MONTANA

CLEAR FORM

AEPC

Rev 06 11

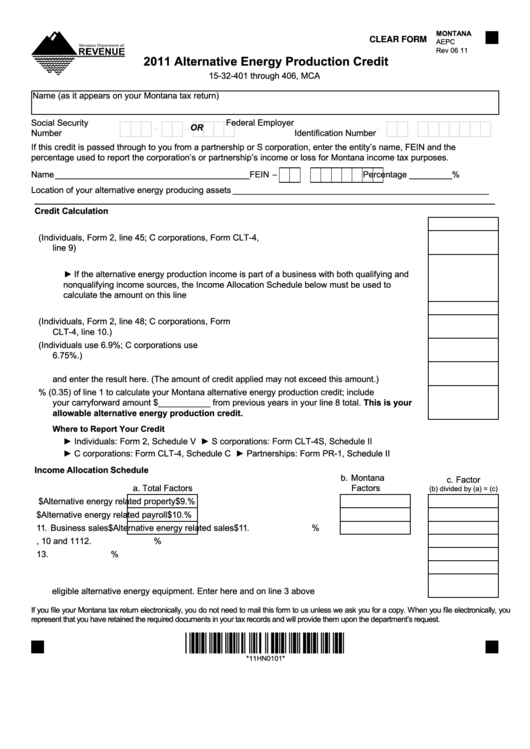

2011 Alternative Energy Production Credit

15-32-401 through 406, MCA

Name (as it appears on your Montana tax return)

Social Security

Federal Employer

-

-

OR

-

Number

Identification Number

If this credit is passed through to you from a partnership or S corporation, enter the entity’s name, FEIN and the

percentage used to report the corporation’s or partnership’s income or loss for Montana income tax purposes.

-

Name _________________________________________ FEIN

Percentage _________ %

Location of your alternative energy producing assets ______________________________________________________

Credit Calculation

1. Enter the amount of your eligible alternative energy equipment investment ................................. 1.

2. Enter your Montana taxable income (Individuals, Form 2, line 45; C corporations, Form CLT-4,

line 9) .............................................................................................................................................2.

3. Enter the net income attributable to eligible alternative energy equipment.

► If the alternative energy production income is part of a business with both qualifying and

nonqualifying income sources, the Income Allocation Schedule below must be used to

calculate the amount on this line ...............................................................................................3.

4. Subtract the amount on line 3 from the amount on line 2 and enter the result here ..................... 4.

5. Enter the total tax as shown on your return (Individuals, Form 2, line 48; C corporations, Form

CLT-4, line 10.) ..............................................................................................................................5.

6. Calculate the tax due for the income reported on line 4 (Individuals use 6.9%; C corporations use

6.75%.) ..........................................................................................................................................6.

7. Subtract line 6 from line 5 to calculate income tax attributable to alternative energy production

and enter the result here. (The amount of credit applied may not exceed this amount.) .............. 7.

8. Enter 35% (0.35) of line 1 to calculate your Montana alternative energy production credit; include

your carryforward amount $___________ from previous years in your line 8 total. This is your

allowable alternative energy production credit. ...................................................................... 8.

Where to Report Your Credit

► Individuals: Form 2, Schedule V

► S corporations: Form CLT-4S, Schedule II

► C corporations: Form CLT-4, Schedule C

► Partnerships: Form PR-1, Schedule II

Income Allocation Schedule

b. Montana

c. Factor

a. Total Factors

Factors

(b) divided by (a) = (c)

9. Business property $

Alternative energy related property

$

9.

%

10. Business payroll

$

Alternative energy related payroll

$

10.

%

11. Business sales

$

Alternative energy related sales

$

11.

%

12. Enter the sum of the factors from lines 9, 10 and 11 ....................................................................12.

%

13. Divide the amount from line 12 by 3 and enter the result here .....................................................13.

%

14. Enter the amount from line 2 above .............................................................................................14.

15. Multiply the amount on line 14 by the amount on line 13. This is your net income attributable to

eligible alternative energy equipment. Enter here and on line 3 above ........................................15.

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically, you

represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

*11HN0101*

*11HN0101*

1

1