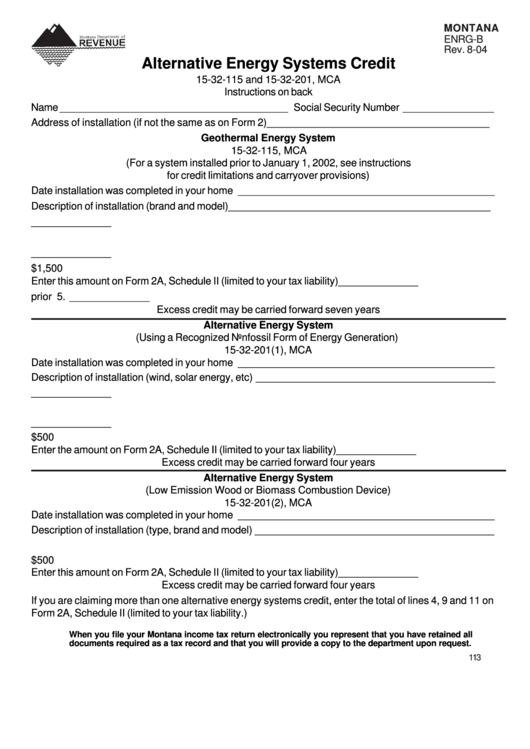

MONTANA

ENRG-B

Rev. 8-04

Alternative Energy Systems Credit

15-32-115 and 15-32-201, MCA

Instructions on back

Name ________________________________________ Social Security Number ________________

Address of installation (if not the same as on Form 2) _______________________________________

Geothermal Energy System

15-32-115, MCA

(For a system installed prior to January 1, 2002, see instructions

for credit limitations and carryover provisions)

Date installation was completed in your home _____________________________________________

Description of installation (brand and model) ______________________________________________

1. Cost of system including installation ................................................................... 1. ______________

2. Amount of grants received ................................................................................. 2. ______________

3. Subtract line 2 from line 1 ................................................................................... 3. ______________

4. Enter the smaller of line 3 or $1,500

Enter this amount on Form 2A, Schedule II (limited to your tax liability) ..................... 4. ______________

5. Total credit claimed in prior years ....................................................................... 5. ______________

Excess credit may be carried forward seven years

Alternative Energy System

(Using a Recognized Nonfossil Form of Energy Generation)

15-32-201(1), MCA

Date installation was completed in your home _____________________________________________

Description of installation (wind, solar energy, etc) __________________________________________

6. Cost of system including installation ................................................................... 6. ______________

7. Amount of grants received ................................................................................. 7. ______________

8. Subtract line 7 from line 6 ................................................................................... 8. ______________

9. Enter the smaller of line 8 or $500

Enter the amount on Form 2A, Schedule II (limited to your tax liability) ...................... 9. ______________

Excess credit may be carried forward four years

Alternative Energy System

(Low Emission Wood or Biomass Combustion Device)

15-32-201(2), MCA

Date installation was completed in your home _____________________________________________

Description of installation (type, brand and model) __________________________________________

10. Cost of system including installation ................................................................. 10. ______________

11. Enter the smaller of line 10 or $500

Enter this amount on Form 2A, Schedule II (limited to your tax liability) ................... 11. ______________

Excess credit may be carried forward four years

If you are claiming more than one alternative energy systems credit, enter the total of lines 4, 9 and 11 on

Form 2A, Schedule II (limited to your tax liability.)

When you file your Montana income tax return electronically you represent that you have retained all

documents required as a tax record and that you will provide a copy to the department upon request.

113

1

1