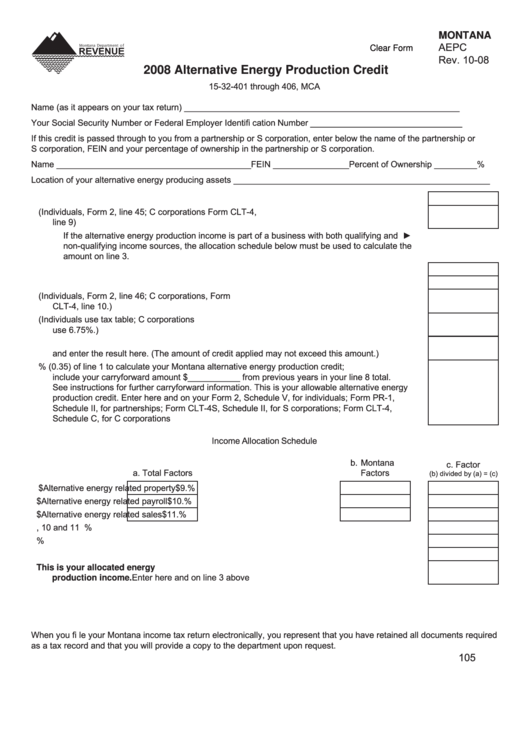

MONTANA

AEPC

Clear Form

Rev. 10-08

2008 Alternative Energy Production Credit

15-32-401 through 406, MCA

Name (as it appears on your tax return) __________________________________________________________

Your Social Security Number or Federal Employer Identifi cation Number ________________________________

If this credit is passed through to you from a partnership or S corporation, enter below the name of the partnership or

S corporation, FEIN and your percentage of ownership in the partnership or S corporation.

Name _________________________________________ FEIN ________________ Percent of Ownership _________ %

Location of your alternative energy producing assets ______________________________________________________

1. Enter the amount of your eligible alternative energy equipment investment ................................. 1.

2. Enter your Montana taxable income (Individuals, Form 2, line 45; C corporations Form CLT-4,

line 9) ............................................................................................................................................. 2.

►

If the alternative energy production income is part of a business with both qualifying and

non-qualifying income sources, the allocation schedule below must be used to calculate the

amount on line 3.

3. Enter the net income attributable to eligible alternative energy equipment ................................... 3.

4. Subtract the amount on line 3 from the amount on line 2 and enter the result here ..................... 4.

5. Enter the total tax as shown on your return (Individuals, Form 2, line 46; C corporations, Form

CLT-4, line 10.) .............................................................................................................................. 5.

6. Calculate the tax due for the income reported on line 4 (Individuals use tax table; C corporations

use 6.75%.) ................................................................................................................................... 6.

7. Subtract line 6 from line 5 to calculate income tax attributable to alternative energy production

and enter the result here. (The amount of credit applied may not exceed this amount.) .............. 7.

8. Enter 35% (0.35) of line 1 to calculate your Montana alternative energy production credit;

include your carryforward amount $___________ from previous years in your line 8 total.

See instructions for further carryforward information. This is your allowable alternative energy

production credit. Enter here and on your Form 2, Schedule V, for individuals; Form PR-1,

Schedule II, for partnerships; Form CLT-4S, Schedule II, for S corporations; Form CLT-4,

Schedule C, for C corporations ..................................................................................................... 8.

Income Allocation Schedule

b. Montana

c. Factor

a. Total Factors

Factors

(b) divided by (a) = (c)

9. Business property $

Alternative energy related property

$

9.

%

10. Business payroll

$

Alternative energy related payroll

$

10.

%

11. Business sales

$

Alternative energy related sales

$

11.

%

12. Enter the sum of the factors from lines 9, 10 and 11 ....................................................................12.

%

13. Divide the amount from line 12 by 3 and enter the result here .....................................................13.

%

14. Enter the amount from line 2 above .............................................................................................14.

15. Multiply the amount on line 14 by the amount on line 13. This is your allocated energy

production income. Enter here and on line 3 above ..................................................................15.

When you fi le your Montana income tax return electronically, you represent that you have retained all documents required

as a tax record and that you will provide a copy to the department upon request.

105

1

1